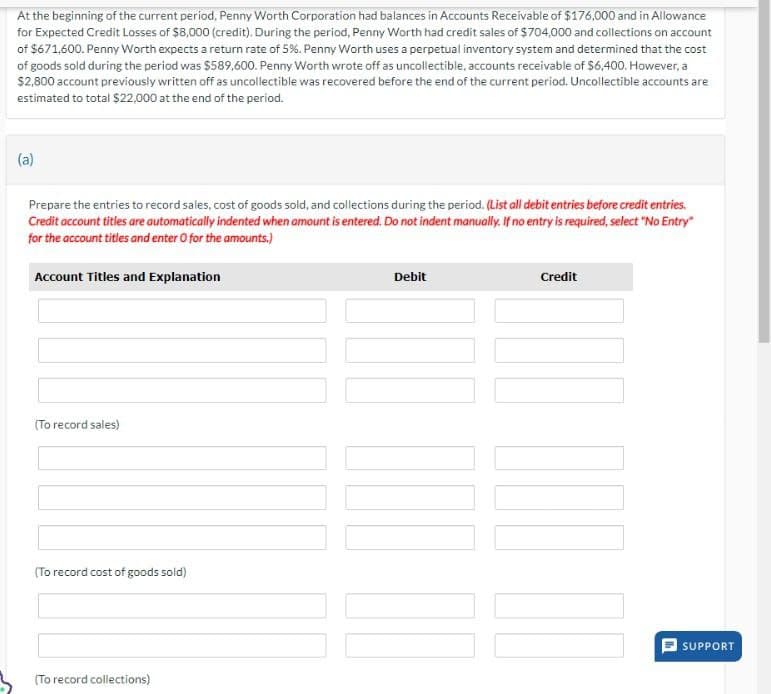

At the beginning of the current period, Penny Worth Corporation had balances in Accounts Receivable of $176,000 and in Allowance for Expected Credit Losses of $8,000 (credit). During the period, Penny Worth had credit sales of $704,000 and collections on account of $671,600. Penny Worth expects a return rate of 5%. Penny Worth uses a perpetual inventory system and determined that the cost of goods sold during the period was $589,600. Penny Worth wrote off as uncollectible, accounts receivable of $6,400. However, a $2,800 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $22,000 at the end of the period. (a) Prepare the entries to record sales, cost of goods sold, and collections during the period. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

At the beginning of the current period, Penny Worth Corporation had balances in Accounts Receivable of $176,000 and in Allowance for Expected Credit Losses of $8,000 (credit). During the period, Penny Worth had credit sales of $704,000 and collections on account of $671,600. Penny Worth expects a return rate of 5%. Penny Worth uses a perpetual inventory system and determined that the cost of goods sold during the period was $589,600. Penny Worth wrote off as uncollectible, accounts receivable of $6,400. However, a $2,800 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $22,000 at the end of the period. (a) Prepare the entries to record sales, cost of goods sold, and collections during the period. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter16: Accounting For Accounts Receivable

Section: Chapter Questions

Problem 3CP: At the end of 20-3, Martel Co. had 410,000 in Accounts Receivable and a credit balance of 300 in...

Related questions

Question

Transcribed Image Text:At the beginning of the current period, Penny Worth Corporation had balances in Accounts Receivable of $176,000 and in Allowance

for Expected Credit Losses of $8,000 (credit). During the period, Penny Worth had credit sales of $704,000 and collections on account

of $671,600. Penny Worth expects a return rate of 5%. Penny Worth uses a perpetual inventory system and determined that the cost

of goods sold during the period was $589,600. Penny Worth wrote off as uncollectible, accounts receivable of $6,400. However, a

$2,800 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are

estimated to total $22,000 at the end of the period.

(a)

Prepare the entries to record sales, cost of goods sold, and collections during the period. (List all debit entries before credit entries.

Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry"

for the account titles and enter O for the amounts.)

Account Titles and Explanation

Debit

Credit

(To record sales)

(To record cost of goods sold)

(To record collections)

SUPPORT

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT