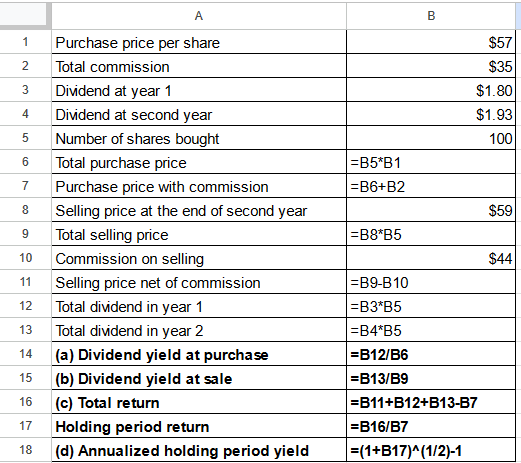

A B 1 Purchase price per share $57 2 Total commission $35 3 Dividend at year 1 $1.80 4 Dividend at second year $1.93 5 Number of shares bought 100 6 Total purchase price =B5*B1 7 Purchase price with commission =B6+B2 8 Selling price at the end of second year $59 9 Total selling price |=B8*B5 10 Commission on selling $44 11 Selling price net of commission =B9-B10 12 Total dividend in year 1 =B3*B5 13 Total dividend in year 2 =B4*B5 14 (a) Dividend yield at purchase =B12/B6 15 (b) Dividend yield at sale =B13/B9 16 (c) Total return |=B11+B12+B13-B7 17 Holding period return 18 (d) Annualized holding period yield =B16/B7 =(1+B17)^(1/2)-1

A B 1 Purchase price per share $57 2 Total commission $35 3 Dividend at year 1 $1.80 4 Dividend at second year $1.93 5 Number of shares bought 100 6 Total purchase price =B5*B1 7 Purchase price with commission =B6+B2 8 Selling price at the end of second year $59 9 Total selling price |=B8*B5 10 Commission on selling $44 11 Selling price net of commission =B9-B10 12 Total dividend in year 1 =B3*B5 13 Total dividend in year 2 =B4*B5 14 (a) Dividend yield at purchase =B12/B6 15 (b) Dividend yield at sale =B13/B9 16 (c) Total return |=B11+B12+B13-B7 17 Holding period return 18 (d) Annualized holding period yield =B16/B7 =(1+B17)^(1/2)-1

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 73E: Preferred Dividends Eastern Inc.s equity includes 8%, $25 par preferred stock. There are 100,000...

Related questions

Question

Transcribed Image Text:A

B

1

Purchase price per share

$57

2

Total commission

$35

3

Dividend at year 1

$1.80

4 Dividend at second year

$1.93

5

Number of shares bought

100

6

Total purchase price

=B5*B1

7

Purchase price with commission

=B6+B2

8

Selling price at the end of second year

$59

9

Total selling price

|=B8*B5

10

Commission on selling

$44

11

Selling price net of commission

=B9-B10

12

Total dividend in year 1

=B3*B5

13

Total dividend in year 2

=B4*B5

14

(a) Dividend yield at purchase

=B12/B6

15

(b) Dividend yield at sale

=B13/B9

16

(c) Total return

|=B11+B12+B13-B7

17

Holding period return

18

(d) Annualized holding period yield

=B16/B7

=(1+B17)^(1/2)-1

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning