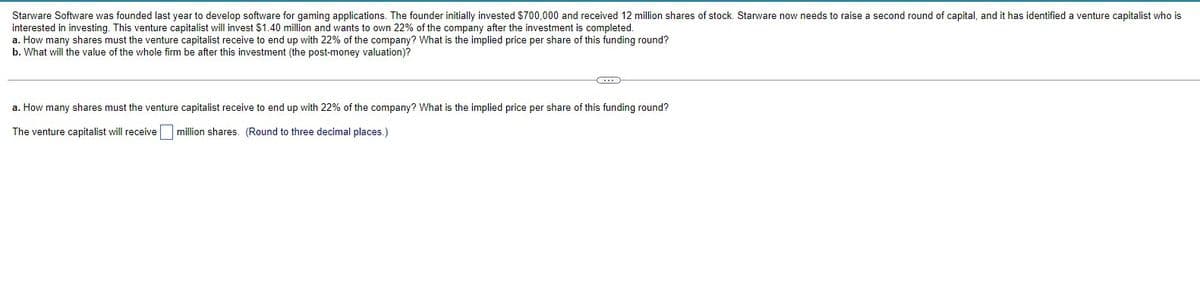

Starware Software was founded last year to develop software for gaming applications. The founder initially invested $700,000 and received 12 million shares of stock. Starware now needs to raise a second round of capital, and it has identified a venture capitali interested in investing. This venture capitalist will invest $1.40 million and wants to own 22% of the company after the investment is completed. a. How many shares must the venture capitalist receive to end up with 22% of the company? What is the implied price per share of this funding round? b. What will the value of the whole firm be after this investment (the post-money valuation)? a. How many shares must the venture capitalist receive to end up with 22% of the company? What is the implied price per share of this funding round? The venture capitalist will receive million shares. (Round to three decimal places.)

Starware Software was founded last year to develop software for gaming applications. The founder initially invested $700,000 and received 12 million shares of stock. Starware now needs to raise a second round of capital, and it has identified a venture capitali interested in investing. This venture capitalist will invest $1.40 million and wants to own 22% of the company after the investment is completed. a. How many shares must the venture capitalist receive to end up with 22% of the company? What is the implied price per share of this funding round? b. What will the value of the whole firm be after this investment (the post-money valuation)? a. How many shares must the venture capitalist receive to end up with 22% of the company? What is the implied price per share of this funding round? The venture capitalist will receive million shares. (Round to three decimal places.)

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter18: Initial Public Offerings, Investment Banking, And Capital Formation

Section: Chapter Questions

Problem 9MC

Related questions

Question

weded

Transcribed Image Text:Starware Software was founded last year to develop software for gaming applications. The founder initially invested $700,000 and received 12 million shares of stock. Starware now needs to raise a second round of capital, and it has identified a venture capitalist who is

interested in investing. This venture capitalist will invest $1.40 million and wants to own 22% of the company after the investment is completed.

a. How many shares must the venture capitalist receive to end up with 22% of the company? What is the implied price per share of this funding round?

b. What will the value of the whole firm be after this investment (the post-money valuation)?

a. How many shares must the venture capitalist receive to end up with 22% of the company? What is the implied price per share of this funding round?

The venture capitalist will receive ☐ million shares. (Round to three decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Provide formula to calculate the total shares after investment of venture capitalist:

VIEWStep 2: (a) Determine the number of shares venture capitalist receive to end up with 22% of the company:

VIEWStep 3: Determine the implied price per share of the funding round:

VIEWStep 4: (b) Determine the value of the whole firm be after this investment (the post-money valuation):

VIEWSolution

VIEWStep by step

Solved in 5 steps with 1 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning