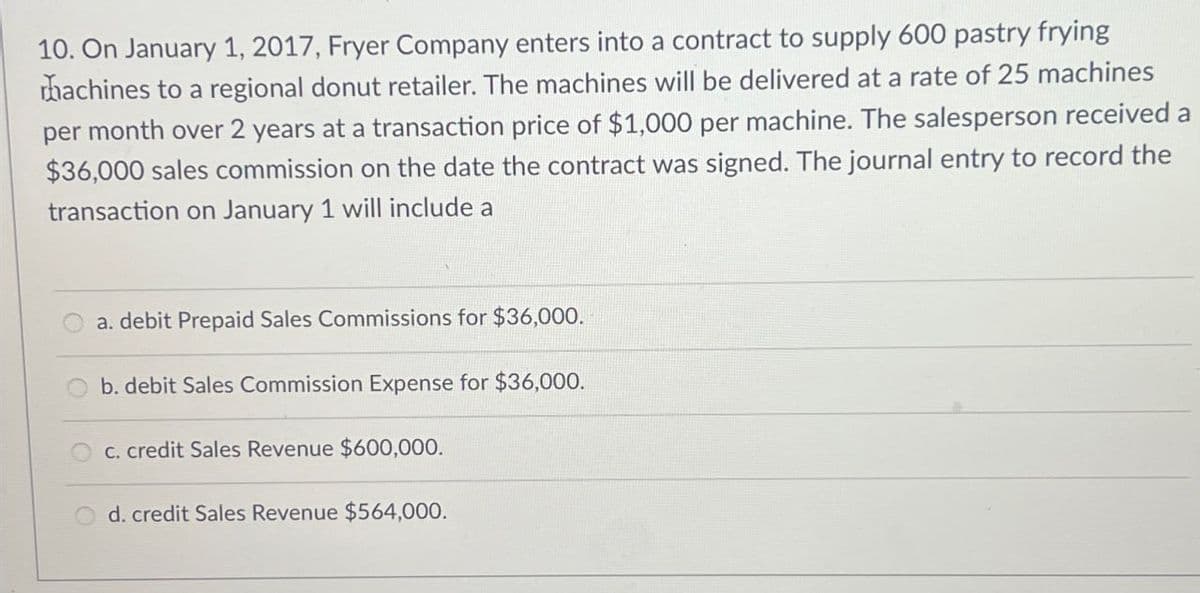

10. On January 1, 2017, Fryer Company enters into a contract to supply 600 pastry frying machines to a regional donut retailer. The machines will be delivered at a rate of 25 machines per month over 2 years at a transaction price of $1,000 per machine. The salesperson received a $36,000 sales commission on the date the contract was signed. The journal entry to record the transaction on January 1 will include a a. debit Prepaid Sales Commissions for $36,000. b. debit Sales Commission Expense for $36,000. c. credit Sales Revenue $600,000. d. credit Sales Revenue $564,000.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps