1) Ms. Linda Udall owns 800 shares of Fordam Inc. that she acquired several years ago at $10 per share. On April 30, 2020, she acquires an additional 200 shares at $12 per share. On July 15, 2020, after Fordam releases unexpectedly bad second quarter results, Ms. Udall sells all 1,000 of her shares at $5 per share. On August 1, 2020, she purchases 200 shares at $1 per share as she believes the market has overreacted to the bad news. Ms. Udall is still holding the shares at the end of the vear. What are the tax consequences of these transactions?

1) Ms. Linda Udall owns 800 shares of Fordam Inc. that she acquired several years ago at $10 per share. On April 30, 2020, she acquires an additional 200 shares at $12 per share. On July 15, 2020, after Fordam releases unexpectedly bad second quarter results, Ms. Udall sells all 1,000 of her shares at $5 per share. On August 1, 2020, she purchases 200 shares at $1 per share as she believes the market has overreacted to the bad news. Ms. Udall is still holding the shares at the end of the vear. What are the tax consequences of these transactions?

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter2: Introduction To Spreadsheet Modeling

Section: Chapter Questions

Problem 20P: Julie James is opening a lemonade stand. She believes the fixed cost per week of running the stand...

Related questions

Question

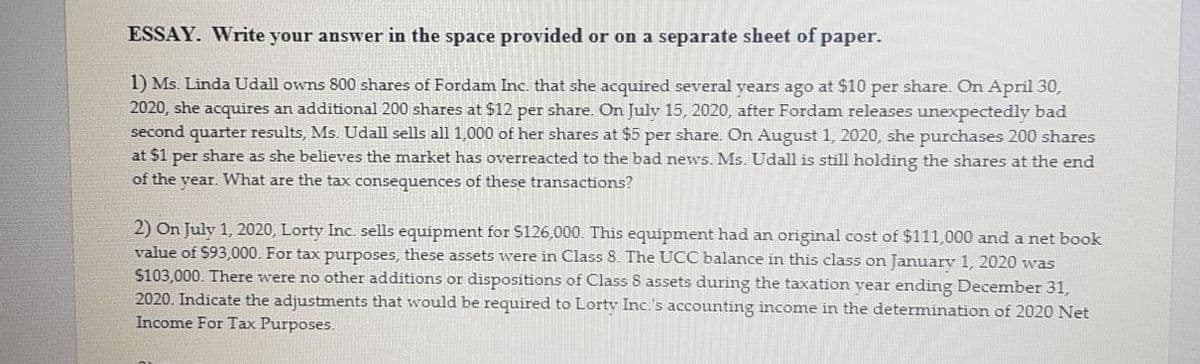

Transcribed Image Text:ESSAY. Write your answer in the space provided or on a separate sheet of paper.

1) Ms. Linda Udall owns 800 shares of Fordam Inc. that she acquired several years ago at $10 per share. On April 30,

2020, she acquires an additional 200 shares at $12 per share. On July 15, 2020, after Fordam releases unexpectedly bad

second quarter results, Ms. Udall sells all 1,000 of her shares at $5 per share. On August 1, 2020, she purchases 200 shares

at $1 per share as she believes the market has overreacted to the bad news. Ms. Udall is still holding the shares at the end

of the year. What are the tax consequences of these transactions?

2) On July 1, 2020, Lorty InC. sells equipment for S126,000. This equipment had an original cost of $111,000 and a net book

value of $93,000. For tax purposes, these assets were in Class 8. The UCC balance in this class on Januarv 1, 2020 was

$103,000. There were no other additions or dispositions of Class 8 assets during the taxation vear ending December 31,

2020. Indicate the adjustments that would be required to Lorty Inc.'s accounting income in the determination of 2020 Net

Income For Tax Purposes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Production and Operations Analysis, Seventh Editi…

Operations Management

ISBN:

9781478623069

Author:

Steven Nahmias, Tava Lennon Olsen

Publisher:

Waveland Press, Inc.