es Harrison Forklift's pension expense includes a service cost of $10 million. Harrison began the year with a pension liability of $28 million (underfunded pension plan). ($ in millions) 1. Interest cost, $6, expected return on assets, $4; amortization of net loss, $2. 2. Interest cost, $6, expected return on assets, $4; amortization of net gain, $2. 3. Interest cost, $6; expected return on assets, $4; amortization of net loss, $2; amortization of prior service cost, $3. Required: Prepare the appropriate general journal entries to record Harrison's pension expense in each of the following independent situations regarding the other (non-service cost) components of pension expense. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10).

es Harrison Forklift's pension expense includes a service cost of $10 million. Harrison began the year with a pension liability of $28 million (underfunded pension plan). ($ in millions) 1. Interest cost, $6, expected return on assets, $4; amortization of net loss, $2. 2. Interest cost, $6, expected return on assets, $4; amortization of net gain, $2. 3. Interest cost, $6; expected return on assets, $4; amortization of net loss, $2; amortization of prior service cost, $3. Required: Prepare the appropriate general journal entries to record Harrison's pension expense in each of the following independent situations regarding the other (non-service cost) components of pension expense. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10).

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 6E

Related questions

Question

Transcribed Image Text:es

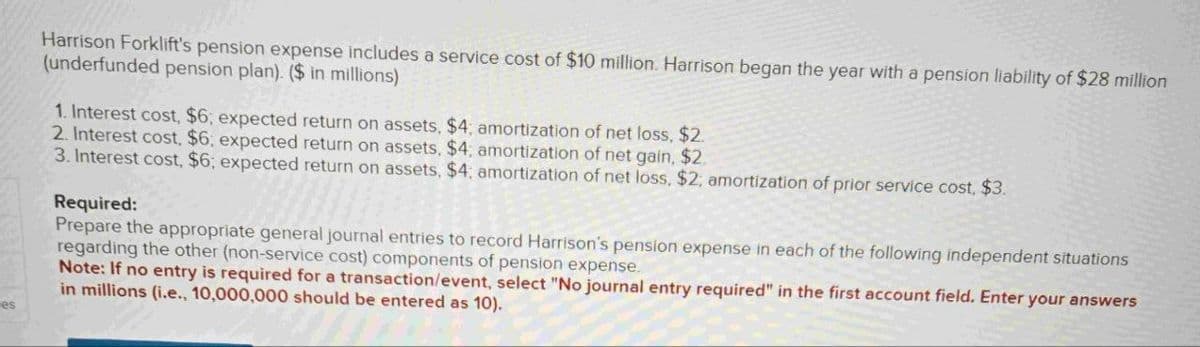

Harrison Forklift's pension expense includes a service cost of $10 million. Harrison began the year with a pension liability of $28 million

(underfunded pension plan). ($ in millions)

1. Interest cost, $6; expected return on assets, $4; amortization of net loss, $2.

2. Interest cost, $6; expected return on assets, $4; amortization of net gain, $2.

3. Interest cost, $6; expected return on assets, $4; amortization of net loss, $2; amortization of prior service cost, $3.

Required:

Prepare the appropriate general journal entries to record Harrison's pension expense in each of the following independent situations

regarding the other (non-service cost) components of pension expense.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers

in millions (i.e., 10,000,000 should be entered as 10).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College