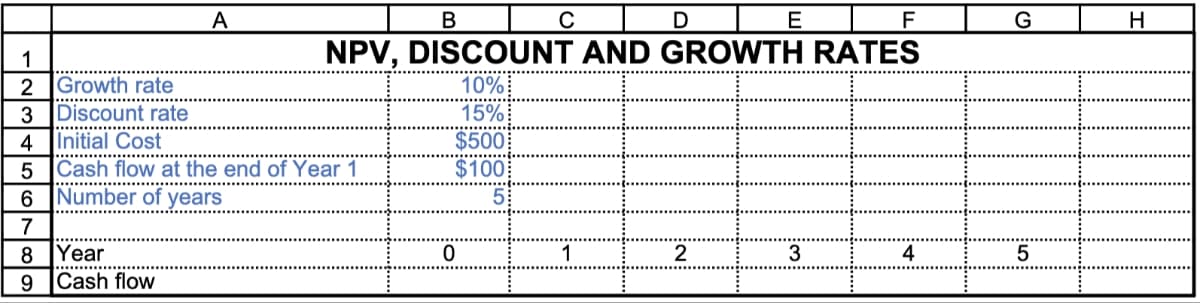

1 2 Growth rate 3 Discount rate 4 A B F NPV, DISCOUNT AND GROWTH RATES 10% 15% $500 $100 Initial Cost Cash flow at the end of Year 1 5 6 Number of years 7 8 Year 9 Cash flow 0 1 D 2 E 3 4 G 5

Q: (Using the CAPM to find expected returns) Sante Capital operates two mutual funds headquartered in…

A: Risk Free Rate = rf = 2.5%Market Return = rm = 10%

Q: common stock currently outstanding. a. Calculate Everdeen's 2019 earnings per share (EPS). b. If the…

A: Profit before tax = $477,000Tax = 21%Preference dividends = $64,100Shares outstanding =…

Q: The governorate of Al Muthanna offered the following cars to sell for people according to deals as…

A: Comound interest means compounding of interest with the principal for the next period interest. This…

Q: ayment of$12,055is due in 2 year,$17,000is due in 4 years, and$8,400is due in 6 years. What single…

A: Present value is the equivalent value today of the future payments based on the time and interest…

Q: Ali borrowed $21,500 at 5.00% p.a. from his parents to start a business. In 3 months he repaid…

A: The given details related to a loan are:Required: Compute the outstanding balance at the end of 15…

Q: ) Suppose an insurance company has £350 million in capital available. The gain from an investment…

A: RAROC, or Risk-Adjusted Return on Capital, is a financial metric used to evaluate the profitability…

Q: Belgravia Petroleum Inc. is trying to evaluate a generation project with the following cash flows:…

A: Capital Budgeting is the technique for evaluating various projects in terms of profitability of the…

Q: 12 million and expected cash inflows of £400,000, £500,000, and £600,000 for Years 1 to 3,…

A: NPV is the net present value and can be found as the difference between present value of cash flow…

Q: What equal payments in 3 years and 5 years would replace payments of $47,500 and $72,500 in 6 years…

A: The concept of time value of money will be used here. As per this concept money has the power to…

Q: One year ago, your company purchased a machine used in manufacturing for $100,000. You have learned…

A: The net present value is a capital budgeting technique that helps to evaluate a capital investment…

Q: The balance on a mortgage was $45,000 and an interest rate of 4.50% compounded semi-annually was…

A: Information Provided:Loan amount = $45,000Interest rate =4.5% compounded semi-annuallyYears = 5

Q: Air Asia has 1.4 million shares of stock outstanding. The stock currently sells for $20 per share.…

A: Weighted average cost of capital is the blended cost of capital. It takes into consideration the…

Q: Compare and contrast different project evaluation methods, including net present value (NPV),…

A: Project evaluation methods like Net Present Value (NPV), Internal Rate of Return (IRR), and Payback…

Q: Second Best Insurance company is advertising a new product to retirees looking to invest their…

A: NPV refers to net present value. It is an important capital budgeting tool. Essentially NPV is the…

Q: The following three Fls dominate a local market and their total assets are given below. Institution…

A: A merger is a strategic business combination in which two or more companies merge their operations…

Q: In 2014, Apple reported profits of more than $50 billion on sales of $182 billion. For that same…

A: As per the given information:To determine:Profit margin, net marketing contribution, marketing…

Q: Suppose a sophisticated Eva faces the choice between investment opportunities with monetary payments…

A: Net Present Value (NPV) is a financial metric used to evaluate the profitability of an investment or…

Q: A project requires an initial investment of RM100,000 and is expected to generate cash flows of…

A: Net Present Value (NPV) is a financial metric used to assess the profitability of an investment or…

Q: A boy borrows 25000 from father. His father lends him money, on the condition that he would be…

A: A loan is a financial arrangement in which a lender provides funds to a borrower, who agrees to…

Q: OneUSF, a U.S. MNC based in Florida, is considering making a fixed direct investment in Italy. The…

A: Loan borrowed in Euro and interest rate is 3%PV of the cash flow is determined and subtracted from…

Q: 1. You have saved $900,000 by your retirement at age 65 and your retirement fund yields 6% annually.…

A: First we need to calculate value of savings at the age of 70 by using future value formula below.…

Q: n is to be repaid over 30 years, with month-end repayments of 5,000. If the interest rate is 4.1%…

A: Loans are to be paid by equal fixed monthly payments and these monthly payments carry payment for…

Q: Today is Amy's 24th birthday. Starting today, Any plans to begin saving for her retirement, which…

A: Future value refers to the anticipated value of an investment or asset at a specific point in the…

Q: An investor buys a 90-day promissory note at a yield of 9.120% p.a. and sells it 30 days laterat a…

A: An instrument that guarantees payment to the holder of such a note by the issuer is called a…

Q: Question a Suppose you deposit $1,117.00 into an account today that earns 12.00%. It will take _ _…

A: The concept of time value of money will be used here. As per the concept of time value of money the…

Q: A recently installed machine earns the company revenue at a continuous rate of 60,000t + 45,000…

A: Present value is the equivalent today of the future cash flow based on the time and interest rate of…

Q: Conroy Consulting Corporation (CCC) has a current dividend of Do $1.20. Shareholders require an 11%…

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts…

Q: To what amount will the following investment accumulate? $4,500, invested today for 4 years at 4…

A: When we make an investment today the sum of money attracts interest. The amount invested gets…

Q: re projected to grow by 25 percent. Interest expense will remain constant; t id the dividend payout…

A: External funding required is the amount of finance needed in the form of debt or equity to increase…

Q: Finance Consider an option with α being a non-negative parameter and the option pays ((S(T))α − K)+…

A: Options are financial derivatives that provide investors with the right, but not the obligation, to…

Q: Question 9 Johnson and Johnson are expanding its first-aid products line for individuals allergic to…

A: Capital budgeting technique helps to evaluate the profitability of the mutually exclusive projects…

Q: Prince Edward Bank considers increasing a type of loans in the credit portfolio by $3,500,000, which…

A: An analysis of risk-adjusted financial performance and a uniform perspective of profitability for…

Q: Required: Determine the (show workings): net present value. payback period. accounting rate of…

A: First we need to determine the net profit using the formula below:Net Profit = (Sales - Expenses -…

Q: Apple wants to issue bonds with $1,000 face value and 10 years to maturity. The bonds would pay…

A: YTM is also known as Yield to maturity. It is a capital budgeting techqniue which helps in decision…

Q: ABC Inc. borrows money at 9%, sells bonds at 8%, and the purchasers of common stock require 13% rate…

A: WACC stands for Weighted Average Cost of Capital and is a financial metric used to calculate the…

Q: Explain similarities between present days joint-stock company and classical Islamic contract of…

A: The joint-stock company is a modern corporate structure that facilitates the pooling of capital from…

Q: You plan to retire after working for 45 years. You estimate you need 1 million to retire and live…

A: Future value refers to the anticipated value of an investment or asset at a specific point in the…

Q: Bond X has 5 years maturity with 8 percent coupon rate, Bond Y also has 5 years maturity but the…

A: When market interest rates rise, bond prices fall. This is a fundamental concept in fixed income.…

Q: Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000…

A: The degree of risk attached to the borrower directly relates to interest rates. In order to make up…

Q: If interest rates rose, would you be happier if you have a low-coupon bond or a high-coupon bond?

A: Low-Coupon Bond: A low-coupon bond has a lower fixed interest payment relative to its face value.…

Q: What percent of the average worker's preretirement earnings is replaced by Social Security?,…

A: Social Security is a social insurance program in the United States that provides financial support…

Q: The payback period method has been criticized for not taking the time value of money into account.…

A: Discussion on payback period method:Payback period: It represents the period required to recover the…

Q: 1) The geologists have suggested that company acquire 640 acres in Scurry County. They believe that…

A: A capital budgeting measure that is used to assess a project's or investment's profitability is net…

Q: summarize high level SNF industry trends and the general financial condition of the Skilled Nursing…

A: Skilled Nursing Facilities (SNFs) play a crucial role in providing care for older adults and…

Q: Which of the following stocks is likely to have a low CAPM beta? A.A manufacturer of luxury cars…

A: The Capital Asset Pricing Model (CAPM) beta, often referred to as just "beta," is a measure of a…

Q: Assume you manage a risky portfolio with an expected rate of return of 15% and a standard deviation…

A: Risk aversion is a behavioral trait in finance where individuals or investors demonstrate a…

Q: Instead of taking a cash worth $200000, a woman decided to invest the money she inherited at 12%…

A: The present value of an annuity is the current worth of a series of future cash flows, discounted at…

Q: (Capital Asset Pricing Model) CSB, Inc. has a beta of 0.758. If the expected market the risk-free…

A: The Capital Asset Pricing Model (CAPM) measures the relationship between the expected return and the…

Q: Suppose your annual starting salary is $54,076. After working for a few years, you start to get…

A: Initial Salary = $54,076Growth rate for first 3 Times = g3 = 0.7%Growth rate for next 6 Times = g6 =…

Q: The cost of capital for a new project: Multiple Choice 1.) is determined by the overall risk level…

A: Cost of Capital refers to the minimum rate of return a company requires to undertake a project or…

Step by step

Solved in 3 steps with 2 images

- Given data: Sales $2,000.000 OpCap $1,120,000 Wacc 9% OP = Nopat/sales 4.5% CR = OpCap/sales 56% Year Rate growth (%) Sales Nopat OpCap Free Cash Flow (FCF) Free Cash Flow - Growth ROIC 0 - $2,000.000 $90.000 $1,120.000 - - - 1 0.10 $2,200.00 $99.000 $1,232.00 $(13.000) - 8.04% 2 0.08 $2,376.00 $106.92 $1,330.56 $8.360 -164.31% 8.04% 3 0.05 $2,494.80 $112.266 $1,397.088 $45.738 447.11% 8.04% 4 0.05 $2,619.54 $117.87 $1,466.94 $48.025 5.00% 8.04% What is the value of operations at Year 0? How does the Year-0 value of operations compare with the Year-0 total net operating capital?Given data: Sales $2,000.000 OpCap $1,120,000 Wacc 9% OP = Nopat/sales 4.5% CR = OpCap/sales 56% Year Rate growth (%) Sales Nopat OpCap Free Cash Flow (FCF) Free Cash Flow - Growth ROIC 0 - $2,000.000 $90.000 $1,120.000 - - - 1 0.10 $2,200.000 $99.000 $1,232.000 $(13.000) - 8.04% 2 0.08 $2,376.000 $106.920 $1,330.560 $8.360 -164.31% 8.04% 3 0.05 $2,494.800 $112.266 $1,397.088 $45.738 447.11% 8.04% 4 0.05 $2,619.540 $117.879 $1,466.942 $48.025 5.00% 8.04% Assume growth rates are at their original levels. What is the impact of simultaneous improvements in operating profitability and capital requirements, the impact of simultaneous improvements in the growth rates, operating profitability, and capital requirements?Given data: Sales $2,000.000 OpCap $1,120,000 Wacc 9% OP = Nopat/sales 4.5% CR = OpCap/sales 56% Year Rate growth (%) Sales Nopat OpCap Free Cash Flow (FCF) Free Cash Flow - Growth ROIC 0 - $2,000.000 $90.000 $1,120.000 - - - 1 0.10 $2,200.000 $99.000 $1,232.000 $(13.000) - 8.04% 2 0.08 $2,376.000 $106.920 $1,330.560 $8.360 -164.31% 8.04% 3 0.05 $2,494.800 $112.266 $1,397.088 $45.738 447.11% 8.04% 4 0.05 $2,619.540 $117.879 $1,466.942 $48.025 5.00% 8.04% Assume growth rates are at their original levels. What happens to the ROIC and current value of operations if the operating profitability ratio increases to 5.5%? Now assume growth rates and operating profitability ratios are at their original levels. What happens to the ROIC and current value of operations if the capital requirement ratio decreases to 51%?

- FCFE Valuation A company's most recent free cash flow to equity was $130 and is expected to grow at 5% thereafter. The company's cost of equity is 10%. Its WACC is 8.48%. What is its current intrinsic value? Round your answer to the nearest dollar.INV3 P6a You are interested in determining the intrinsic value of Hoffman Inc. Your analysis shows that the firm’s growth rate will drop from its current pace by 20% each of the next two years, and then you estimate that dividends will continue to grow at the year 2 rate, with the same dividend policy in place, indefinitely. Lastly, your estimate of the required return on the firm’s equity is 12%. Hoffman’s recently published annual report shows the following financial relationships: Assets = 1.4 x Equity Current Assets = 1.7 x Current Liabilities Sales = 1.5 x Assets Net Income = 8% x Sales Dividends = 30% x Net Income Earnings per share (Basic) = $0.80 per share Determine the growth rate of the company for the prior and for each of the next two years.INV3 P6b You are interested in determining the intrinsic value of Hoffman Inc. Your analysis shows that the firm’s growth rate will drop from its current pace by 20% each of the next two years, and then you estimate that dividends will continue to grow at the year 2 rate, with the same dividend policy in place, indefinitely. Lastly, your estimate of the required return on the firm’s equity is 12%. Hoffman’s recently published annual report shows the following financial relationships: Assets = 1.4 x Equity Current Assets = 1.7 x Current Liabilities Sales = 1.5 x Assets Net Income = 8% x Sales Dividends = 30% x Net Income Earnings per share (Basic) = $0.80 per share Use the multi-period DDM to estimate the intrinsic value of the company’s stock now, at the beginning of year 1.

- 36.Given the following possible returns (dividends plus capital gains) over the coming year from P100,000 investment in General Motors common stock: State of Economy Profitability ReturnRecession 0.20 P-1,000 Normal year 0.60 1,500Boom 0.20 2,500What is the expected return?A4) Finance You estimate that the net income for a company next year is a uniform distribution with a minimum of $106 million and a maximum of $127 million. What is the probability that the company's net income is less than or equal to $117 million? Enter answer in percents, to two decimal places.Year Cash Flow 0 −$8,200 1 2,500 2 4,100 3 3,900 What is the profitability index for the cash flows if the relevant discount rate is 10 percent? A. 1.079 B. 1.100 C. 0.995 D. 1.016 E. 1.048 What is the profitability index for the cash flows if the relevant discount rate is 16 percent? A. 0.939 B. 0.967 C. 0.986 D. 0.892 E. 0.911 What is the profitability index for the cash flows if the relevant discount rate is 26 percent? A. 0.795 B. 0.819 C. 0.834 D. 0.755 E. 0.771

- Year Cash Flow 0 (8,100.00) 1 3,600.00 2 3,900.00 3 2,800.00 a. What is the profitability index for the cash flows if the relevant discount rate is 9 percent? b. What is the profitability index for the cash flows if the relevant discount rate is 14 percent? c. What is the profitability index for the cash flows if the relevant discount rate is 24 percent?Year Cash Inflow1 14,0002 19,0003 31,0004 05 06 07 130,000 what is the future value of this cash flow at 3%, 11%, and 18% interest rates at the end of year 7An analyst gathered the following information regarding Darius Investments: Current year FCFF = $5.2 million Expected growth rate in FCFF for the next three years = 14% Long-term constant growth rate from Year 4 onward = 6% WACC during the high-growth phase = 18% WACC during the mature phase = 11% Q) The company's excess earnings are closest to: Select one: a.$84,810 b.$75,350 c.$81,650