Daniel, age 38, is single and has the following income and expenses in 2023: Salary income Net rent income Dividend income Payment of alimony (divorce finalized in March 2021) Mortgage interest on residence Property tax on residence Contribution to traditional IRA (assume the amount is fully deductible) Contribution to United Church Loss on the sale of real estate (held for investment) Medical expenses State income tax Federal income tax Daniel's standard deduction for 2023 is $13,850. $123,000 1,500 1,900 20,000 8,300 3,300 2,700 500 2,450 3,550 1,950 3,200 a. Classify the following expenses as either "Deductible for AGI", "Deductible from AGI", or "Not deductible". Payment of alimony (divorce finalized in March 2021) Mortgage interest on residence Property tax on residence < Daniel's standard deduction for 2023 is $13,850. a. Classify the following expenses as either "Deductible for AGI", "Deductible from AGI", or "Not deductible". Payment of alimony (divorce finalized in March 2021) Mortgage interest on residence Property tax on residence Contribution to traditional IRA (assume the amount is fully deductible) Contribution to United Church Loss on the sale of real estate (held for investment) Medical expenses State income tax Federal income tax What is Daniel's gross income and his AGI? Gross income: $ AGI: $ b. Should Daniel itemize his deductions from AGI or take the standard deduction? Because Daniel's total itemized deductions (after any limitations) are $ he would benefit from 10:34

Daniel, age 38, is single and has the following income and expenses in 2023: Salary income Net rent income Dividend income Payment of alimony (divorce finalized in March 2021) Mortgage interest on residence Property tax on residence Contribution to traditional IRA (assume the amount is fully deductible) Contribution to United Church Loss on the sale of real estate (held for investment) Medical expenses State income tax Federal income tax Daniel's standard deduction for 2023 is $13,850. $123,000 1,500 1,900 20,000 8,300 3,300 2,700 500 2,450 3,550 1,950 3,200 a. Classify the following expenses as either "Deductible for AGI", "Deductible from AGI", or "Not deductible". Payment of alimony (divorce finalized in March 2021) Mortgage interest on residence Property tax on residence < Daniel's standard deduction for 2023 is $13,850. a. Classify the following expenses as either "Deductible for AGI", "Deductible from AGI", or "Not deductible". Payment of alimony (divorce finalized in March 2021) Mortgage interest on residence Property tax on residence Contribution to traditional IRA (assume the amount is fully deductible) Contribution to United Church Loss on the sale of real estate (held for investment) Medical expenses State income tax Federal income tax What is Daniel's gross income and his AGI? Gross income: $ AGI: $ b. Should Daniel itemize his deductions from AGI or take the standard deduction? Because Daniel's total itemized deductions (after any limitations) are $ he would benefit from 10:34

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

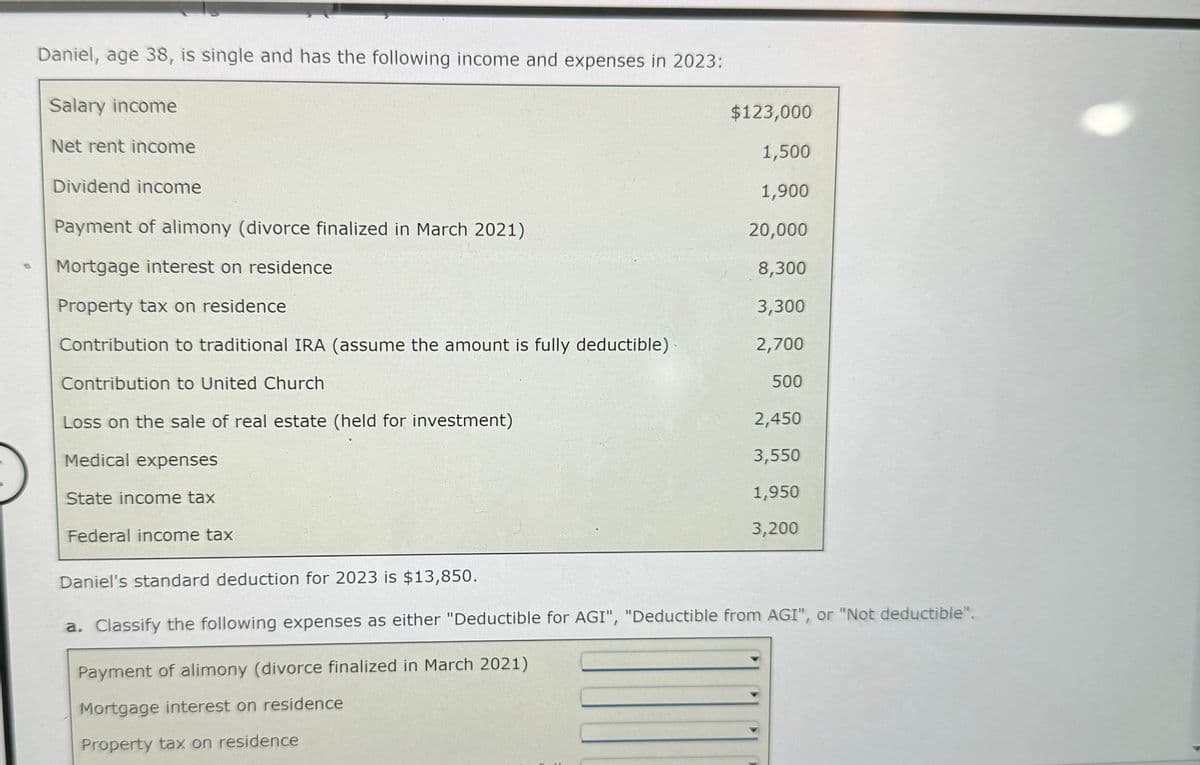

Transcribed Image Text:Daniel, age 38, is single and has the following income and expenses in 2023:

Salary income

Net rent income

Dividend income

Payment of alimony (divorce finalized in March 2021)

Mortgage interest on residence

Property tax on residence

Contribution to traditional IRA (assume the amount is fully deductible)

Contribution to United Church

Loss on the sale of real estate (held for investment)

Medical expenses

State income tax

Federal income tax

Daniel's standard deduction for 2023 is $13,850.

$123,000

1,500

1,900

20,000

8,300

3,300

2,700

500

2,450

3,550

1,950

3,200

a. Classify the following expenses as either "Deductible for AGI", "Deductible from AGI", or "Not deductible".

Payment of alimony (divorce finalized in March 2021)

Mortgage interest on residence

Property tax on residence

Transcribed Image Text:<

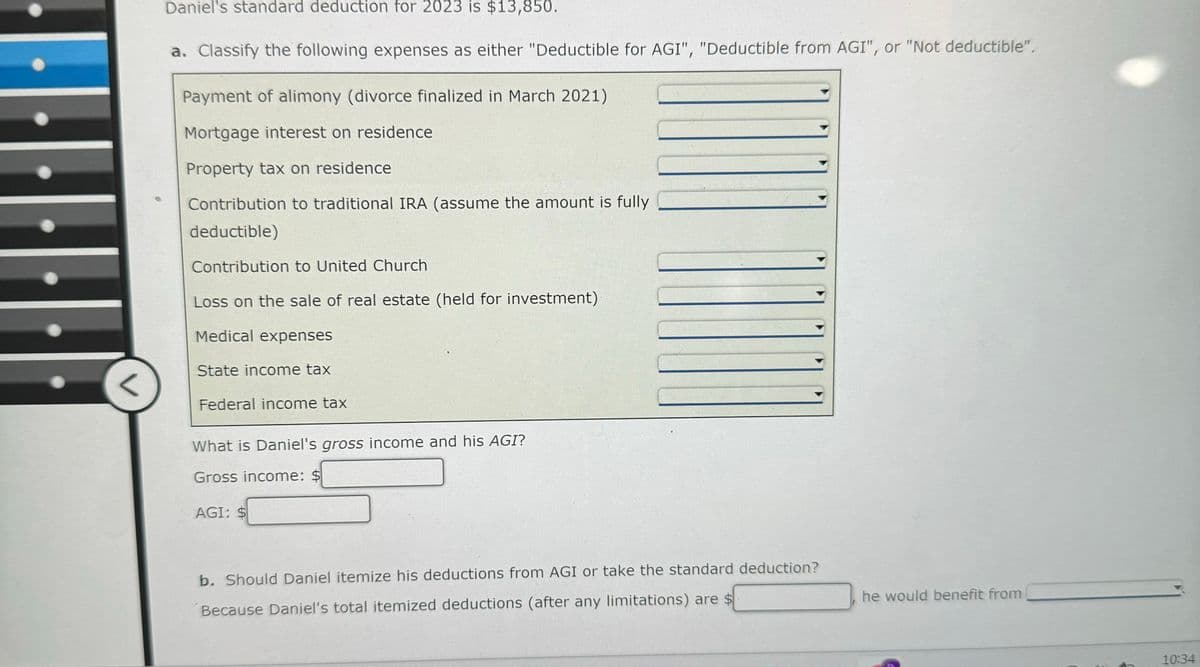

Daniel's standard deduction for 2023 is $13,850.

a. Classify the following expenses as either "Deductible for AGI", "Deductible from AGI", or "Not deductible".

Payment of alimony (divorce finalized in March 2021)

Mortgage interest on residence

Property tax on residence

Contribution to traditional IRA (assume the amount is fully

deductible)

Contribution to United Church

Loss on the sale of real estate (held for investment)

Medical expenses

State income tax

Federal income tax

What is Daniel's gross income and his AGI?

Gross income: $

AGI: $

b. Should Daniel itemize his deductions from AGI or take the standard deduction?

Because Daniel's total itemized deductions (after any limitations) are $

he would benefit from

10:34

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 1 steps

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education