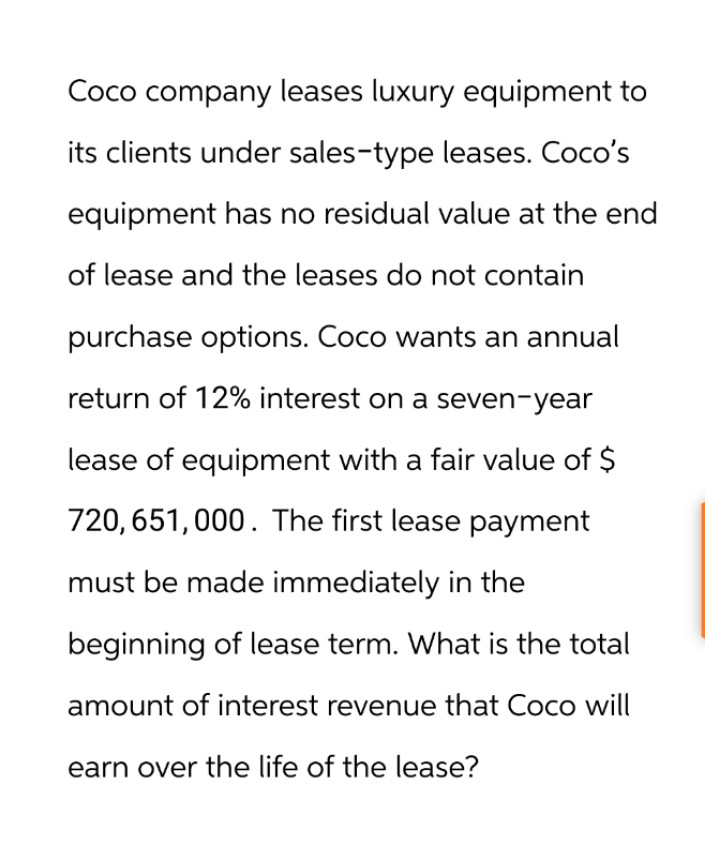

Coco company leases luxury equipment to its clients under sales-type leases. Coco's equipment has no residual value at the end of lease and the leases do not contain purchase options. Coco wants an annual return of 12% interest on a seven-year lease of equipment with a fair value of $ 720,651,000. The first lease payment must be made immediately in the beginning of lease term. What is the total amount of interest revenue that Coco will earn over the life of the lease?

Q: Alta Ski Company's inventory records contained the following information regarding its latest ski…

A: Inventory methods like FIFO, LIFO uses two types of inventory system to calculate the cost of goods…

Q: Cost of goods sold Operating expenses Dividend income Net income Retained earnings, 1/1/24 Net…

A: Consolidation:Consolidation means combining the financial items of two or more entities to prepare a…

Q: Pureform, Inc., uses the FIFO method in its process costing system. It manufactures a product that…

A: FIFO METHOD:— Under this method, equivalent units are calculated by adding equivalent units in…

Q: In accounting, which principle emphasizes recording transactions at their original cost? A) Matching…

A: The accounting principles are considered to be the general guidelines and the rules which relate to…

Q: Avril Company makes collections on sales according to the following schedule: 30% in the month of…

A: A cash flow budget estimates your business's cash flow over a specific time period. You can use the…

Q: Access controls prevent and detect unauthorized and illegal access to the firm's assets. The…

A: B) Making the mail room responsible for opening and recording cash and checks received from…

Q: Garden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Management has…

A: Budgeting is the process of estimating future income and expenses for a specified period of time.…

Q: Oahu Kiki tracks the number of units purchased and sold throughout each accounting period but…

A: Ending inventory is the amount of inventory that an entity has on hand, at the end of the period. It…

Q: Ida Company produces a handcrafted musical instrument called a gamelan that is similar to a…

A: The income statement can be prepared using different methods as variable and absorption costing.…

Q: Property and Equipment (in thousands) Feb. 3, 2019 Jan. 28, 2018 Land $78,636 $83,048 Buildings…

A: The objective of the question is to analyze the Property, Plant, and Equipment (PPE) components of…

Q: erhead per unit was constant at $4,500 fc Year 1 Year 2 Year 3 198 210 150 210 150 280 $294,400…

A: Absorption costing:The absorption costing is different from the variable costing because absorption…

Q: Ida Company produces a handcrafted musical Instrument called a gamelan that is similar to a…

A: Income statement is a financial statement that shows profitability, total revenue and total expenses…

Q: Voltaic Electronics uses a standard part in the manufacture of different types of radios. The total…

A: Total fixed costs to be avoided = Total Fixed costs × 20%= $40,000×20%= $8,000Fixed cost remains…

Q: Oki Company pays $294,100 for equipment expected to last four years and have a $30,000 salvage…

A: Journal entries are used in accounting to record the financial transactions of a business. They…

Q: Compute the following for the week ended August 25.

A: FICA (Federal Insurance Contributions Act) taxes are social security and Medicare taxes that both…

Q: Required Information Ch06 Predecessor-Successor Auditor Communications [LO6-2] Predecessor-Successor…

A: Audit standards require that successor auditors communicate with predecessor auditors prior to…

Q: On January 1, 20X6, Plus Corporation acquired 90 percent of Side Corporation for $180,000 cash. Side…

A: Investment is the allocation of resources, generally money, with the goal of earning profit or…

Q: Compute the additional Medicare tax for the following taxpayers. If required, round your answers to…

A: It is the federal payroll tax that helps the employees and employers to pay for the medical…

Q: Required: a. Complete the production cost report for August using the weighted-average method. Note:…

A: Equivalent units are those partial completed units which are used in process costing to calculate…

Q: Neon Inc.’s forecast sales for July is $72,000. It has $15,000 in accounts receivable at the end of…

A: The objective of this question is to calculate the amount of accounts receivable at the end of July…

Q: Ervin Company uses the allowance method to account for uncollectible accounts receivable. The…

A: Accounts receivable are the money that is owed by the customer or buyer from the business who has…

Q: Pearl Products Limited of Shenzhen, China, manufactures and distributes toys throughout South East…

A: The budget is prepared to estimate the requirements for the period. The production budget estimate…

Q: terials. Bwing data are available for the second quarter. Number of bikes assembled Coaster 750…

A: Operation costing is a costing technique that adds additional operation costs and material costs to…

Q: Vail Company recorded the following transactions during November. Date General Journal November 5…

A: Account receivablesThe amount of money that a company has to receive from the customers is called…

Q: A company incurred $50,000 of indirect labor costs in production. The journal entry to record this…

A: The objective of the question is to understand the journal entry that needs to be made when a…

Q: At the end of the current year, Accounts Receivable has a balance of $790,000; Allowance for…

A: ALLOWANCE FOR DOUBTFUL DEBT ACCOUNTAllowance for Doubtful Debt Account is Considered as Contra Asset…

Q: Desrosiers Ltd. had the following long-term receivable account balances at December 31, 2019. Notes…

A: Cash flow from notes refers to the recording and reporting of financial transactions related to…

Q: The Fun Zone sells a variety of children's toys, games, books, and accessories. Assume that a local…

A: Income statement is a financial statement that shows profitability, total revenue and total…

Q: Required information [The following information applies to the questions displayed below.] In 2022,…

A: An intangible asset connected to the acquisition of one business by another is goodwil. In…

Q: Sheffield Sells is unable to reconcile the bank balance at January 31. Sheffield's reconciliation is…

A: The management prepares bank reconciliation statements at a particular time period. This statement…

Q: [The following information applies to the questions displayed below.] Jenkins has a one-third…

A: Overall, a long-term capital loss is less tax-saving than an ordinary loss. While a capital loss is…

Q: what of the costs is an example of a cost that remains the same in total as the number of units…

A: The objective of the question is to identify which among the given costs is a fixed cost. A fixed…

Q: Required: 1. Record the transactions of Littleton Books, assuming the company uses a perpetual…

A: Journal Entry :— It is an act of recording transactions in books of account when transaction…

Q: Only typed solution

A: The objective of the question is to calculate the total revenue at two different price points and…

Q: Assuming that a perpetual inventory system is used, what is the cost of goods sold on a LIFO basis…

A: The following inventory methods used for inventory valuation as follows under:--Specific…

Q: Required information Problem 7-5B (Algo) Determine depreciation under three methods (LO7-4) [The…

A: Depreciation Expenses are the expenses incurred on the wear and tear of the fixed assets. This is…

Q: Which of the following ratios indicates the percentage of each sales dollar that is available to…

A: The objective of the question is to identify the correct ratio that indicates the percentage of each…

Q: Which of the following items would be classified as part of factory overhead? a. amortization of…

A: a. Amortization of manufacturing patents: The cost spread over time for using patented manufacturing…

Q: Compute the additional Medicare tax for the following taxpayers. If required, round your answers to…

A: Answer:- The Medicare tax is a levy that is taken out of receipients' paychecks to pay for…

Q: Samuel and Annamaria are married, file a joint return, and have three qualifying children 2023, they…

A: Answer:- Earned Income Tax Credit:- The Earned Income Tax Credit (EITC) is a refundable tax credit…

Q: ! Required information Use the following information for the Exercises below. (Algo) [The following…

A: Warranty expenses refers to the estimated expense recorded by the business entity related to costs…

Q: Grouper Ltd. manufactures a line of amplifiers that carry a three-year warranty against defects.…

A: Warranty expenses are those expenses which are associate with providing warranty at the time of…

Q: Current Attempt in Progress Tamarisk Express reports the following costs and expenses in June 2022…

A: Product cost = Indirect material used + Depreciation-on delivery equipment+ Dispatcher's salary +…

Q: Concord Corporation had the following inventory transactions occur during 2022: Units Cost/unit Feb.…

A: Gross profit is the amount of money earned by the entity after deducting the cost of goods sold from…

Q: a. What is the anticipated level of profits for the expected sales volumes? b. Assuming that the…

A: Break even point :The break-even point is the level of sales or production at which total revenue…

Q: Give me correct answer with explanation.m Don't upload any image

A: The objective of the question is to journalize the issuance of common and preferred shares by…

Q: The accounting department of the client reports that the balance of Accounts Receivable is $210,000.…

A: The concept used is classical variable sampling, which is a statistical sampling technique commonly…

Q: Tobias is a 50% partner in Solomon LLC, which does not invest in real estate. On January 1, Tobias's…

A: These are deductions available to the taxpayers from their taxable income. These tax deductions will…

Q: A company engages in the following external transactions for November. Purchase equipment in…

A: Journal Entry:— It is an act of recording transactions in books of account when transaction…

Q: Not a graded assignment

A: To determine the presentation for the statement of financial position for any resulting deferred tax…

Unlock instant AI solutions

Tap the button

to generate a solution

Click the button to generate

a solution

- Use the information in RE20-3. Prepare the journal entries that Garvey Company would make in the first year of the lease assuming the lease is classified as a finance lease. However, assume that Garvey is now required to make the 65,949.37 payments on January 1 each year and that the fair value at the lease inception is now 275,000 (65,949:37 4:169865).Use the information in RE20-6. However, assume that there is no bargain purchase option and that Montevallo guarantees the 20,000 estimated residual value at the end of the 10-year lease. Montevallo estimates that it is probable that it will have to pay 15,000 cash due to the residual value guarantee. Calculate the present value of the lease payments. Round your answer to the nearest dollar.Sales-Type Lease with Unguaranteed Residual Value Lessor Company and Lessee Company enter into a 5-year, noncancelable, sales-type lease on January 1, 2019, for equipment that cost Lessor 375,000 (useful life is 5 years). The fair value of the equipment is 400,000. Lessor expects a 12% return on the cost of the asset over the 5-year period of the lease. The equipment will have an estimated unguaranteed residual value of 20,000 at the end of the fifth year of the lease. The lease provisions require 5 equal annual amounts, payable each January 1, beginning with January 1, 2019. Lessee pays all executory costs directly to a third party. The equipment reverts to the lessor at the termination of the lease. Assume there are no initial direct costs, and the lessor expects to be able to collect all lease payments. Required: 1. Show how Lessor should compute the annual rental amounts. 2. Prepare a table summarizing the lease and interest receipts that would be suitable for Lessor. 3. Prepare a table showing the accretion of the unguaranteed residual asset. 4. Prepare the journal entries for Lessor for the years 2019, 2020, and 2021.

- Sales-Type Lease with Guaranteed Residual Value Calder Company, the lessor, enters into a lease with Darwin Company, the lessee, to provide heavy equipment beginning January 1, 2017. The lease is appropriately classified as a sales-type lease. The lease terms, provisions, and related events are as follows: The lease is noncancelable, has a term of 8 years, and has no renewal or bargain purchase option. The annual rentals are 65,000, payable at the end of each year. The interest rate implicit in the lease is 15%. Darwin agrees to pay all executory costs directly to a third party. The cost of the equipment is 280,000. The fair value of the equipment to Calder is 308,021.03. Calder incurs no material initial direct costs. Calder expects that it will be able to collect all lease payments. Calder estimates that the fair value at the end of the lease term will be 50,000 and that the economic life the equipment is 9 years. This residual value is guaranteed by Darwin. The following present value factors are relevant: PV of an ordinary annuity n = 8, i = 15% = 4.487322 PV n = 8, i = 15% = 0.326902 PV n = 1, i = 15% = 0.869565 Required: 1. Determine the proper classification of the lease. 2. Prepare a table summarizing the lease receipts and interest income earned by Calder for this lease. 3. Prepare journal entries for Calder for the years 2019, 2020, and 2021. 4. Next Level Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reported. Use the present value of next years payment approach to classify the lease receivable as current and noncurrent. 5. Next Level Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reported. Use the change in present value approach to classify the lease receivable as current and noncurrent.Comprehensive Landlord Company and Tenant Company enter into a noncancelable, direct financing lease on January 1, 2019, for nonspecialized equipment that cost the Landlord 280,000 (useful life is 6 years with no residual value). The fair value of the equipment is 300,000. The interest rate implicit in the lease is 14%. The 6-year lease requires 6 equal annual amounts payable each January 1, beginning with January 1, 2019. Tenant pays all executory costs directly to a third party on December 1 of each year. The equipment reverts to the lessor at the termination of the lease. Assume that there are no initial direct costs. Landlord expects to collect all rental payments. Required: 1. Next Level (a) Show how landlord should compute the annual rental amounts, (b) Discuss how the Tenant Company should compute the present value of the lease payments. What additional information would be required to make this computation? 2. Next Level Prepare a table summarizing the lease and interest receipts that would be suitable for Landlord. Under what conditions would this table be suitable for Tenant? 3. Assuming that the table prepared in Requirement 2 is suitable for both the lessee and the lessor, prepare the journal entries for both firms for the years 2019 and 2020. Use the straight-line depreciation method for the leased equipment. The executory costs paid by the lessee are in 2019: insurance, 700 and property taxes, 800; in 2020: insurance, 600 and property taxes, 750. 4. Next Level Show the items and amounts that would be reported on the comparative 2019 and 2020 income statements and ending balance sheets for both the lessor and the lessee, using the change in present value approach.Lessee and Lessor Accounting Issues Diego Leasing Company agrees to provide La Jolla Company with equipment under a noncancelable lease for 5 years. The equipment has a 5-year life, cost Diego 25,000, and will have no residual value when the lease term ends. The fair value of the equipment is 30,000. La Jolla agrees to pay all executory costs (500 per year) throughout the lease period directly to a third party. On January 1, 2019, the equipment is delivered. Diego expects a 14% return on its net investment. The five equal annual rents are payable in advance starting January 1, 2019. Required: 1. Assuming this is a sales-type lease for the Diego and a finance lease for the La Jolla, prepare a table summarizing the lease and interest payments suitable for use by either party. 2. Next Level On the assumption that both companies adjust and close books each December 31, prepare journal entries relating to the lease for both companies through December 31, 2020, based on data derived in the table. Assume that La Jolla depreciates similar equipment by the straight line method

- Which of the following statements regarding the new accounting rules, which take effect in 2019, for leases is false? If the lease term is one year or longer, a liability must be recognized. If the lease term is less than one year, an asset must be recognized. The new lease accounting rules will result in more assets and liabilities being recognized on the balance sheet. Leasing will likely remain popular under the new lease accounting rules because leases do not require a large initial outlay of cash.Lessee Accounting Issues Sax Company signs a lease agreement dated January 1, 2019, that provides for it to lease computers from Appleton Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 5 years. The lease is noncancelable and requires equal rental payments to be made at the end of each year. The computers are not specialized for Sax. 2. The computers have an estimated life of 5 years, a fair value of 300,000, and a zero estimated residual value. 3. Sax agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. The annual payment is set by Appleton at 83,222.92 to earn a rate of return of 12% on its net investment. Sax is aware of this rate. Saxs incremental borrowing rate is 10%. 6. Sax uses the straight-line method to record depreciation on similar equipment. Required: 1. Next Level Examine and evaluate each capitalization criteria and determine what type of lease this is for Sax. 2. Calculate the amount of the asset and liability of Sax at the inception of the lease (round to the nearest dollar). 3. Prepare a table summarizing the lease payments and interest expense. 4. Prepare journal entries for Sax for the years 2019 and 2020.Lessor Accounting Issues Ramsey Company leases heavy equipment to Terrell Inc. on March 1, 2019, on the following terms: 1. Twenty-four lease rentals of 2,950 at the beginning of each month are to be paid by Terrell, and the lease is noncancelable. 2. The cost of the heavy equipment to Ramsey was 55,000. 3. Ramsey uses an implicit interest rate of 18% per year and will account for this lease as a sales-type lease. Required: Prepare journal entries for Ramsey (the lessor) to record the lease contract on March 1, 2019, the receipt of the first two lease rentals, and any interest income for March and April 2019. (Round your answers to the nearest dollar.)

- Guaranteed and Unguaranteed Residual Values Grygiel Company leases a nonspecialized machine with a lair value of 50,000 to Baker Company. The lease has a life of 6 years and requires a 10,000 payment at the end of each year. The lease does not include a transfer of ownership nor a bargain purchase option, and the life of the lease is less than a major part of the expected economic life of the machine. It is probable that Grygiel will collect the lease payments plus any amount necessary to satisfy a residual value guarantee. Round your answers to the nearest dollar. Required: 1. Next Level If the interest rate implicit in the lease is 10%, compute the machines expected residual value. 2. Next Level If the residual value is guaranteed by Baker, how would each company classify the lease? 3. Next Level If the residual value is not guaranteed by Baker but is instead guaranteed by a third party, how would each company classify the lease?Grygiel Company leases a nonspecialized machine with a fair 20 value of $50,000 to Baker Company. The lease has a life of 6 years and requires a $10,000 payment at the end of each year. The lease does not include a transfer of ownership nor a bargain purchase option, and life of the lease is less than a major part of the expected economic life of the machine. It is probable at Grygiel will collect lease payments plus any amount necessary to satisfy a residual value guarantee. Round your answers to the nearest dollar. 1. Next Level If the interest rate implicit lease is 10%, compute the machine's expected residual value. 2. Next Level If the residual alue is guaranteed by Baker, how would each company classify the lease? 3. Next Level If the residual value is not guaranteed by Baker but is instead guaranteed by a third party,how would each company classify the lease?Plessings Company leased a piece of machinery to Banana, Inc. on January 1, 2023. The lease is correctly classified as a sales-type lease. Plessings will receive three annual lease payments of $20,900, with the first one received on January 1, 2023. There is no guaranteed or unguaranteed residual value. The fair value of the machine is $50,000 and Plessings incurs initial direct costs of $5,000. What is the implicit rate assuming the initial direct costs are expensed? Group of answer choices 27.95% 14.72% 6.85% 12.23%