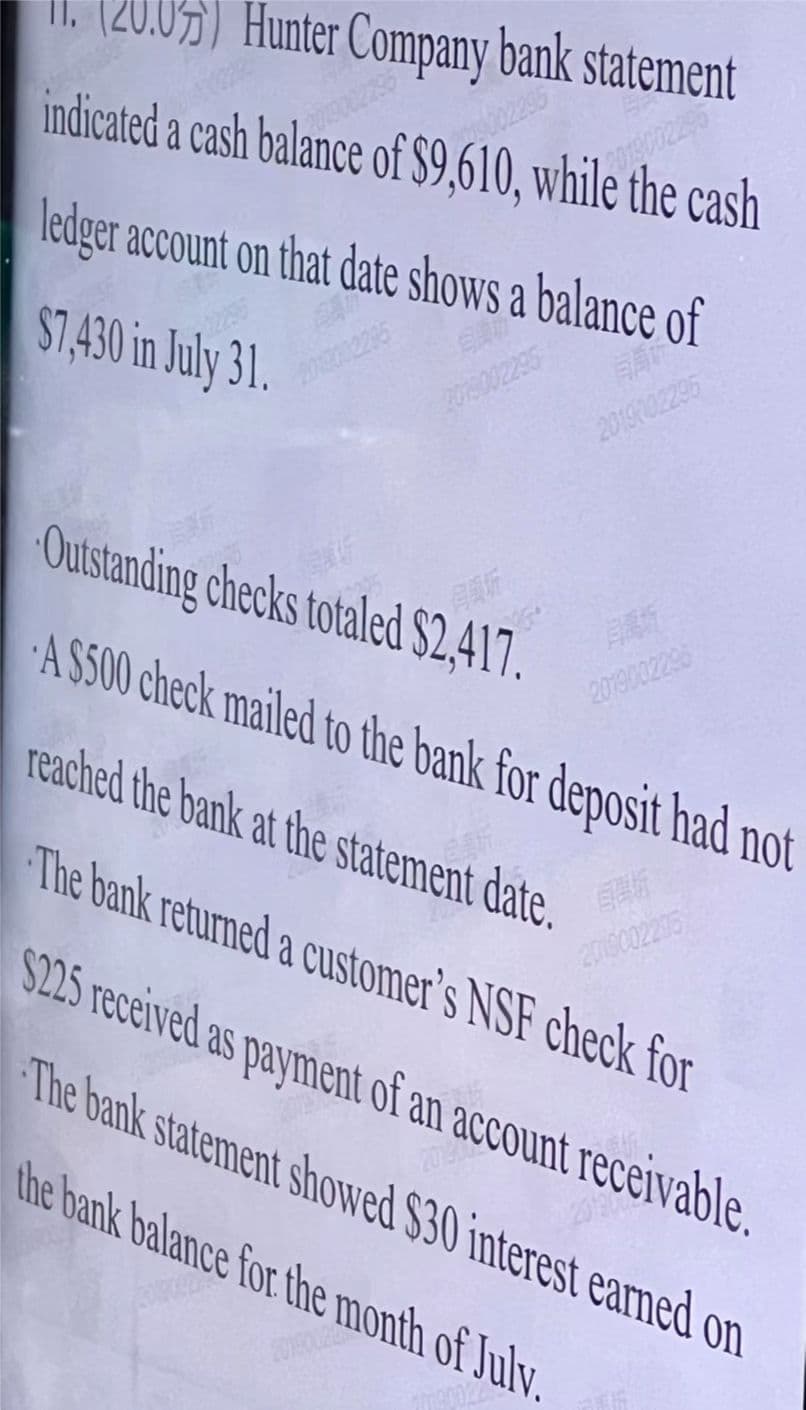

075) Hunter Company bank statement indicated a cash balance of $9,610, while the cash 2019002795 ledger account on that date shows a balance of $7,430 in July 31. 2019002295 Outstanding checks totaled $2,417. A $500 check mailed to the bank for deposit had not reached the bank at the statement date. The bank returned a customer's NSF check for $225 received as payment of an account receivable. The bank statement showed $30 interest earned on 2019 2019302295 7090022 2019002295 2019002295 the bank balance for the month of July.

075) Hunter Company bank statement indicated a cash balance of $9,610, while the cash 2019002795 ledger account on that date shows a balance of $7,430 in July 31. 2019002295 Outstanding checks totaled $2,417. A $500 check mailed to the bank for deposit had not reached the bank at the statement date. The bank returned a customer's NSF check for $225 received as payment of an account receivable. The bank statement showed $30 interest earned on 2019 2019302295 7090022 2019002295 2019002295 the bank balance for the month of July.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 5E

Related questions

Question

Transcribed Image Text:Hunter Company bank statement

indicated a cash balance of $9,610, while the cash

11.

chut

ledger account on that date shows a balance of

$7,430 in July 31.

Outstanding checks totaled $2,417.

A $500 check mailed to the bank for deposit had not

reached the bank at the statement date.

The bank returned a customer's NSF check for

$225 received as payment of an account receivable.

2016092

FAT

2019302296

The bank statement showed $30 interest earned on

201504

20130022

2019002295

the bank balance for the month of July.

7090022

2019002295

20120

Transcribed Image Text:the bank balance for the month of July.

Check 781 for supplies cleared the bank for $268

19802295

but was erroneously recorded in our books as $240.

2295

A $486 deposit by A Company was erroneously

credited to our account by the bank.

9002295

2002295

2019002296

002295

Required:

Prepare a July 31 bank reconciliation statement for

the Hunter Company.

MICHES

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage