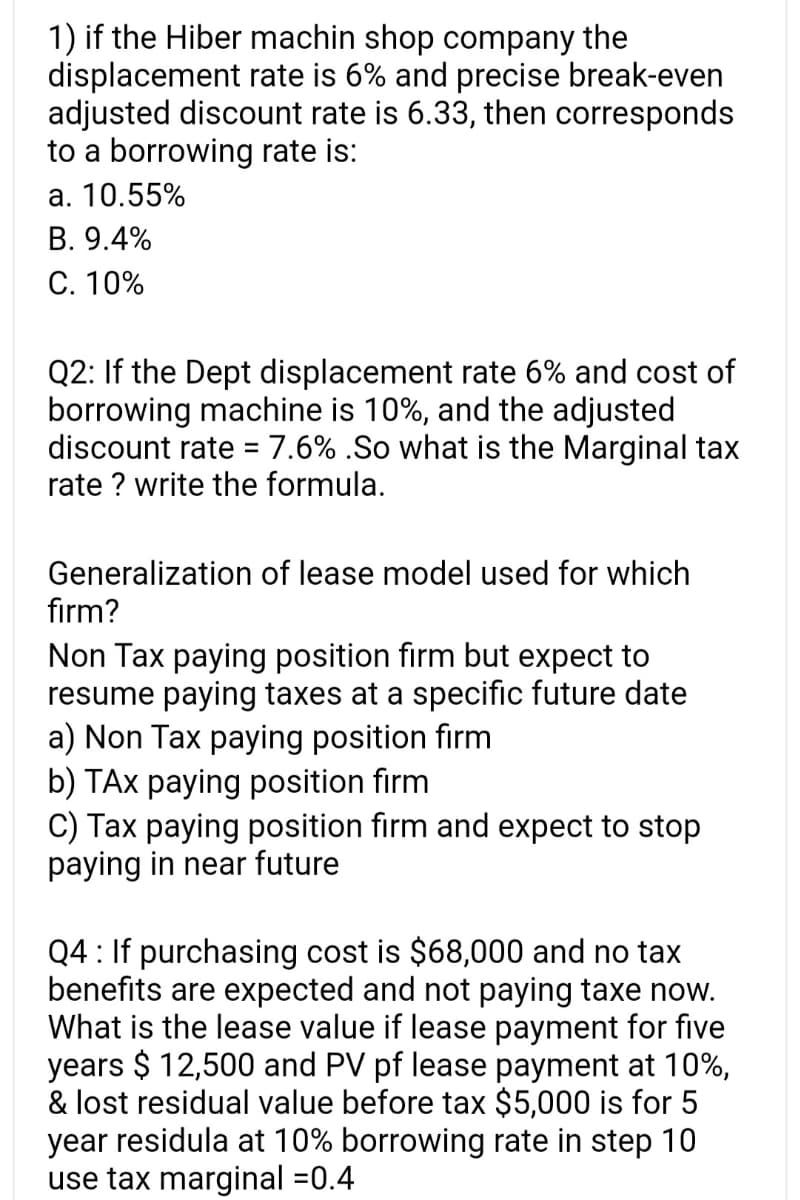

1) if the Hiber machin shop company the displacement rate is 6% and precise break-even adjusted discount rate is 6.33, then corresponds to a borrowing rate is: a. 10.55% B. 9.4% C. 10%

1) if the Hiber machin shop company the displacement rate is 6% and precise break-even adjusted discount rate is 6.33, then corresponds to a borrowing rate is: a. 10.55% B. 9.4% C. 10%

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter21: Supply Chains And Working Capital Management

Section: Chapter Questions

Problem 15P: Suppose a firm makes purchases of $3.65 million per year under terms of 2/10, net 30, and takes...

Related questions

Concept explainers

Question

100%

Fast in 5 min i will give u thumsup

Transcribed Image Text:1) if the Hiber machin shop company the

displacement rate is 6% and precise break-even

adjusted discount rate is 6.33, then corresponds

to a borrowing rate is:

a. 10.55%

B. 9.4%

C. 10%

Q2: If the Dept displacement rate 6% and cost of

borrowing machine is 10%, and the adjusted

discount rate = 7.6% .So what is the Marginal tax

rate ? write the formula.

Generalization of lease model used for which

firm?

Non Tax paying position firm but expect to

resume paying taxes at a specific future date

a) Non Tax paying position firm

b) TAX paying position firm

C) Tax paying position firm and expect to stop

paying in near future

Q4: If purchasing cost is $68,000 and no tax

benefits are expected and not paying taxe now.

What is the lease value if lease payment for five

years $ 12,500 and PV pf lease payment at 10%,

& lost residual value before tax $5,000 is for 5

year residula at 10% borrowing rate in step 10

use tax marginal -0.4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning