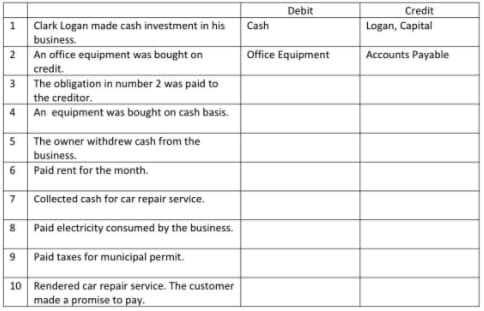

Debit Credit Logan, Capital Clark Logan made cash investment in his business. 2 An office equipment was bought on credit. 3 The obligation in number 2 was paid to the creditor. 4 An equipment was bought on cash basis. 1 Cash Office Equipment Accounts Payable The owner withdrew cash from the business. 6 Paid rent for the month. 5 7 Collected cash for car repair service. 8 Paid electricity consumed by the business. 8 9 Paid taxes for municipal permit. 10 Rendered car repair service. The customer ade: oromise 2.

Debit Credit Logan, Capital Clark Logan made cash investment in his business. 2 An office equipment was bought on credit. 3 The obligation in number 2 was paid to the creditor. 4 An equipment was bought on cash basis. 1 Cash Office Equipment Accounts Payable The owner withdrew cash from the business. 6 Paid rent for the month. 5 7 Collected cash for car repair service. 8 Paid electricity consumed by the business. 8 9 Paid taxes for municipal permit. 10 Rendered car repair service. The customer ade: oromise 2.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 19EB: A business has the following transactions: A. The business is started by receiving cash from an...

Related questions

Topic Video

Question

Transcribed Image Text:Debit

Credit

Clark Logan made cash investment in his

business.

1

Cash

Logan, Capital

Office Equipment

An office equipment was bought on

credit.

The obligation in number 2 was paid to

the creditor.

4 An equipment was bought on cash basis.

2

Accounts Payable

3

5 The owner withdrew cash from the

business.

6 Paid rent for the month.

7 Collected cash for car repair service.

8 Paid electricity consumed by the business.

9 Paid taxes for municipal permit.

10 Rendered car repair service. The customer

made a promise to pay.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT