). Suppose that 1 years from now, one investment plan will be generating profit at the rate of Pi(t) = 100 + hundred dollars per year, while a second investment will be generating profit at the rate of P2(1) = 220 + 21 hundred dollars per year. (a) For how many years does the rate of profitability of the second investment exceed that of the first? (b) Compute the net excess profit assuming that you invest in the second plan for the time period determined in part (a). (c) Sketch the rate of profitability curves y = P(1) and y = P2(t) and shade the region whose area represents the net excess profit computed in part (b). %3D

). Suppose that 1 years from now, one investment plan will be generating profit at the rate of Pi(t) = 100 + hundred dollars per year, while a second investment will be generating profit at the rate of P2(1) = 220 + 21 hundred dollars per year. (a) For how many years does the rate of profitability of the second investment exceed that of the first? (b) Compute the net excess profit assuming that you invest in the second plan for the time period determined in part (a). (c) Sketch the rate of profitability curves y = P(1) and y = P2(t) and shade the region whose area represents the net excess profit computed in part (b). %3D

Algebra & Trigonometry with Analytic Geometry

13th Edition

ISBN:9781133382119

Author:Swokowski

Publisher:Swokowski

Chapter5: Inverse, Exponential, And Logarithmic Functions

Section: Chapter Questions

Problem 18T

Related questions

Question

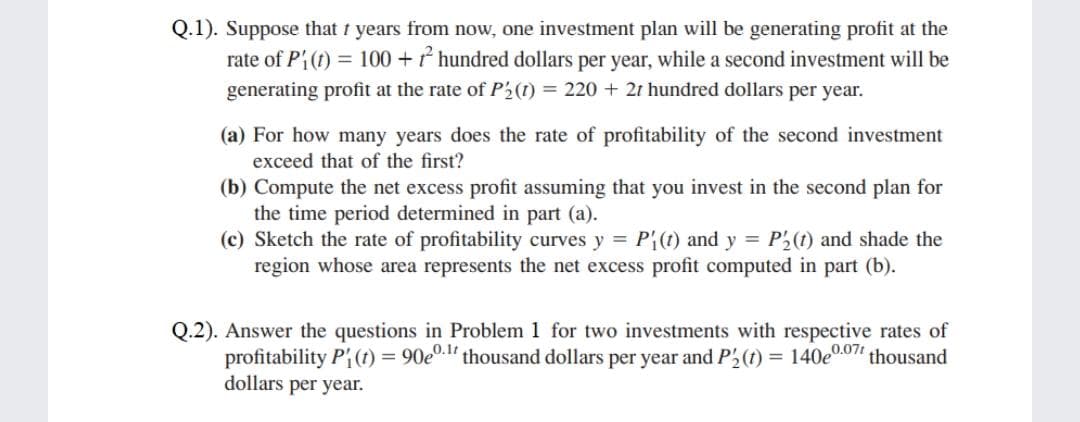

Question 1:

Suppose that I years from now, one investment plan will be generating profit at the rate of P₁(t) = 100+ hundred dollars per year, while a second investment will be generating profit at the rate of P2(t) = 220 + 2r hundred dollars per year.

(a) For how many years does the rate of profitability of the second investment exceed that of the first?

(b) Compute the net excess profit assuming that you invest in the second plan for the time period determined in part (a).

(c) Sketch the rate of profitability curves y = P₁(t) and y = P2(t) and shade the region whose area represents the net excess profit computed in part (b).

Question 2:

Answer the questions in Question 1 for two investments with respective rates of profitability P₁(t) = 90e thousand dollars per year and P2 (t) = 140e0.0 thousand dollars per year.

I also need help in question 5 which is in the image attached below.

Transcribed Image Text:Q.1). Suppose that t years from now, one investment plan will be generating profit at the

rate of Pi(t) = 100 + * hundred dollars per year, while a second investment will be

generating profit at the rate of P2(1) = 220 + 2t hundred dollars per year.

(a) For how many years does the rate of profitability of the second investment

exceed that of the first?

(b) Compute the net excess profit assuming that you invest in the second plan for

the time period determined in part (a).

(c) Sketch the rate of profitability curves y = P{(1) and y = P2(1) and shade the

region whose area represents the net excess profit computed in part (b).

Q.2). Answer the questions in Problem 1 for two investments with respective rates of

profitability Pi(1) = 90e0.l' thousand dollars per year and P2(t) = 140e0.07" thousand

dollars per year.

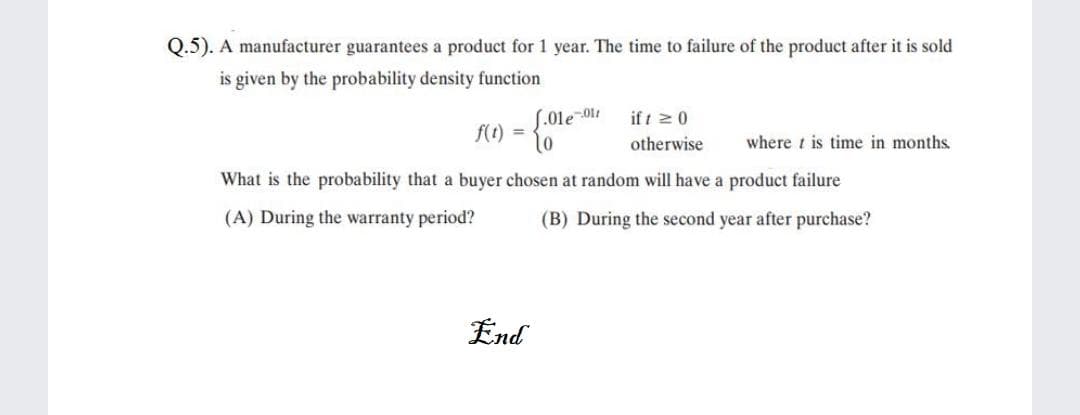

Transcribed Image Text:Q.5). A manufacturer guarantees a product for 1 year. The time to failure of the product after it is sold

is given by the probability density function

S.01e-01t

f(t) =

if t z0

otherwise

where t is time in months.

What is the probability that a buyer chosen at random will have a product failure

(A) During the warranty period?

(B) During the second year after purchase?

End

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, calculus and related others by exploring similar questions and additional content below.Recommended textbooks for you

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage