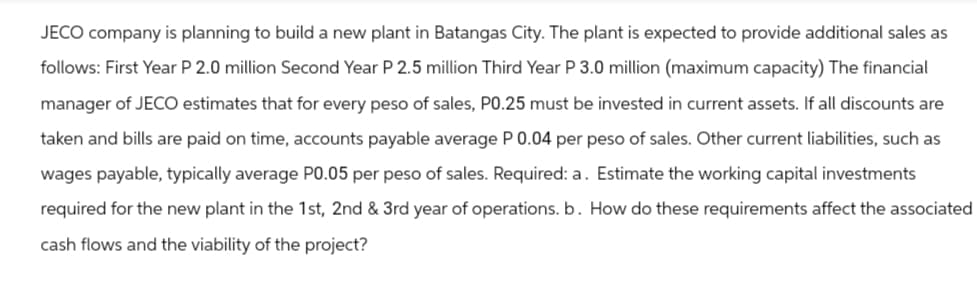

JECO company is planning to build a new plant in Batangas City. The plant is expected to provide additional sales as follows: First Year P 2.0 million Second Year P 2.5 million Third Year P 3.0 million (maximum capacity) The financial manager of JECO estimates that for every peso of sales, P0.25 must be invested in current assets. If all discounts are taken and bills are paid on time, accounts payable average P 0.04 per peso of sales. Other current liabilities, such as wages payable, typically average P0.05 per peso of sales. Required: a. Estimate the working capital investments required for the new plant in the 1st, 2nd & 3rd year of operations. b. How do these requirements affect the associated cash flows and the viability of the project?

JECO company is planning to build a new plant in Batangas City. The plant is expected to provide additional sales as follows: First Year P 2.0 million Second Year P 2.5 million Third Year P 3.0 million (maximum capacity) The financial manager of JECO estimates that for every peso of sales, P0.25 must be invested in current assets. If all discounts are taken and bills are paid on time, accounts payable average P 0.04 per peso of sales. Other current liabilities, such as wages payable, typically average P0.05 per peso of sales. Required: a. Estimate the working capital investments required for the new plant in the 1st, 2nd & 3rd year of operations. b. How do these requirements affect the associated cash flows and the viability of the project?

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 19P

Related questions

Question

Transcribed Image Text:JECO company is planning to build a new plant in Batangas City. The plant is expected to provide additional sales as

follows: First Year P 2.0 million Second Year P 2.5 million Third Year P 3.0 million (maximum capacity) The financial

manager of JECO estimates that for every peso of sales, P0.25 must be invested in current assets. If all discounts are

taken and bills are paid on time, accounts payable average P 0.04 per peso of sales. Other current liabilities, such as

wages payable, typically average P0.05 per peso of sales. Required: a. Estimate the working capital investments

required for the new plant in the 1st, 2nd & 3rd year of operations. b. How do these requirements affect the associated

cash flows and the viability of the project?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub