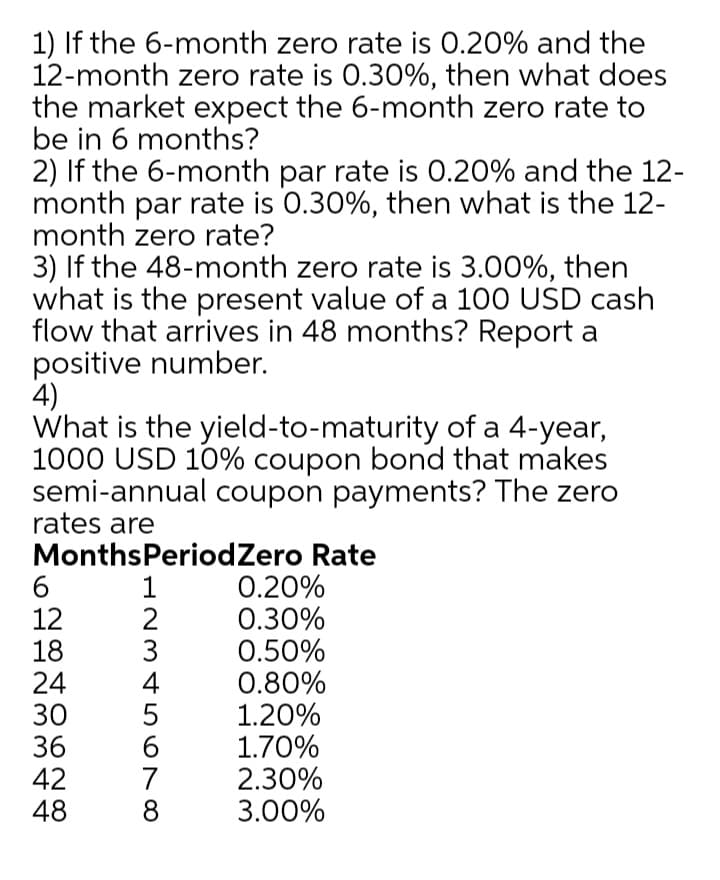

1) If the 6-month zero rate is 0.20% and the 12-month zero rate is 0.30%, then what does the market expect the 6-month zero rate to be in 6 months?

Q: A geometric gradient that increases at f = 6% per year for 15 years is shown in the following…

A: The present value of the growing annuity is the current worth of a cash flow series growing at a…

Q: How many years will it take for something costing $61 today to cost $91 if inflation averages 1% per…

A: Using excel nper function

Q: The spot price of an investment asset is $50. The asset pays sure income of $5 in 6 months and the…

A: Using the Formula (stock price less present value of dividend ) * (1+rate)^no. of period

Q: what does the market expect the 1-year Treasury rate to be six years

A: Forward Rate Agreement is a contract entered by a lender or borrower. Here agreement is entered to…

Q: How much is the sum of the present value of the expected return over those periods

A: Cash Flows (Year 1-10) (CF) = $15,000 per year Annual interest rate (r) = 5% Time Period (t) = 10…

Q: What per annum nominal interest rate with interest compounded quarterly would be needed to achieve…

A: Compounding refers to the power of doubling the investment by adding interest .Compounding helps in…

Q: You note the following yield curve in The Wall Street Journal. According to the unbiased…

A: In this question, we have to solve this question on the basis unbiased expectations theory.

Q: Suppose that your salary is $45,000 in year one, will increase at 4%per year through year four, and…

A: The present value is the value of the sum received at time 0 or the current period. It is the value…

Q: Suppose that the current 1-year rate (1-year spot rate) and expected 1-year T-bill rates over the…

A: Year 1:Current (Long-Term) Rates = 1R1 = 2.78% Year 2:1R1 = 2.78% or 0.0278E(2r1) = 4.10% or 0.0410…

Q: If you note the following yield curve in The Wall Street Journal, what is the one-year forward rate…

A: Unbiased expectation theory states that the long-term and short-term interest rates are related. No…

Q: An investment currently costs $28,000. If the current inflation rate is 6% and the effective annual…

A: Present value (PV) = $ 28000 Future value (FV) = $ 40,000 Interest rate (r) = 10% Period = n0

Q: nder the unbiased expectations theory, what must today's three year spot rate be? Supposed the three…

A: Excel Spreadsheet:

Q: What would be “The 3x6 month implied forward rate“ if SpotOX6=0.410% and SpotOX3=0.212%?

A: Information Provided: Spot rate for 3 Months = 0.212% Spot rate for 6 Months = 0.410%

Q: if the nominal rate is 11.5% per year compounded continuously, what is the equivalent effective rate…

A: Nominal Rate = 11.5% Continuous Compounding

Q: Quarterly sales have a trend given by Y = 50,000t – 15,000, where Y is sales in pesos and t is the…

A: Trend for Q2 = 50,000t – 15,000 = (50000*6) -15000 = 285000 * As Q2 for 2021 is period 6 from Q1…

Q: What is the present value of $5,600 when the interest rateis 8% and the return of $5,600 will not be…

A: Present value is the present worth of a cash flow at a certain rate of interest and time period.…

Q: An asset has a current price of ₱80.00 and it has an expected price of ₱95 in 6 months. In your…

A: Value of a contracted asset prior to maturity-It is the value of the asset contacted to trade in the…

Q: A) You have the following information about prices today, month=0. 2-month t-bill, interest rate…

A: Given Information : 2 Month t-bill interest rate = 0.02 6 Month t-bill interest rate = 0.025

Q: What per annum nominal interest rate with interest compounded quarterly would be needed to achieve…

A: The present value function or concept can be used to determine the present value of a future sum or…

Q: If the interest rate is 2.8% per month and the first installment is $ 3,200,000. What will be the…

A: Time value of money (TVM) means that the amount of money received in the present period will have…

Q: Suppose you are attempting to value a one-year maturity option on d) if your binomial model is set…

A: appropriate value for down factor = exp(sd*square root of T)

Q: The one-year spot rate is currently 4 percent; the one-year spot rate one year from now will be 3…

A: Computation of three-year spot rate is shown as follows: Formula sheet is shown:

Q: the discount yield on a 3 month T-bill is 6.5%. assuming there are 360 days in a year, what is the…

A: Given: Face value = 1,000 Interest rate = 6.5% Period = 3 months or 90 days(3*30)

Q: The one-year spot rate is currently 4%; the one-year spot rate one year from now will be 3%; and the…

A: Spot rate Price/rate quoted for a transaction that is taken/settled immediately.

Q: An investment will pay $10,000 eighteen months from now. What purchase price will provide a rate of…

A: Maturity amount (MV) = $10,000 Interest rate (r) = 7% Period (m) = 18 months

Q: Using the unbiased expectations theory, calculate the current (long-term) rates for one-, two-,…

A: Unbiased Expectations Theory: This theory implies that the current interest rate (long-term)…

Q: Suppose that the current 1-year rate (1-year spot rate) and expected 1-year T-bill rates over the…

A: Given: 1R1 = 2.50%, E(2r1) = 3.75%, E(3r1) = 4.25%, E(4r1) = 5.75%

Q: Assume that you conduct a relative value trade and close it out after 34 days. Your 34-day return is…

A: Effective annual yield is the real rate of return that is obtain on an investment as it considers…

Q: Zwango Plus Manufacturing expects that fixed costs of keeping its Zephyr Hills Plant operating will…

A: = Initial Amount + AC

Q: How long (in months) will it take for your investment to double at 5% interest?

A: This question would be solve by using the compounding interest formula and the formula is - A = P…

Q: How many months will it take for an investment to triple if the interest rate is9% compounded…

A: The Rule of 115 follows the Rule of 72. The Rule of 115 will show how long it will take to triple…

Q: Based on economists' forecasts and analysis, one-year T-bill rates and liquidity premiums for the…

A: T-Bills or Treasury Bills are debt instruments used by government to raise debt from public.…

Q: If you note the following yield curve in The Wall Street Journal, what is the one-year forward rate…

A: A forward rate is a rate of interest that refers to a financial transaction that will occur in the…

Q: The inflation rates for 4 years are forecast to be 3%, 3%, 4%, and 5%. The interest rate exclusive…

A: Time value of money- It is based on the concept that money earned today is worth more than similar…

Q: Three-month spot rate is 10% and one-year spot rate is 15%. What is the forward rate between three…

A: Pure expectation theory can be defined as a theory that states that expected future rates are…

Q: Suppose that the current one-year rate (one-year spot rate) and expected one-year T-bill rates over.…

A: For One-year The rate will be same as current one year rate or 1R1

Q: Consider a long position of USD100 million in a par 10-year note. Payments are annual. Interest…

A: Long Position value is $100 million, Note period is 10 years Interest rate is 6% Volatility of…

Q: If you have $1,000,000 but you have to use it in the next 6 months. SPOT RATE 1S =30.50-31 B 6MTH…

A: Spot and Forward Rates: The spot rate is the exchange rate that is currently prevailing for a…

Q: Suppose today’s LIBOR rates for 1, 2, 3, 4, 5, and 6 months are 1.6%, 1.8%, 2.0%, 2.0%, 1.9%, and…

A: If Sn is the spot rate for the nth month, and Fn-1, n is the forward rate for future 1-month period,…

2

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

- Three-month spot rate is 10% and one-year spot rate is 15%. What is the forward rate between three month and one year under pure expectations theory?A small country is experiencing hyperinflation of 56% per month. A) By what percent have prices climbed after 5 months? B) If an item currently costs $14, how much will it cost after 1 year of such inflation? Text so i can copy itSuppose 6-month Treasury bills are trading at a YTM of 1%, 12-month T-bills are trading at a YTM of 3%. If 18-month Treasury notes with a coupon rate of 4% are trading at par ($100), then what is the 18-month spot rate? Assume semi-annual compounding. Round your answer to 4 decimal places. For example if your answer is 3.205%, then please write down 0.0321.

- Suppose that the current one-year rate (one-year spot rate) and expected one-year T-bill rates over the following three years (i.e., years 2, 3, and 4, respectively) are as follows: 1R1 = 0.3%, E(2r 1) = 1.3%, E(3r1) = 8.9%, E(4r1) = 9.25% Using the unbiased expectations theory, calculate the current (long-term) rates for one-, two-, three-, and four-year-maturity Treasury securities.Quarterly sales have a trend given by Y = 50,000t – 15,000, where Y is sales in pesos and t is the time period with t = 1 in the first quarter of 2020. What is the forecasted sales (to the nearest peso) in the second quarter of 2021 if the seasonal variation using the multiplicative model is 0.93?Suppose that the current 1-year rate (1-year spot rate) and expected 1-year T-bill rates over the following three years (i.e., years 2, 3, and 4, respectively) are as follows:1R1 = 2.78%, E(2r1) = 4.10%, E(3r1) = 4.60%, E(4r1) = 6.10%Using the unbiased expectations theory, calculate the current (long-term) rates for one-, two-, three-, and four-year-maturity Treasury securities. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Year Current (Long-Term) Rates 1 _____.__% 2 _____.__% 3 _____.__% 4 _____.__%

- What is the PV of a stream of 5 consecutive CFs, starting next year. The first CF =$5,000, and the rest are 20% more than the CF of the prior year? The discount rate is 10%?A stopwatch used for TMS has a selling price of P1,500. If its selling price is expected do decline at a rate of 10% per year due to obsolescence, what will be its selling price after 3 years using DBM? A. P1,000 B. P1,500 C. P150.50 D. P1,093.5Suppose that the current 1-year rate (1-year spot rate) and expected 1-year T-bill rates over the following three years (i.e., years 2, 3, and 4, respectively) are as follows:1R1 = 2.62%, E(2r1) = 3.90%, E(3r1) = 4.40%, E(4r1) = 5.90%Using the unbiased expectations theory, calculate the current (long-term) rates for one-, two-, three-, and four-year-maturity Treasury securities. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

- Suppose that the current 1-year rate (1-year spot rate) and expected 1-year T-bill rates over the following three years (i.e., years 2, 3, and 4, respectively) are as follows:1R1 = 2.62%, E(2r1) = 3.90%, E(3r1) = 4.40%, E(4r1) = 5.90%Using the unbiased expectations theory, calculate the current (long-term) rates for one-, two-, three-, and four-year-maturity Treasury securitiesIf you note the following yield curve in The Wall Street Journal, what is the one-year forward rate for the period beginning one year from today, 2f1 according to the unbiased expectations theory? (Do not round intermediate calculations. Round your answer to 2 decimal places. (e.g., 32.16)) Maturity Yield One day 1.16 % One year 1.68 Two years 1.92 Three years 2.03 one Year Foward rate = %Suppose a European put has a strike price of $50 on July 5. The put expires in 30 days. Suppose the yield of T-bill maturing in 29 days is 4.6% and the yield of T-bill maturing in 36 days is 10.6%. What is the maximum value of the European put? Please type your answer in the box below and round it up to two decimals.