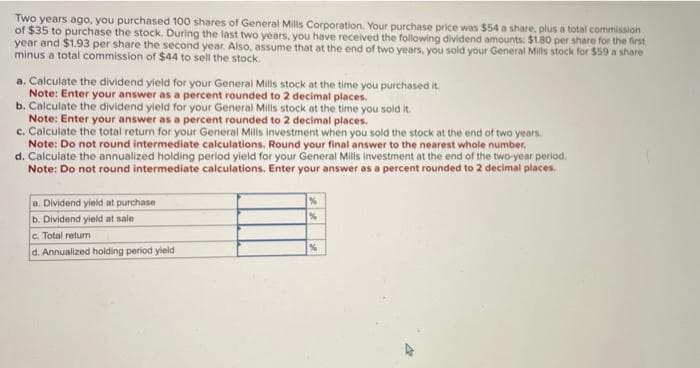

Two years ago, you purchased 100 shares of General Mills Corporation. Your purchase price was $54 a share, plus a total commission of $35 to purchase the stock. During the last two years, you have received the following dividend amounts: $1.80 per share for the first year and $1.93 per share the second year. Also, assume that at the end of two years, you sold your General Mills stock for $59 a share minus a total commission of $44 to sell the stock. a. Calculate the dividend yield for your General Mills stock at the time you purchased it. Note: Enter your answer as a percent rounded to 2 decimal places. b. Calculate the dividend yield for your General Mills stock at the time you sold it. Note: Enter your answer as a percent rounded to 2 decimal places. c. Calculate the total return for your General Mills investment when you sold the stock at the end of two years. Note: Do not round intermediate calculations. Round your final answer to the nearest whole number. d. Calculate the annualized holding period yield for your General Mills investment at the end of the two-year period. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. a. Dividend yield at purchase b. Dividend yield at sale c. Total return % d. Annualized holding period yield %

Two years ago, you purchased 100 shares of General Mills Corporation. Your purchase price was $54 a share, plus a total commission of $35 to purchase the stock. During the last two years, you have received the following dividend amounts: $1.80 per share for the first year and $1.93 per share the second year. Also, assume that at the end of two years, you sold your General Mills stock for $59 a share minus a total commission of $44 to sell the stock. a. Calculate the dividend yield for your General Mills stock at the time you purchased it. Note: Enter your answer as a percent rounded to 2 decimal places. b. Calculate the dividend yield for your General Mills stock at the time you sold it. Note: Enter your answer as a percent rounded to 2 decimal places. c. Calculate the total return for your General Mills investment when you sold the stock at the end of two years. Note: Do not round intermediate calculations. Round your final answer to the nearest whole number. d. Calculate the annualized holding period yield for your General Mills investment at the end of the two-year period. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. a. Dividend yield at purchase b. Dividend yield at sale c. Total return % d. Annualized holding period yield %

Chapter2: The Domestic And International Financial Marketplace

Section: Chapter Questions

Problem 3P

Related questions

Question

Transcribed Image Text:Two years ago, you purchased 100 shares of General Mills Corporation. Your purchase price was $54 a share, plus a total commission

of $35 to purchase the stock. During the last two years, you have received the following dividend amounts: $1.80 per share for the first

year and $1.93 per share the second year. Also, assume that at the end of two years, you sold your General Mills stock for $59 a share

minus a total commission of $44 to sell the stock.

a. Calculate the dividend yield for your General Mills stock at the time you purchased it.

Note: Enter your answer as a percent rounded to 2 decimal places.

b. Calculate the dividend yield for your General Mills stock at the time you sold it.

Note: Enter your answer as a percent rounded to 2 decimal places.

c. Calculate the total return for your General Mills investment when you sold the stock at the end of two years.

Note: Do not round intermediate calculations. Round your final answer to the nearest whole number.

d. Calculate the annualized holding period yield for your General Mills investment at the end of the two-year period.

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.

a. Dividend yield at purchase

b. Dividend yield at sale

c. Total return

d. Annualized holding period yield

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT