Exercise 13-9A (Static) Using the contribution margin approach for a special order decision LO 13-2 Hensely Company, which produces and sells a small digital clock, bases its pricing strategy on a 25 percent markup on total cost. Based on annual production costs for 25,000 units of product, computations for the sales price per clock follow. Unit-level costs Fixed costs Total cost (a) Markup (a x 0.25) Total sales (b) Sales price per unit (b ÷ 25,000) Required $240,000 60,000 300,000 75,000 $375,000 $15 a. Hensely has excess capacity and receives a special order for 8,000 clocks for $12 each. Calculate the contribution margin per unit. Based on this, should Hensely accept the special order? b. Prepare a contribution margin income statement for the special order. Complete this question by entering your answers in the tabs below. Required A Required B Hensely has excess capacity and receives a special order for 8,000 clocks for $12 each unit. Based on this, should Hensely accept the special order? Note: Round your answer to 2 decimal places. Contribution margin per unit Should Hensely accept the special order? < Required A Required B >

Exercise 13-9A (Static) Using the contribution margin approach for a special order decision LO 13-2 Hensely Company, which produces and sells a small digital clock, bases its pricing strategy on a 25 percent markup on total cost. Based on annual production costs for 25,000 units of product, computations for the sales price per clock follow. Unit-level costs Fixed costs Total cost (a) Markup (a x 0.25) Total sales (b) Sales price per unit (b ÷ 25,000) Required $240,000 60,000 300,000 75,000 $375,000 $15 a. Hensely has excess capacity and receives a special order for 8,000 clocks for $12 each. Calculate the contribution margin per unit. Based on this, should Hensely accept the special order? b. Prepare a contribution margin income statement for the special order. Complete this question by entering your answers in the tabs below. Required A Required B Hensely has excess capacity and receives a special order for 8,000 clocks for $12 each unit. Based on this, should Hensely accept the special order? Note: Round your answer to 2 decimal places. Contribution margin per unit Should Hensely accept the special order? < Required A Required B >

Financial & Managerial Accounting

14th Edition

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter19: Cost-Volume-Profit Analysis

Section: Chapter Questions

Problem 19.6BPR

Related questions

Question

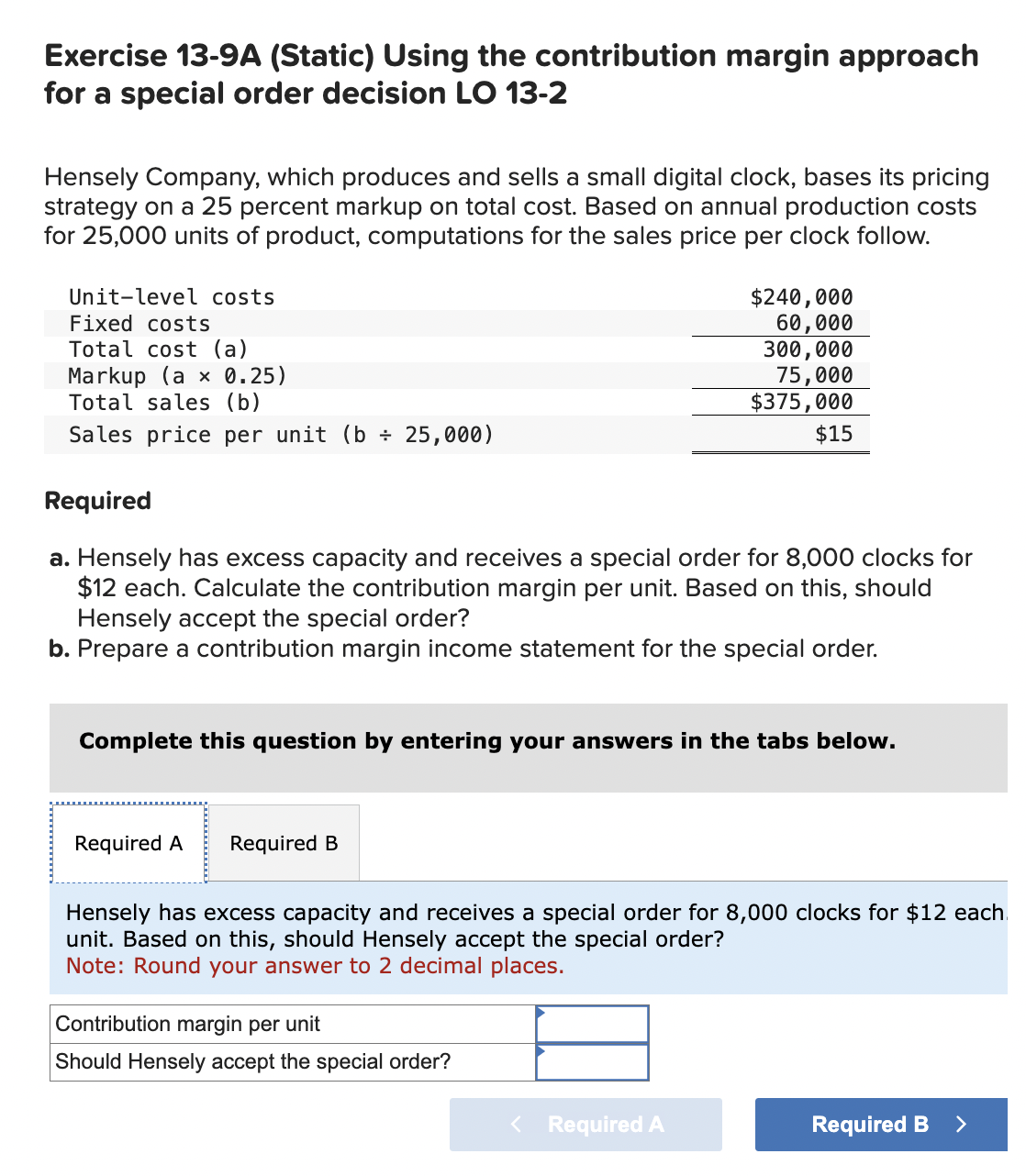

Transcribed Image Text:Exercise 13-9A (Static) Using the contribution margin approach

for a special order decision LO 13-2

Hensely Company, which produces and sells a small digital clock, bases its pricing

strategy on a 25 percent markup on total cost. Based on annual production costs

for 25,000 units of product, computations for the sales price per clock follow.

Unit-level costs

Fixed costs

Total cost (a)

Markup (a x 0.25)

Total sales (b)

Sales price per unit (b÷ 25,000)

Required

$240,000

60,000

300,000

75,000

$375,000

$15

a. Hensely has excess capacity and receives a special order for 8,000 clocks for

$12 each. Calculate the contribution margin per unit. Based on this, should

Hensely accept the special order?

b. Prepare a contribution margin income statement for the special order.

Complete this question by entering your answers in the tabs below.

Required A Required B

Hensely has excess capacity and receives a special order for 8,000 clocks for $12 each

unit. Based on this, should Hensely accept the special order?

Note: Round your answer to 2 decimal places.

Contribution margin per unit

Should Hensely accept the special order?

< Required A

Required B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,