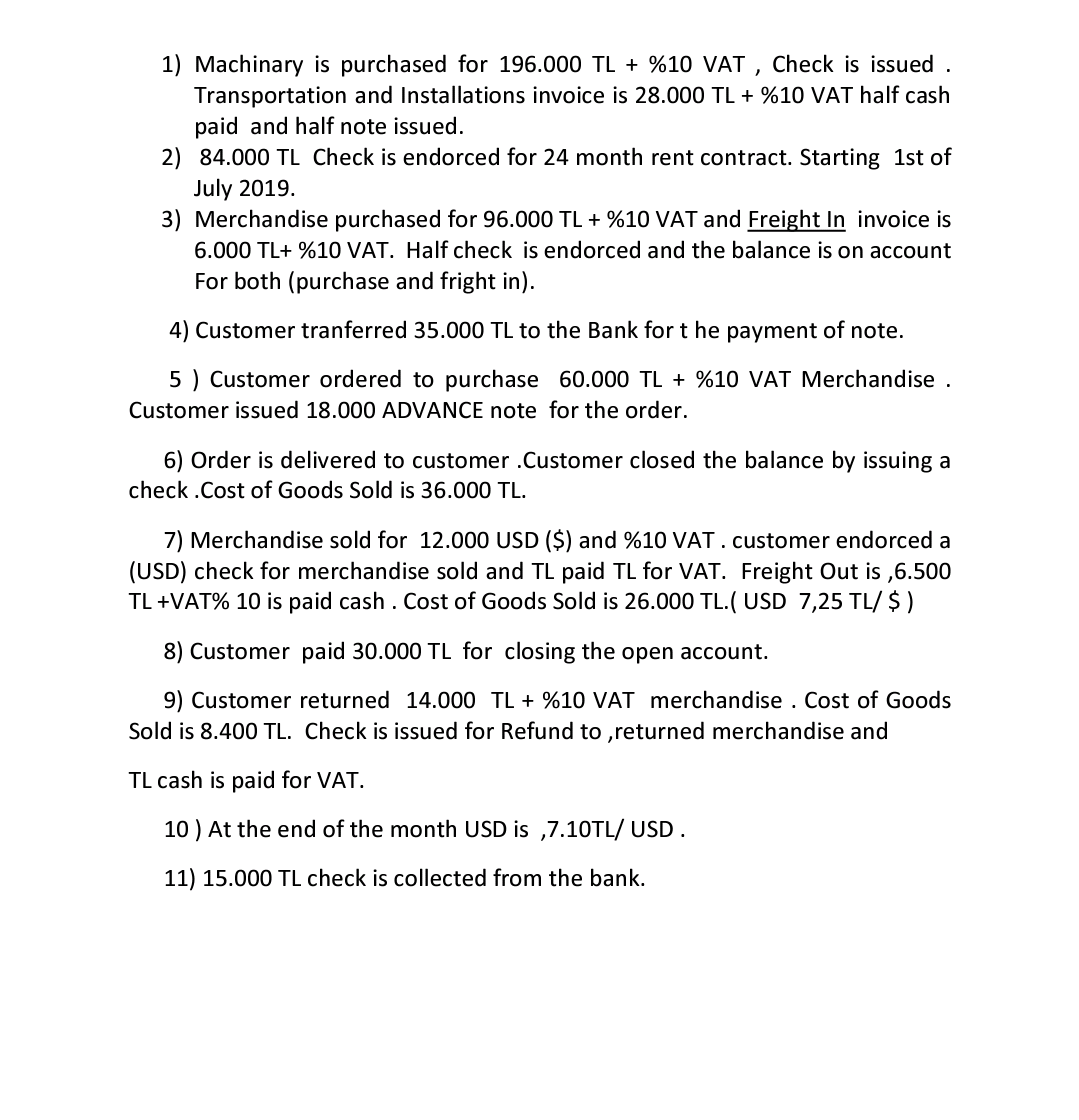

1) Machinary is purchased for 196.000 TL + %10 VAT , Check is issued . Transportation and Installations invoice is 28.000 TL + %10 VAT half cash paid and half note issued. 2) 84.000 TL Check is endorced for 24 month rent contract. Starting 1st of July 2019. 3) Merchandise purchased for 96.000 TL + %10 VAT and Freight In invoice is 6.000 TL+ %10 VAT. Half check is endorced and the balance is on account For both (purchase and fright in).

1) Machinary is purchased for 196.000 TL + %10 VAT , Check is issued . Transportation and Installations invoice is 28.000 TL + %10 VAT half cash paid and half note issued. 2) 84.000 TL Check is endorced for 24 month rent contract. Starting 1st of July 2019. 3) Merchandise purchased for 96.000 TL + %10 VAT and Freight In invoice is 6.000 TL+ %10 VAT. Half check is endorced and the balance is on account For both (purchase and fright in).

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 11RE: On December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to...

Related questions

Question

100%

Maket the following journal entries

Transcribed Image Text:1) Machinary is purchased for 196.000 TL + %10 VAT , Check is issued

Transportation and Installations invoice is 28.000 TL + %10 VAT half cash

paid and half note issued.

2) 84.000 TL Check is endorced for 24 month rent contract. Starting 1st of

July 2019.

3) Merchandise purchased for 96.000 TL + %10 VAT and Freight In invoice is

6.000 TL+ %10 VAT. Half check is endorced and the balance is on account

For both (purchase and fright in).

4) Customer tranferred 35.000 TL to the Bank for t he payment of note.

5 ) Customer ordered to purchase 60.000 TL + %10 VAT Merchandise .

Customer issued 18.000 ADVANCE note for the order.

6) Order is delivered to customer .Customer closed the balance by issuing a

check .Cost of Goods Sold is 36.000 TL.

7) Merchandise sold for 12.000 USD ($) and %10 VAT.customer endorced a

(USD) check for merchandise sold and TL paid TL for VAT. Freight Out is ,6.500

TL +VAT% 10 is paid cash . Cost of Goods Sold is 26.000 TL.( USD 7,25 TL/ $)

8) Customer paid 30.000 TL for closing the open account.

9) Customer returned 14.000 TL + %10 VAT merchandise . Cost of Goods

Sold is 8.400 TL. Check is issued for Refund to ,returned merchandise and

TL cash is paid for VAT.

10 ) At the end of the month USD is ,7.10TL/ USD .

11) 15.000 TL check is collected from the bank.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College