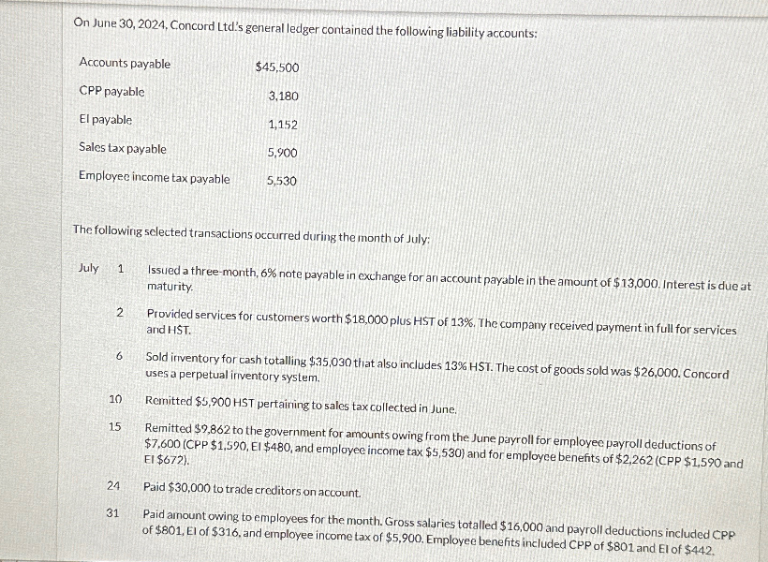

On June 30, 2024, Concord Ltd's general ledger contained the following liability accounts: Accounts payable CPP payable $45,500 3,180 El payable 1,152 Sales tax payable 5,900 Employee income tax payable 5,530 The following selected transactions occurred during the month of July: July 1 2 6 Issued a three-month, 6% note payable in exchange for an account payable in the amount of $13,000. Interest is due at maturity. Provided services for customers worth $18,000 plus HST of 13%. The company received payment in full for services and HST. Sold inventory for cash totalling $35,030 that also includes 13% HST. The cost of goods sold was $26,000. Concord uses a perpetual inventory system. 10 Remitted $5,900 HST pertaining to sales tax collected in June. 15 Remitted $9,862 to the government for amounts owing from the June payroll for employee payroll deductions of $7,600 (CPP $1,590, El $480, and employee income tax $5,530) and for employee benefits of $2,262 (CPP $1,590 and El $672). 24 Paid $30,000 to trade creditors on account. 31 Paid amount owing to employees for the month. Gross salaries totalled $16,000 and payroll deductions included CPP of $801, El of $316, and employee income tax of $5,900. Employee benefits included CPP of $801 and El of $442.

On June 30, 2024, Concord Ltd's general ledger contained the following liability accounts: Accounts payable CPP payable $45,500 3,180 El payable 1,152 Sales tax payable 5,900 Employee income tax payable 5,530 The following selected transactions occurred during the month of July: July 1 2 6 Issued a three-month, 6% note payable in exchange for an account payable in the amount of $13,000. Interest is due at maturity. Provided services for customers worth $18,000 plus HST of 13%. The company received payment in full for services and HST. Sold inventory for cash totalling $35,030 that also includes 13% HST. The cost of goods sold was $26,000. Concord uses a perpetual inventory system. 10 Remitted $5,900 HST pertaining to sales tax collected in June. 15 Remitted $9,862 to the government for amounts owing from the June payroll for employee payroll deductions of $7,600 (CPP $1,590, El $480, and employee income tax $5,530) and for employee benefits of $2,262 (CPP $1,590 and El $672). 24 Paid $30,000 to trade creditors on account. 31 Paid amount owing to employees for the month. Gross salaries totalled $16,000 and payroll deductions included CPP of $801, El of $316, and employee income tax of $5,900. Employee benefits included CPP of $801 and El of $442.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 5PB: Payroll accounts and year-end entries The following accounts, with the balances indicated, appear in...

Related questions

Question

Transcribed Image Text:On June 30, 2024, Concord Ltd's general ledger contained the following liability accounts:

Accounts payable

CPP payable

$45,500

3,180

El payable

1,152

Sales tax payable

5,900

Employee income tax payable

5,530

The following selected transactions occurred during the month of July:

July

1

2

6

Issued a three-month, 6% note payable in exchange for an account payable in the amount of $13,000. Interest is due at

maturity.

Provided services for customers worth $18,000 plus HST of 13%. The company received payment in full for services

and HST.

Sold inventory for cash totalling $35,030 that also includes 13% HST. The cost of goods sold was $26,000. Concord

uses a perpetual inventory system.

10

Remitted $5,900 HST pertaining to sales tax collected in June.

15

Remitted $9,862 to the government for amounts owing from the June payroll for employee payroll deductions of

$7,600 (CPP $1,590, El $480, and employee income tax $5,530) and for employee benefits of $2,262 (CPP $1,590 and

El $672).

24

Paid $30,000 to trade creditors on account.

31

Paid amount owing to employees for the month. Gross salaries totalled $16,000 and payroll deductions included CPP

of $801, El of $316, and employee income tax of $5,900. Employee benefits included CPP of $801 and El of $442.

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub