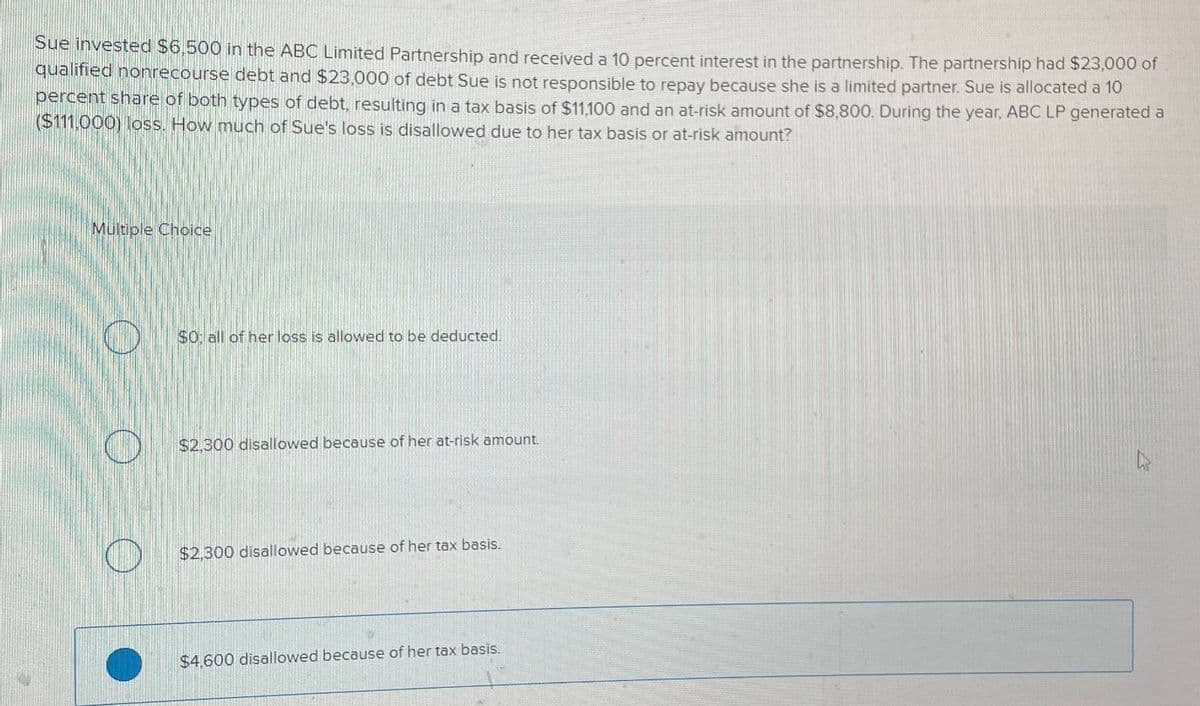

Sue invested $6,500 in the ABC Limited Partnership and received a 10 percent interest in the partnership. The partnership had $23,000 of qualified nonrecourse debt and $23,000 of debt Sue is not responsible to repay because she is a limited partner. Sue is allocated a 10 percent share of both types of debt, resulting in a tax basis of $11,100 and an at-risk amount of $8,800. During the year, ABC LP generated a ($111,000) loss. How much of Sue's loss is disallowed due to her tax basis or at-risk amount? Multiple Choice $0: all of her loss is allowed to be deducted. $2.300 disallowed because of her at-risk amount. $2,300 disallowed because of her tax basis. $4,600 disallowed because of her tax basis.

Sue invested $6,500 in the ABC Limited Partnership and received a 10 percent interest in the partnership. The partnership had $23,000 of qualified nonrecourse debt and $23,000 of debt Sue is not responsible to repay because she is a limited partner. Sue is allocated a 10 percent share of both types of debt, resulting in a tax basis of $11,100 and an at-risk amount of $8,800. During the year, ABC LP generated a ($111,000) loss. How much of Sue's loss is disallowed due to her tax basis or at-risk amount? Multiple Choice $0: all of her loss is allowed to be deducted. $2.300 disallowed because of her at-risk amount. $2,300 disallowed because of her tax basis. $4,600 disallowed because of her tax basis.

Chapter14: Choice Of Business Entity—operations And Distributions

Section: Chapter Questions

Problem 46P

Related questions

Question

Transcribed Image Text:Sue invested $6,500 in the ABC Limited Partnership and received a 10 percent interest in the partnership. The partnership had $23,000 of

qualified nonrecourse debt and $23,000 of debt Sue is not responsible to repay because she is a limited partner. Sue is allocated a 10

percent share of both types of debt, resulting in a tax basis of $11,100 and an at-risk amount of $8,800. During the year, ABC LP generated a

($111,000) loss. How much of Sue's loss is disallowed due to her tax basis or at-risk amount?

Multiple Choice

$0: all of her loss is allowed to be deducted.

$2.300 disallowed because of her at-risk amount.

$2,300 disallowed because of her tax basis.

$4,600 disallowed because of her tax basis.

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT