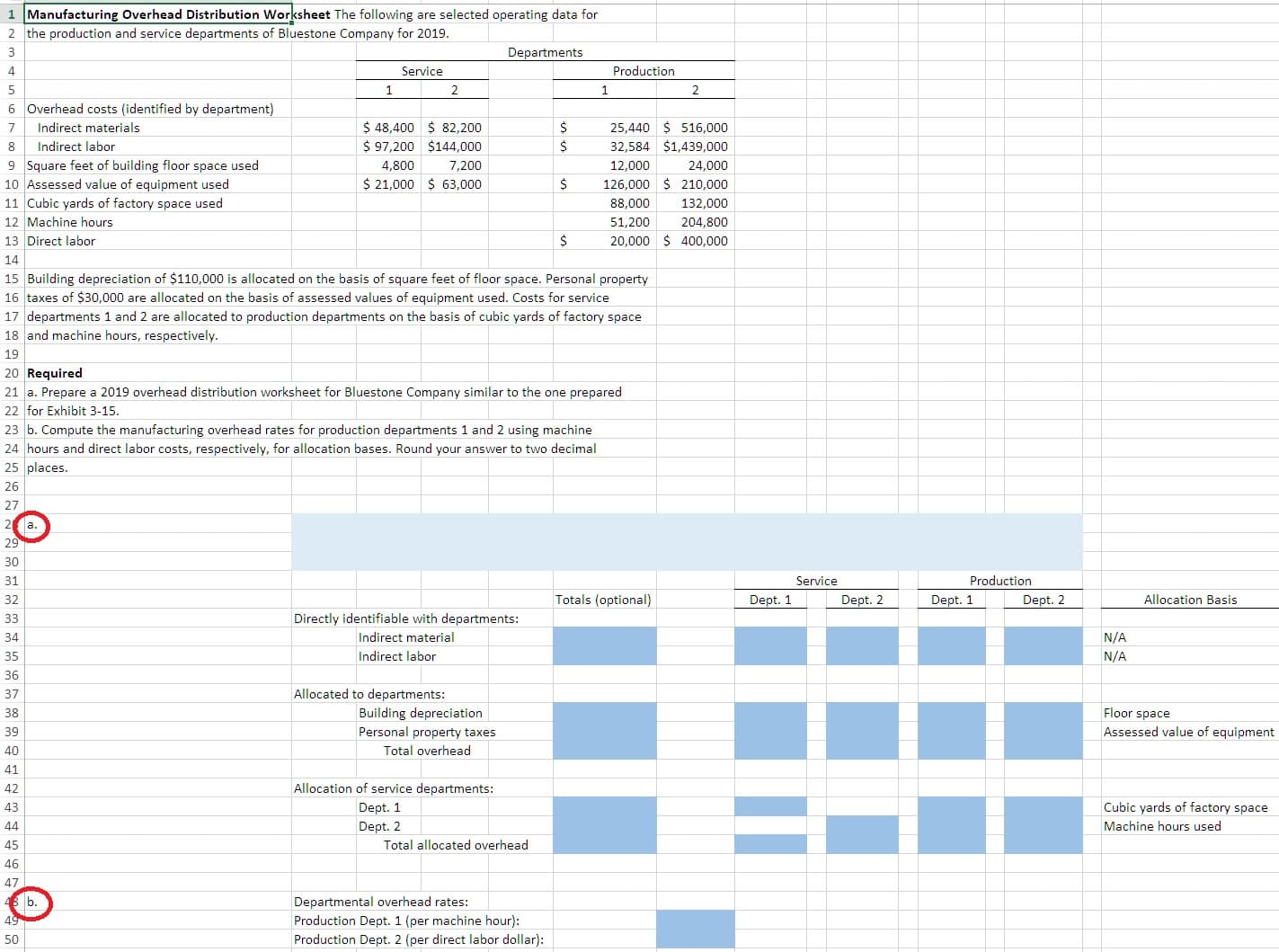

1 Manufacturing Overhead Distribution Worksheet The following are selected operating data for 2 the production and service departments of Bluestone Company for 2019 3 Departments Service Production 4 1 2 1 2 6 Overhead costs (identified by department) $ 48,400 82,200 25,440 516,000 32,584 $1,439,000 Indirect materials 7 $97,200 $144,000 Indirect labor 8 7,200 9 Square feet of building floor space used 10 Assessed value of equipment used 11 Cubic yards of factory space used 4,800 24,000 12,000 $ 21,000 63,000 126,000 210,000 88,000 132,000 12 Machine hours 51,200 204,800 20,000 400,000 13 Direct labor 14 15 Building depreciation of $110,000 is allocated on the basis of square feet of floor space. Personal property 16 taxes of $30,000 are allocated on the basis of assessed values of equipment used. Costs for service 17 departments 1 and 2 are allocated to production departments on the basis of cubic yards of factory space 18 and machine hours, respectively. 19 20 Required 21 a. Prepare a 2019 overhead distribution worksheet for Bluestone Company similar to the one prepared 22 for Exhibit 3-15 23 b. Compute the manufacturing overhead rates for production departments 1 and 2 using machine 24 hours and direct labor costs, respectively, for allocation bases. Round your answer to two decimal 25 places. 26 27 2 a. 29 30 Service Production 31 Totals (optional) Dept. 1 Dept. 2 Allocation Basis 32 Dept. 1 Dept. 2 Directly identifiable with departments: 33 Indirect material N/A 34 Indirect labor N/A 35 36 Allocated to departments: 37 Building depreciation Personal property taxes Floor space 38 Assessed value of equipment 39 Total overhead 40 41 Allocation of service departments: 42 Cubic yards of factory space 43 Dept. 1 Machine hours used 44 Dept. 2 Total allocated overhead 45 46 Departmental overhead rates: b. 49 Production Dept. 1 (per machine hour): Production Dept. 2 (per direct labor dollar): 50

1 Manufacturing Overhead Distribution Worksheet The following are selected operating data for 2 the production and service departments of Bluestone Company for 2019 3 Departments Service Production 4 1 2 1 2 6 Overhead costs (identified by department) $ 48,400 82,200 25,440 516,000 32,584 $1,439,000 Indirect materials 7 $97,200 $144,000 Indirect labor 8 7,200 9 Square feet of building floor space used 10 Assessed value of equipment used 11 Cubic yards of factory space used 4,800 24,000 12,000 $ 21,000 63,000 126,000 210,000 88,000 132,000 12 Machine hours 51,200 204,800 20,000 400,000 13 Direct labor 14 15 Building depreciation of $110,000 is allocated on the basis of square feet of floor space. Personal property 16 taxes of $30,000 are allocated on the basis of assessed values of equipment used. Costs for service 17 departments 1 and 2 are allocated to production departments on the basis of cubic yards of factory space 18 and machine hours, respectively. 19 20 Required 21 a. Prepare a 2019 overhead distribution worksheet for Bluestone Company similar to the one prepared 22 for Exhibit 3-15 23 b. Compute the manufacturing overhead rates for production departments 1 and 2 using machine 24 hours and direct labor costs, respectively, for allocation bases. Round your answer to two decimal 25 places. 26 27 2 a. 29 30 Service Production 31 Totals (optional) Dept. 1 Dept. 2 Allocation Basis 32 Dept. 1 Dept. 2 Directly identifiable with departments: 33 Indirect material N/A 34 Indirect labor N/A 35 36 Allocated to departments: 37 Building depreciation Personal property taxes Floor space 38 Assessed value of equipment 39 Total overhead 40 41 Allocation of service departments: 42 Cubic yards of factory space 43 Dept. 1 Machine hours used 44 Dept. 2 Total allocated overhead 45 46 Departmental overhead rates: b. 49 Production Dept. 1 (per machine hour): Production Dept. 2 (per direct labor dollar): 50

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter2: Job Order Costing

Section: Chapter Questions

Problem 4BE: Applying factory overhead Bergan Company estimates that total factory overhead costs will be 620,000...

Related questions

Concept explainers

Question

I need help doing the attached problem. Parts "a" and "b" are circuled

Transcribed Image Text:1 Manufacturing Overhead Distribution Worksheet The following are selected operating data for

2 the production and service departments of Bluestone Company for 2019

3

Departments

Service

Production

4

1

2

1

2

6 Overhead costs (identified by department)

$ 48,400 82,200

25,440 516,000

32,584 $1,439,000

Indirect materials

7

$97,200 $144,000

Indirect labor

8

7,200

9 Square feet of building floor space used

10 Assessed value of equipment used

11 Cubic yards of factory space used

4,800

24,000

12,000

$ 21,000 63,000

126,000 210,000

88,000

132,000

12 Machine hours

51,200

204,800

20,000 400,000

13 Direct labor

14

15 Building depreciation of $110,000 is allocated on the basis of square feet of floor space. Personal property

16 taxes of $30,000 are allocated on the basis of assessed values of equipment used. Costs for service

17 departments 1 and 2 are allocated to production departments on the basis of cubic yards of factory space

18 and machine hours, respectively.

19

20 Required

21 a. Prepare a 2019 overhead distribution worksheet for Bluestone Company similar to the one prepared

22 for Exhibit 3-15

23 b. Compute the manufacturing overhead rates for production departments 1 and 2 using machine

24 hours and direct labor costs, respectively, for allocation bases. Round your answer to two decimal

25 places.

26

27

2 a.

29

30

Service

Production

31

Totals (optional)

Dept. 1

Dept. 2

Allocation Basis

32

Dept. 1

Dept. 2

Directly identifiable with departments:

33

Indirect material

N/A

34

Indirect labor

N/A

35

36

Allocated to departments:

37

Building depreciation

Personal property taxes

Floor space

38

Assessed value of equipment

39

Total overhead

40

41

Allocation of service departments:

42

Cubic yards of factory space

43

Dept. 1

Machine hours used

44

Dept. 2

Total allocated overhead

45

46

Departmental overhead rates:

b.

49

Production Dept. 1 (per machine hour):

Production Dept. 2 (per direct labor dollar):

50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,