,000,000 on February 1, 2022 and expects 2% to be uncollectible. The City has o due dates for collection, 1/2 on October 31, 2022 and 1/2 on April 30, 2023. ecord the requested journal entries: 1. Record the levy on February 1, 2022, assuming the City records the entire levy as unavailable revenue. 2. Record the collection of property taxes of $2,410,000 on October 31, 2022. 3. Record any necessary adjusting journal entry at December 31, 2022.

,000,000 on February 1, 2022 and expects 2% to be uncollectible. The City has o due dates for collection, 1/2 on October 31, 2022 and 1/2 on April 30, 2023. ecord the requested journal entries: 1. Record the levy on February 1, 2022, assuming the City records the entire levy as unavailable revenue. 2. Record the collection of property taxes of $2,410,000 on October 31, 2022. 3. Record any necessary adjusting journal entry at December 31, 2022.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter9: Current Liabilities And Contingent Obligations

Section: Chapter Questions

Problem 7P

Related questions

Topic Video

Question

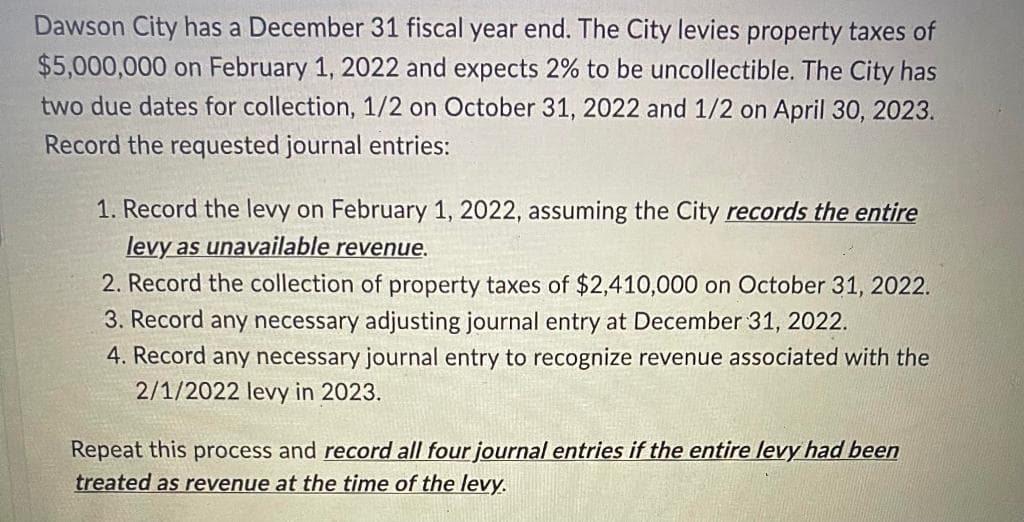

Transcribed Image Text:Dawson City has a December 31 fiscal year end. The City levies property taxes of

$5,000,000 on February 1, 2022 and expects 2% to be uncollectible. The City has

two due dates for collection, 1/2 on October 31, 2022 and 1/2 on April 30, 2023.

Record the requested journal entries:

1. Record the levy on February 1, 2022, assuming the City records the entire

levy as unavailable revenue.

2. Record the collection of property taxes of $2,410,000 on October 31, 2022.

3. Record any necessary adjusting journal entry at December 31, 2022.

4. Record any necessary journal entry to recognize revenue associated with the

2/1/2022 levy in 2023.

Repeat this process and record all four journal entries if the entire levy had been

treated as revenue at the time of the levy.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning