:. On January 1, 2020, Riki Co. acquires the entire share capital of Doom Co. by issuing 100,000 new P2 ordinary shares at a fair value at the acquisition date of P2.50. The professional fees associated with the acquisition are P20,000 and the issue costs of the shares are P10,000. The carrying value of the net assets of Doom Co. at the time of acquisition is P150,000, which is equal to its fair value. A contract exists whereby Riki Co. will buy certain components from Doom Co. over the next five years. The contract was signed when market prices for these components were markedly higher than they are at the acquisition date. At the acquisition date the fair value of the amount by which the contract prices are expected to exceed market prices over the next five years is P1.5 million. Required: Based on the above data, prepare the journal entries and compute the goodwill (gain) assuming: Case No. 1: If Doom's profits for the first full year following acquisition exceed P2 million, Riki Co. will make an additional cash consideration of P200,000 within one month after that year end. It is doubtful whether Doom Co. will achieve this profit, hence the acquisition-date fair value of this contingent consideration is P100,000. On July 15, 2020, the value of the contingent consideration is determined to be P125,000. This additional valuation is related to facts and circumstances that existed as of the acquisition date. On September 16, 2020, the value of the contingent consideration is revised to P129,000. This additional valuation is not related to facts and circumstances that existed as of the acquisition date. On October 1, 2020, Riki Co. receives the information it was seeking about facts and circumstances that existed as of the acquisition date. Doom's profits for the first full year is P2.5 million and settlement was made on January 15, 2021.

:. On January 1, 2020, Riki Co. acquires the entire share capital of Doom Co. by issuing 100,000 new P2 ordinary shares at a fair value at the acquisition date of P2.50. The professional fees associated with the acquisition are P20,000 and the issue costs of the shares are P10,000. The carrying value of the net assets of Doom Co. at the time of acquisition is P150,000, which is equal to its fair value. A contract exists whereby Riki Co. will buy certain components from Doom Co. over the next five years. The contract was signed when market prices for these components were markedly higher than they are at the acquisition date. At the acquisition date the fair value of the amount by which the contract prices are expected to exceed market prices over the next five years is P1.5 million. Required: Based on the above data, prepare the journal entries and compute the goodwill (gain) assuming: Case No. 1: If Doom's profits for the first full year following acquisition exceed P2 million, Riki Co. will make an additional cash consideration of P200,000 within one month after that year end. It is doubtful whether Doom Co. will achieve this profit, hence the acquisition-date fair value of this contingent consideration is P100,000. On July 15, 2020, the value of the contingent consideration is determined to be P125,000. This additional valuation is related to facts and circumstances that existed as of the acquisition date. On September 16, 2020, the value of the contingent consideration is revised to P129,000. This additional valuation is not related to facts and circumstances that existed as of the acquisition date. On October 1, 2020, Riki Co. receives the information it was seeking about facts and circumstances that existed as of the acquisition date. Doom's profits for the first full year is P2.5 million and settlement was made on January 15, 2021.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 19E

Related questions

Question

100%

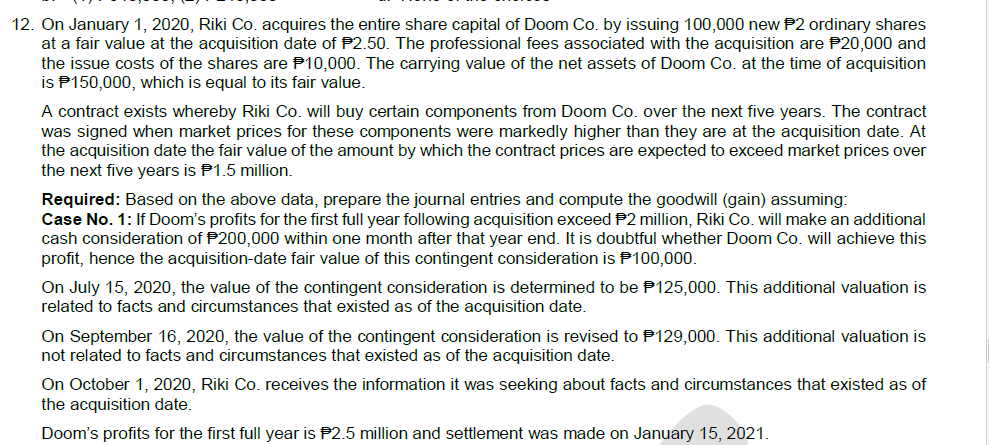

Transcribed Image Text:12. On January 1, 2020, Riki Co. acquires the entire share capital of Doom Co. by issuing 100,000 new P2 ordinary shares

at a fair value at the acquisition date of P2.50. The professional fees associated with the acquisition are P20,000 and

the issue costs of the shares are P10,000. The carrying value of the net assets of Doom Co. at the time of acquisition

is P150,000, which is equal to its fair value.

A contract exists whereby Riki Co. will buy certain components from Doom Co. over the next five years. The contract

was signed when market prices for these components were markedly higher than they are at the acquisition date. At

the acquisition date the fair value of the amount by which the contract prices are expected to exceed market prices over

the next five years is P1.5 million.

Required: Based on the above data, prepare the journal entries and compute the goodwill (gain) assuming:

Case No. 1: If Doom's profits for the first full year following acquisition exceed P2 million, Riki Co. will make an additional

cash consideration of P200,000 within one month after that year end. It is doubtful whether Doom Co. will achieve this

profit, hence the acquisition-date fair value of this contingent consideration is P100,000.

On July 15, 2020, the value of the contingent consideration is determined to be P125,000. This additional valuation is

related to facts and circumstances that existed as of the acquisition date.

On September 16, 2020, the value of the contingent consideration is revised to P129,000. This additional valuation is

not related to facts and circumstances that existed as of the acquisition date.

On October 1, 2020, Riki Co. receives the information it was seeking about facts and circumstances that existed as of

the acquisition date.

Doom's profits for the first full year is P2.5 million and settlement was made on January 15, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT