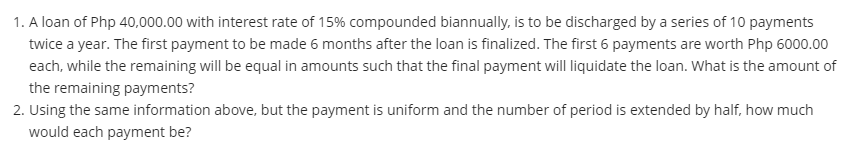

. A loan of Php 40,000.00 with interest rate of 15% compounded biannually, is to be discharged by a series of 10 payments twice a year. The first payment to be made 6 months after the loan is finalized. The first 6 payments are worth Php 6000.00 each, while the remaining will be equal in amounts such that the final payment will liquidate the loan. What is the amount of the remaining payments? . Using the same information above, but the payment is uniform and the number of period is extended by half, how much would each payment be?

. A loan of Php 40,000.00 with interest rate of 15% compounded biannually, is to be discharged by a series of 10 payments twice a year. The first payment to be made 6 months after the loan is finalized. The first 6 payments are worth Php 6000.00 each, while the remaining will be equal in amounts such that the final payment will liquidate the loan. What is the amount of the remaining payments? . Using the same information above, but the payment is uniform and the number of period is extended by half, how much would each payment be?

Chapter4: Time Value Of Money

Section4.17: Amortized Loans

Problem 1ST

Related questions

Question

Transcribed Image Text:1. A loan of Php 40,000.00 with interest rate of 15% compounded biannually, is to be discharged by a series of 10 payments

twice a year. The first payment to be made 6 months after the loan is finalized. The first 6 payments are worth Php 6000.00

each, while the remaining will be equal in amounts such that the final payment will liquidate the loan. What is the amount of

the remaining payments?

2. Using the same information above, but the payment is uniform and the number of period is extended by half, how much

would each payment be?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College