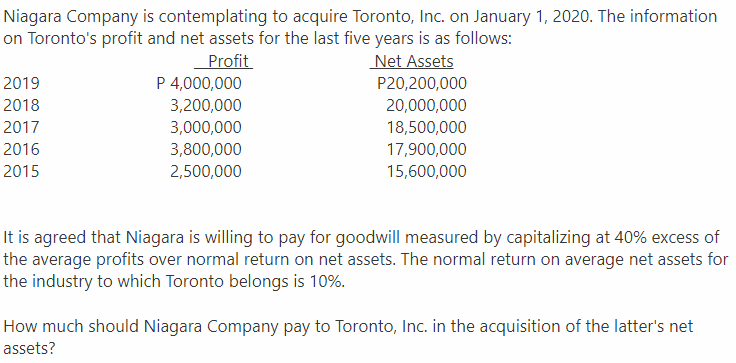

1 18rohto s profit ar net as of the last five years is as IOws: Net Assets Profit P 4,000,000 3,200,000 3,000,000 019 P20,200,000 018 017 016 015 20,000,000 18,500,000 3,800,000 17,900,000 2,500,000 15,600,000 is agreed that Niagara is willing to pay for goodwill measured by capitalizing at 40% excess o e average profits over normal return on net assets. The normal return on average net assets e industry to which Toronto belongs is 10%.

Q: $ 22,000 $ 52,800 $ 55,000 $170,000 $299,800 nits. Prepare a flexible budget for Blossom bas

A: Flexible budget adjusts as per the actual volume or activity. It changes as per the production and…

Q: XYZ Company purchases a machine On January 1, 2014 for $100,000 with an estimated residual value of…

A: Double declining depreciation rate = Straight line depreciation rate x 2 = (100/4 years) x 2 = 50%

Q: What is SAVANT Framework and what do you understand about it?

A: SAVANT stands for strategy, anticipation, value-adding, negotiating, and transforming. It was…

Q: During the month of March 2022, Turaco sole trader purchased goods to the value of N$12 000, of…

A: Net purchases is calculated after subtracting the purchase discounts, purchase returns, and…

Q: Jaybird Company operates in a highly competitive market where the market price for its product is…

A: The profits are calculated as difference between total revenue and expenses for the period.

Q: On January 2, 2019, Upo Co. purchased 75% of the outstanding shares of Napa Co. resulting to a…

A: Consolidation refers to the method under which two or more smaller companies merge into the large…

Q: Answer: А. Electronic Federal Tax Payment System В. lookback period C. monthly depositor status D.…

A: During the deposit period, if the accumulated tax liability exceeds $100,000 or more, then after…

Q: A company has already spent $5,180 to harvest tomatoes. The tomatoes can be sold as is for $93,240.…

A: In sell as is or process further analysis questions, decision is made on the basis of Incremental…

Q: AA8 The adjusted trial balance of ZZZ Corp. on December 31, 2021 includes the following account…

A: Preference shareholders enjoy the preference of capital redemption in the event of liquidation of…

Q: Contribution Margin Incone Statenent Sales (420, 000 units) Variable costs Direct materials Direct…

A: The question is based on the concept of Cost Accounting.

Q: Express the following comparative income statements in common-size percents. Using the common-size…

A: Common size income statement is prepared to show every expense as a percentage of Sales Revenue.

Q: O $53,034

A: The average retail inventory is calculated by taking the sum of all the inventory at the beginning…

Q: Depreciation by Three Methods; Partial Years Perdue Company purchased equipment on October 1 for…

A: Depreciation expense refers to the fall in the value of the asset due to time usage, wear and tear,…

Q: Question 20: Identify the incorrect statement regarding EFTPS. Answer: А. It's a free, online…

A: Answer 20:- Option C is incorrect. Explanation:- When the payment is done using this system must be…

Q: doubtful aceounts estimated at 5% of eredit sales A What amount should be reported as net realiaable…

A: Sales on account means the credit sales which means that goods has been sold but amount will be…

Q: Lia ITZY has determined that the annual demand for number 6 screws is 100,000 screws. Lia, who works…

A: Solution:- i)Calculation of average inventory as follows under:- Average inventory = EOQ / 2

Q: 2. At an interest rate of 10% per year, calculate the capitalized cost of $10,000 (cost) in year 0,…

A: Capitalized Cost=-Initial Cost-Annual Payment×(P/A, r%, n years)-Terminal Payment×(P/F, r%, n years)

Q: its own hardware or that of another accounting services company. In addition to the cost of the…

A: A capitalized cost is an item added to the cost base of a fixed asset on a company's balance sheet.…

Q: The John and John Corporation has ordinary income of $250,000 for 2021, including dividends of…

A: Under USA Taxation rules, if the corporates are receiving any dividend from the other body…

Q: office.com received an $8000 invoice dated April 10. Terms were 2/10, 1/15, n/60. On April 14,…

A: Note: 2/10, 1/15, n/60: Here, 2 represents the discount rate if payment is made within ten days. 1…

Q: Mr. Marvin is a merchandising company which has business operations in Ipoh, Perak. The following…

A: Financial statements of a firm is prepared at the end of an accounting period. The financial…

Q: One day, the company chooses to buy their new accounting information system (AIS), and decide which…

A: Accounting Information System is the system of various program or functions for accounting. It…

Q: a. From the following list of balances, prepare the Accounts Receivable Control Account for the…

A: Accounts Receivable: Accounts receivable indicates the amounts which company has not received from…

Q: Question 6: Form 941 shares the same due date as Answer: A. Form 940 В. O FUTA payments C. O Form…

A: Lets understand the basics. In united states, form 941 is for reporting tax withhold from the…

Q: every six months, mahmood deposit $800 into an account paying 6% compounded semiannually. find the…

A: Present value (PV) = $800 Rate (r) = 6% or 0.06 Semiannually rate (r) = 0.0.3 (0.06/2) Time (n) = 30…

Q: 1. P Company acquired 70% interest in S Company in 2019. S reported net income of P80,000 and…

A: Minority interest means ownership or interest of less then 50% of an enterprise. The minority…

Q: S Depreciation Deduction Accumulated Depreciation Book Value $ 1 $ ✕ 33.33% = $

A: Introduction: The depreciable base for the calculation of depreciation is the amount of cost…

Q: Monaco manufacturing corp has the following account balances per ledger for the period ending…

A: The question is related to Cost Sheet for the year ended December 31st, 2019. The Cost Sheet or…

Q: On January 1, 20x2, Penn Co (parent purchased 90% of the outstanding common shares of Senn Co.…

A: A journal entry is used to document a business transaction in a company's accounting records. A…

Q: Question 3: In 2022, Johnson Company's first year of operations, the following transactions…

A: Journal entries are the transaction we posted in our books, to keep records of our receivables and…

Q: 1 What is stakeholder? Explain their influence and why?

A: Disclaimer: “Since you have asked multiple questions, we will solve the first question for you. If…

Q: Instructions: ldentify each of the following accounts as an asset, Liability or Equity. ACCOUNTS…

A: An equity is residual interest in net assets of the organization.

Q: The accountant for Polo's Pet Shop prepared the following list of account balances from the entity's…

A: Statement of owners equity is an essential part of financial statements. It indicates the investment…

Q: Which of the following items retain their character when they are passed through to shareholders of…

A: The following items do not retain their characteristics when passed through shareholders. 1. Wages…

Q: Rollins and Cohen, CPAS, offer three types of services to clients: auditing, tax, and small business…

A: ROLLINS AND COHEN, CPAs Professional Fees Earned Budget For the Month Ending January 31,…

Q: . Partners Lanvega, Tauroneo, and Bryce share profits and losses in the ratio of 4:5:1. The…

A: Liquidation of partnership means cancelling all the rights and liabilities of the partners,…

Q: Required: • prepare a worksheet

A: Accounting is the process of recording, classifying and summarising accounting information. At the…

Q: Sales revenue is $ 500000 , Variable costs are 30 % of sales revenue and fixed costs are $ 200000 ,…

A: Net profit is the outcome of subtracting all expenditures from revenues. This statistic represents…

Q: The following transactions and adjusting entries were completed by Robinson Furniture Co. during a…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: The following were taken from the books of GK Company: January 1: RM P270,000; WIP P0; FG P45,000…

A: Following formulas were used Production cost for the year = RM used +DL + Factory overhead Nos of…

Q: Equipment for immersion cooling of electronic components has an installed value of P 819,000 with an…

A: Introduction:- It is one of the depreciation method It is accelerated depreciation method. The…

Q: ersion costs are added evenly during the testing department’s process. As work in assembly is…

A: Solution a.

Q: 16. Ragnell and Alondite are partners sharing profits in the ratio of 3:2, respectively. On January…

A: Answer:- C The new capital balance of Ragnell, Alondite and Altina respectively would be = ₱11,520…

Q: Aliara Corporation is considering purchasing one of two new machines. Estimates for each machine are…

A: Net Present Value- The net present value or net present worth applies to a sequence of cash flows…

Q: Five Measures of Solvency or Profitability The balance sheet for Quigg Inc. at the end ofr the…

A: "Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: the stock rights to expire. Ryan's recognized loss and the basis of the original 100 shares after…

A: Stock rights are those rights which are given to the shareholders (existing) by the company so that…

Q: Peroni Company paid wages of $170,900 this year. Of this amount, $114,000 was taxable for net FUTA…

A: When a company doesn't even have enough liquid cash to meet its liabilities, it has cash flow…

Q: Financial statement analysis is a part of business analysis. please explain about that statement!…

A: Financial Statements Financial Statements refer to those statements that provide a snapshot of the…

Q: During the month of March 2022, Turaco sole trader purchased goods to the value of N$12 000, of…

A: Net profit is the difference between gross profit and expenses. Gross profit is the difference…

Q: Ranran, Sansan, and Tantan are forming a new partnership. The following are their contributions:…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Step by step

Solved in 2 steps

- Niagara Company is contemplating acquiring Toronto, Inc. on January 1, 2020. The information on Toronto's profit and net assets for the last five years are as follows: Profit Net Assets2019 P 4,000,000 P20,200,0002018 3,200,000 20,000,0002017 3,000,000 18,500,0002016 3,800,000 17,900,0002015 2,500,000 15,600,000 It is agreed that Niagara is willing to pay for goodwill measured by capitalizing at 40% excess of the average profits over normal return on net assets. The normal return on average net assets for the industry to which Toronto belongs is 10%.How much should Niagara Company pay to Toronto, Inc. in the…Frappe Company is acquiring Frappuccino Corporation on January 1, 2020. The cumulative earnings of Frappuccino from 2015 to 2019 amounted to P7,200,000. On January 1, 2020, the assets and liabilities of Frappuccino at appraised values are P10,350,000 and P6,650,000, respectively. The normal return in Frappuccino 's industry is 20%. Goodwill is computed by capitalizing at 25% average earnings in excess of normal return based on appraised value of net assets. What is the amount paid by Frappe in the acquisition of Frappuccino Corporation?The following are preliminary financial statements for Choco Co. and Cake Co. for the year ending December 31, 2020 prior to Choco’s acquisition of Cake. Choco Co. Cake Co. Book Values Book Values Fair Values Cash and Receivable 120,000 30,000 30,000 Inventories 240,000 90,000 94,000 Land 120,000 108,000 128,000 Building 480,000 336,000 348,000 Accounts payable (70,000) (100,000) (100,000) Long-term debt (38,000) (32,000) (34,000) Common stock (192,000) (72,000) Additional paid in capital (96,000)…

- On January 1 2020, Philippine Airlines purchased 20% of Cebu Pacific's total outstandingordinary shares for two tenths of a billion peos. Net assets of the investee were fairly valuedexcept for one of its BUILDINGS, has a fair value of P5,000,000 greater than its carryingamount. The total carrying amount of all assets is P900,00,000.Assuming the building still has a remaining life of 10 years, how much “INVESTMENTINCOME” is debited to amortize the excess of cost for the year 2020?Adams, Inc., acquires Clay Corporation on January 1, 2020, in exchange for $732,300 cash. Immediately after the acquisition, the two companies have the following account balances. Clay’s equipment (with a five-year remaining life) is actually worth $604,900. Credit balances are indicated by parentheses. Adams Clay Current assets $ 326,000 $ 290,000 Investment in Clay 732,300 0 Equipment 781,900 526,000 Liabilities (280,000 ) (170,000 ) Common stock (350,000 ) (150,000 ) Retained earnings, 1/1/20 (1,210,200 ) (496,000 ) In 2020, Clay earns a net income of $62,700 and declares and pays a $5,000 cash dividend. In 2020, Adams reports net income from its own operations (exclusive of any income from Clay) of $193,000 and declares no dividends. At the end of 2021, selected account balances for the two companies are as follows: Adams Clay Revenues $ (452,000 ) $ (272,000 ) Expenses 327,700 204,000 Investment…Adams, Inc., acquires Clay Corporation on January 1, 2020, in exchange for $713,300 cash. Immediately after the acquisition, the two companies have the following account balances. Clay’s equipment (with a five-year remaining life) is actually worth $641,000. Credit balances are indicated by parentheses. Adams Clay Current assets $ 382,000 $ 272,000 Investment in Clay 713,300 0 Equipment 837,000 584,000 Liabilities (202,000 ) (224,000 ) Common stock (350,000 ) (150,000 ) Retained earnings, 1/1/20 (1,380,300 ) (482,000 ) In 2020, Clay earns a net income of $74,100 and declares and pays a $5,000 cash dividend. In 2020, Adams reports net income from its own operations (exclusive of any income from Clay) of $160,000 and declares no dividends. At the end of 2021, selected account balances for the two companies are as follows: Adams Clay Revenues $ (544,000 ) $ (286,000 ) Expenses 394,400 214,500 Investment…

- Adams, Inc., acquires Clay Corporation on January 1, 2020, in exchange for $713,300 cash. Immediately after the acquisition, the two companies have the following account balances. Clay’s equipment (with a five-year remaining life) is actually worth $641,000. Credit balances are indicated by parentheses. Adams Clay Current assets $ 382,000 $ 272,000 Investment in Clay 713,300 0 Equipment 837,000 584,000 Liabilities (202,000 ) (224,000 ) Common stock (350,000 ) (150,000 ) Retained earnings, 1/1/20 (1,380,300 ) (482,000 ) In 2020, Clay earns a net income of $74,100 and declares and pays a $5,000 cash dividend. In 2020, Adams reports net income from its own operations (exclusive of any income from Clay) of $160,000 and declares no dividends. At the end of 2021, selected account balances for the two companies are as follows: Adams Clay Revenues $ (544,000 ) $ (286,000 ) Expenses 394,400 214,500 Investment…Music Corporation had current assets of P2,000,000 at the end of 2020 and P1,800,000 at the end of 2019. In addition, Music had current liabilities of P1,000,000 in 2020 and P1,500,000 in 2019. Using this information, Music’s net current asset investment for 2020 was P700,000 P(300,000) P300,000 P(700,000)Lee Company is contemplating the purchase of the net assets of Min Company for P800,000 cash. To contemplate the transactin, direct acquisition costs are P15,000. The balance sheet of Min Company on the purchse date is as follows: Min Company Balance Sheet December 31, 2020 Assets Liabilities & Equity Current Assets 80,000 Liabilities 100,000 Land 50,000 Common Stock, P10 par 100,000 Building 450,000 Paid-in capital in excess of par 150,000 Accumulated Depreciation (200,000) Retained Earnings…

- On January 1, 2022 the Aquila Co. acquired 100% of the Taurus Co. when the fair value of Taurus net assets was P4,000,000 and their carrying amount was P3,500,000. The consideration transferred consisted of P4,400,000 in cash transferred at the acquisition date, plus another P200,000 in cash to be transferred 10 months after (November 1, 2022) the acquisition date if a specified profit target was met by Taurus.At the acquisition date, there was only a low probability, around 40% of the profit target is being met.On November 1, 2022, additional P200,000 was paid by Aquila to Taurus after the latter met the specified profit target.How much is the goodwill to be reported on December 31, 2022? a. P480,000 b. P600,000 c. P980,000 d. P400,000I need this question answered in under 30 minutes please. On January 1, 2020, Bactin Corporation acquired 10% of Oakton Company for $100,000. On that date, the total book value and fair value of Oakton's identifiable net assets was $900,000. Any difference between cost and fair value is attributable to goodwill. In 2020, Oakton reported net income of $60,000 and paid dividends of $30,000. On January 1, 2021, Bactin Corporation bought another 10% of Oakton for $100,000, and on that date, the book value and fair value of Oakton's net assets still was $900,000 (the fair value of Oakton did not change during 2020). Bactin concluded that its 20% ownership now allowed it to significantly influence Oakton’s operations. In 2021, Oakton reported net income of $80,000 and paid dividends of $40,000. Required:Prepare all journal entries for Bactin for 2020 and 2021, assuming no change in fair value of the Oakton stock during that time period. (If no entry is required for a transaction/event,…Suppose that AXE company acquires exactly 25% of the voting common stock of Company SARDAR Inc. for $3,000,000 at the beginning of the year 2020. Pfizer company reports $1,200,000 earnings for the year in its net income and pays $550,000 in cash dividends at the end of the year 2020. 1. Using the cost method, what is the investment income and the balance sheet investment account balance respectively for AXE company? * A) $137,500, $3,000,000 B) $300,000; $3,162,500 C) $137,500; $2,300,000 D) None of the above. 2. Using the equity method, what is the investment income and the balance sheet investment account balance respectively for AXE company? * A) $137,500, $3,000,000 B) $300,000; $3,162,500 C) $137,500; $2,300,000 D) None of the above.