Asbury Coffee Enterprises (ACE) manufactures two models of coffee grinders: Personal and Commercial. The Personal grinders have smaller capacity and are less durable than the Commercial grinders. ACE only recently began producing the Commercial model. Sind the Introduction of the new product, profits have been steadily declining, although sales have been increasing. The management at ACE belleves that the problem might be in how the accounting system allocates costs to products. The current system at ACE allocates manufacturing overhead to products based on direct labor costs. For the most recent year, which Is representative, manufacturing overhead totaled $2,050,500 based on production of 30,000 Personal grinders and 10,000 Commercial grinders. Direct costs were as follows: Direct materials Direct labor Personal $1,445,800 1,031,000 Commercial $ 630,250 677,750 Total $ 2,076,050 1,708,750 Management has determined that overhead costs are caused by three cost drivers. These drivers and their costs for last year are as follows: Activity Level Cost Driver Costs Assigned Personal Commercial Total Number of production runs Quality tests performed Shipping orders processed $ 982,500 824,000 244,000 $2,050,500 se 15 25 25 75 40 150 200 Total overhead Required: a. How much overhead will be assigned to each product if these three cost drivers are used to allocate overhead? What is the total cost per unit produced for each product? b. How much overhead will be assigned to each product if direct labor cost is used to allocate overhead? What is the total cost per

Asbury Coffee Enterprises (ACE) manufactures two models of coffee grinders: Personal and Commercial. The Personal grinders have smaller capacity and are less durable than the Commercial grinders. ACE only recently began producing the Commercial model. Sind the Introduction of the new product, profits have been steadily declining, although sales have been increasing. The management at ACE belleves that the problem might be in how the accounting system allocates costs to products. The current system at ACE allocates manufacturing overhead to products based on direct labor costs. For the most recent year, which Is representative, manufacturing overhead totaled $2,050,500 based on production of 30,000 Personal grinders and 10,000 Commercial grinders. Direct costs were as follows: Direct materials Direct labor Personal $1,445,800 1,031,000 Commercial $ 630,250 677,750 Total $ 2,076,050 1,708,750 Management has determined that overhead costs are caused by three cost drivers. These drivers and their costs for last year are as follows: Activity Level Cost Driver Costs Assigned Personal Commercial Total Number of production runs Quality tests performed Shipping orders processed $ 982,500 824,000 244,000 $2,050,500 se 15 25 25 75 40 150 200 Total overhead Required: a. How much overhead will be assigned to each product if these three cost drivers are used to allocate overhead? What is the total cost per unit produced for each product? b. How much overhead will be assigned to each product if direct labor cost is used to allocate overhead? What is the total cost per

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 15E: Activity-based costing and product cost distortion The management of Four Finger Appliance Company...

Related questions

Question

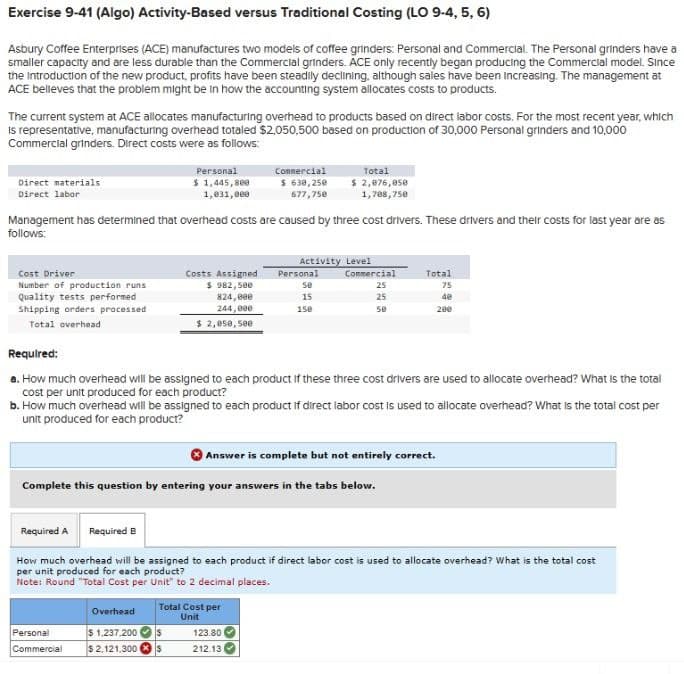

Transcribed Image Text:Exercise 9-41 (Algo) Activity-Based versus Traditional Costing (LO 9-4, 5, 6)

Asbury Coffee Enterprises (ACE) manufactures two models of coffee grinders: Personal and Commercial. The Personal grinders have a

smaller capacity and are less durable than the Commercial grinders. ACE only recently began producing the Commercial model. Since

the Introduction of the new product, profits have been steadily declining, although sales have been increasing. The management at

ACE belleves that the problem might be in how the accounting system allocates costs to products.

The current system at ACE allocates manufacturing overhead to products based on direct labor costs. For the most recent year, which

Is representative, manufacturing overhead totaled $2,050,500 based on production of 30,000 Personal grinders and 10,000

Commercial grinders. Direct costs were as follows:

Direct materials

Direct labor

Personal

$ 1,445,800

1,031,000

Commercial

$ 630,250

677,750

Total

$ 2,076,050

1,788,750

Management has determined that overhead costs are caused by three cost drivers. These drivers and their costs for last year are as

follows:

Activity Level

Cost Driver

Number of production runs

Quality tests performed

Shipping orders processed

Total overhead

Costs Assigned

$ 982,500

824,000

244,000

$2,050,500

Personal

Commercial

Total

se

15

25

75

25

40

150

se

200

Required:

a. How much overhead will be assigned to each product if these three cost drivers are used to allocate overhead? What is the total

cost per unit produced for each product?

b. How much overhead will be assigned to each product if direct labor cost is used to allocate overhead? What is the total cost per

unit produced for each product?

Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Required A Required B

How much overhead will be assigned to each product if direct labor cost is used to allocate overhead? What is the total cost

per unit produced for each product?

Note: Round "Total Cost per Unit" to 2 decimal places.

Overhead

Total Cost per

Unit

Personal

Commercial

$ 1,237,200 (

S

123.80

$2,121,300

S

212.13

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning