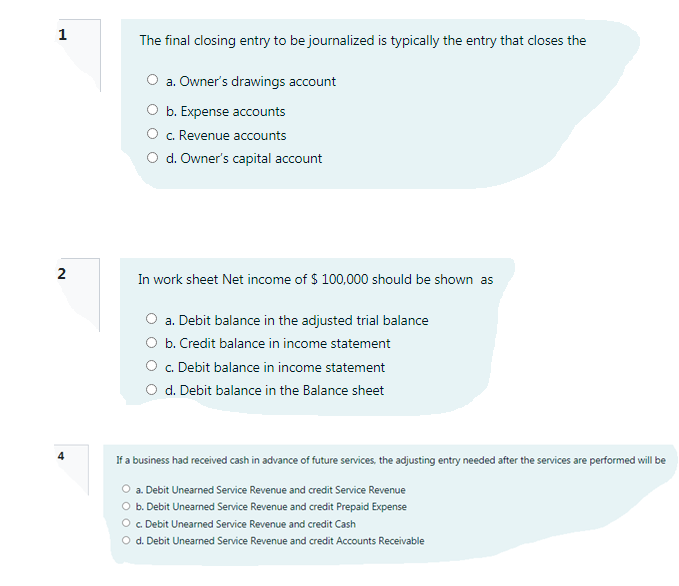

1 The final closing entry to be journalized is typically the entry that closes the O a. Owner's drawings account ОБ. Еxрense accounts O . Revenue accounts O d. Owner's capital account

Q: 1.What is the total of the debit column of the post-closing trial balance after all 4 closing…

A: Post-closing trial balance: A post-closing trial balance is a listing of all balance sheet accounts…

Q: Required: 4. Record the adjusting journal entries (k) through (p). (If no entry is required for a…

A: Transaction occured during the year are directly recorded by the accountants, but there are some…

Q: Instructions: a. Journalize the above transactions b. Post to ledger using the T-account format c.…

A: Journals, Ledgers and Unadjusted trial Balance are important for a company's accounting

Q: Pass the necessary Adjusting Entries Prepare Income Statement and Balance Sheet Prepare Closing…

A: Reversing Entry Adjusting Journal entries in the previous accounting period are reversed by…

Q: Write any ten transactions relating to the business. h) Prepare Journal,

A: The ten transaction related to a business are John started a business with an investment of…

Q: Required: A. Assume that the compahy a. Prepare the original entry on June 15, 20x0. b. Prepare the…

A: Reversing entries are passed at the beginning of the next period. Reversing entries are passed so…

Q: A. Analyze business transactions. B. Journalize the transactions. C. Post to ledger accounts. D.…

A: Introduction: Accounting: Accounting is an art of recording , classifying , summarizing and…

Q: 2. At the end of the closing process, all temporary accounts in the ledger will have a contains a…

A: "Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: 1. Unearned Fees appear on the A. balance sheet as a current liability B. income statement as…

A: Unearned Fees are liabilities account.

Q: 3. Prepare an adjusted trial balance. Required: 1. Prepare the adjusting entries. 2. Establish a…

A: Adjusting entries are entries passed for correct reflection of incomes, expenses, assets and…

Q: Identify the following transactions as either: a. Journal entries b. Adjusting journal entries…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: Prepare following: a.Prepare journal entry, Post to Ledger(T account) and prepare Unadjusted Trial…

A: Financial statements are prepared to analyze the financial position of a company.

Q: D. Prepare closing journal entries. If an amount box does not require an entry field, leave it…

A: Total expenses = $7,600 + $39,000 + $4,800 Total expenses = $51,400 Net income = $54,900 - $51,400…

Q: instructions a) prepare the for Good luckKCo. elosing ejournalentries b) prepare a post-closing…

A: Closing Journal Entries: Closing journal entries are those journal entries that are prepared at the…

Q: losing entries prepare the general ledger for use during the next accounting period. Select one:…

A: Solution Concept Ledger is a book of accounting where the transaction balance are posted on debit…

Q: Required: a. Record all the transaction in the general journal b. Record the transaction in the…

A:

Q: Requirements: 1.Journal 2.Posting trial balance Financial statements 3.(Income, balance, sheet,…

A: Journal Entry The basic process of accounting is to journalize the required transaction on both…

Q: 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages…

A: Here, I am assuming rent unearned at July 31, $300. to prepare adjusting entries and adjusted trial…

Q: 4. Journalize the closing entries. 5. Open the T-accounts using the balances from the adjusted trial…

A:

Q: When an entry is made in journal:(a) Assets are listed first.(b) Accounts to be debited listed…

A: As per general conventions, While writing journal entries. Accounts which are debited are listed…

Q: project. 1. Record transactions with journal entries in the General Journal. 2. Post journal entries…

A: Journal Entry The purpose of providing the journal entry to enter the required transaction into…

Q: Transactions are first recorded in which book/account? TAccounts Book of Original Entry O Book of…

A: Hi student Since there are multiple questions, we will answer only first question.

Q: ultiple choice: 1. The accounts which appear on post-closing trial balance are: A. Assets,…

A: Solution: Post closing trial balance is prepared after closing all the temporary accounts such as…

Q: a)Journalize the adjusting entries. b)Record the adjusting entries.

A: Date Account Name Debit Credit Jan 1 Prepaid Insurance Cash $36,000 $36,000 Jan 4…

Q: (b) Post to Owner's Capital and Income Summary accounts. (Post entries in the order of journal…

A: Closing entries means the entries to be made on the closing of any particular period . All revenue…

Q: .Prepare Closing Entries b.Adjusted Trial balance, Income Statement & Balance Sheet

A: The financial statements of the business includes the income statement and balance sheet.

Q: 28)The final step in the accounting cycle is to prepare A)closing entries. B)financial statements.…

A: Concept used :

Q: REQUIRED: а. Journalize the unrecorded transactions. b. Journalize these adjusting entries for the…

A: A journal entry is used to record day-to-day transactions of the business by debiting and crediting…

Q: se the filling partial listing of T accounts to complete this exercise. 1)

A: Solution: Introduction: T account is a graphical representation used in a double entry accounting…

Q: hapter Assignments Discussion Questions 1. Number in order the following steps in the accounting…

A: Hello, I am only answering second question as per your requirement. Thank you

Q: Steps in the Accounting Cycle Rearrange the following steps in the accounting cycle in proper…

A: One of the main duties of an accountant is to keep track of the complete accounting cycle from…

Q: Closing entries may be prepared from all of the following except Select one: a. Income statement and…

A: Following is the answer to given question

Q: SLO-2.1. All of the following are required steps in the accounting cycle except: OJournalizing and…

A: Accounting cycle is the process of recording the transactions happening in the business.

Q: Appendix: Completing an End-of-Period Spreadsheet Alert Security Services Co. offers security…

A: Financial Statements are prepared by the management for reporting purposes. These are the essential…

Q: 17. Arrange the following steps in the accounting process in its proper order: * I. Preparation of…

A: Accounting Process: It is step by step process followed by an enterprise to account the business…

Q: b. Prepare a before-closing trial balance. MARY'S DESIGNS Before-Closing Trial Balance December 31,…

A: Workings: (1.) Cash = 16,000 + 900 + 4,900 - 4,200 + 7,100 - 420 - 3,700 - 2,800 - 1,900 - 470 =…

Q: (a) Prepare the general journal entries to record the July transactions. (b) Set up T accounts,…

A: “Since you have posted a question with many sub-parts, we will solve three sub-parts for you. To get…

Q: 1. The steps of the accounting cycle are presented below. Identify the correct order of the steps. A…

A: The accounting cycle is a process of a complete sequence of accounting procedures in appropriate…

Q: Write the accounting equation from the post closing trial balance of leyes service grafix

A: Accounting equation considered as the foundation of the system of the accounting double entry and it…

Q: Instructions: 1. Prepare Adjusting Journal Entries 2. Prepare Income Statement

A: Journal entries refer to the recording/classifying of business transactions initially into books of…

Q: Required: a) Open the accounts b) Records all accounting operation c) Prepare closing balance sheet

A: Accounting transactions or events dealt with in monetary aspect are recorded in books of accounts.…

Q: Part I (1) What are the steps in the accounting cycle and why do they have to be done in order?…

A: Analysis: Here the question Contains two parts, we can only answer for the first part of the…

these multiple choice Questions from ACCOUNTING PRINCIPLES 1 Course.

I need the final.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Identify which of the following accounts would be listed on the companys Post-Closing Trial Balance. A. Accounts Receivable B. Accumulated Depreciation C. Cash D. Office Expense E. Note Payable F. Rent Revenue G. Retained Earnings H. Unearned Rent RevenueThe partial work sheet for Ho Consulting for May follows: Required 1. Write the owners name on the Capital and Drawing T accounts. 2. Record the account balances in the T accounts for owners equity, revenue, and expenses. 3. Journalize the closing entries using the four steps in correct order. Number the closing entries 1 through 4. 4. Post the closing entries to the T accounts immediately after you journalize each one to see the effect of the closing entries. Number the closing entries 1 through 4. Check Figure Debit to Income Summary, second entry, 5,840Case 3-78 Interpreting Closing Entries Barnes Building Systems made the following closing entries at the end of a recent year: a. Income Summary ............................. 129,750 Retained Earnings ........................ 129,750 b. Retained Earnings ........................... 25,000 Dividends ..................................... 25.000 c. Sales Revenue .................................. 495,300 Income Summary ......................... 495,300 d. Income Summary ............................. 104,100 Interest Expense ........................... 104,100 Required: If the sales revenue identified in Entry c was Barness only revenue, what was the total amount of Barness expenses?

- Journal entries and trial balance Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 20Y3, follows: The following business transactions were completed by Elite Realty during April 20Y3: Apr. 1. Paid rent on office for month, 6,500. 2. Purchased office supplies on account, 2,300. 5. Paid insurance premiums, 6,000. 10. Received cash from clients on account, 52,300. 15. Purchased land for a future building site for 200,000, paying 30,000 in cash and giving a note payable for the remainder. 17. Paid creditors on account, 6,450. 20. Returned a portion of the office supplies purchased on April 2, receiving full credit for their cost, 325. 23. Paid advertising expense, 4,300. Enter the following transactions on Page 19 of the two-column journal: 27. Discovered an error in computing a commission; received cash from the salesperson for the overpayment, 2,500. 28. Paid automobile expense (including rental charges for an automobile), 1,500. 29. Paid miscellaneous expenses, 1,400. 30. Recorded revenue earned and billed to clients during the month, 57,000. 30. Paid salaries and commissions for the month, 11,900. 30. Paid dividends, 4,000. 30. Rented land purchased on April 15 to local merchants association for use as a parking lot in May and June, during a street rebuilding program; received advance payment of 10,000. Instructions 1. Record the April 1, 20Y3, balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for April in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of April 30, 20Y3. 5. Assume that the April 30 transaction for salaries and commissions should have been 19,100. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide? The following business transactions were completed by Elite Realty during April 20Y3: Apr. 1. Paid rent on office for month, 6,500. 2. Purchased office supplies on account, 2,300. 5. Paid insurance premiums, 6,000. 10. Received cash from clients on account, 52,300. 15. Purchased land for a future building site for 200,000, paying 30,000 in cash and giving a note payable for the remainder. 17. Paid creditors on account, 6,450. 20. Returned a portion of the office supplies purchased on April 2, receiving full credit for their cost, 325. 23. Paid advertising expense, 4,300. Enter the following transactions on Page 19 of the two-column journal: 27. Discovered an error in computing a commission; received cash from the salesperson for the overpayment, 2,500. 28. Paid automobile expense (including rental charges for an automobile), 1,500. 29. Paid miscellaneous expenses, 1,400. 30. Recorded revenue earned and billed to clients during the month, 57,000. 30. Paid salaries and commissions for the month, 11,900. 30. Paid dividends, 4,000. 30. Rented land purchased on April 15 to local merchants association for use as a parking lot in May and June, during a street rebuilding program; received advance payment of 10,000. Instructions 1. Record the April 1, 20Y3, balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for April in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of April 30, 20Y3. 5. Assume that the April 30 transaction for salaries and commissions should have been 19,100. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?Journal entries and trial balance On October 1, 20Y6, Jay Crowley established Affordable Realty, which completed the following transactions during the month: a. Jay Crowley transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 40,000. b. Paid rent on office and equipment for the month, 4,800. c. Purchased supplies on account, 2,150. d. Paid creditor on account, 1,100. e. Earned sales commissions, receiving cash, 18,750. f. Paid automobile expenses (including rental charge) for month, 1,580, and miscellaneous expenses, 800. g. Paid office salaries, 3,500. h. Determined that the cost of supplies used was 1,300. i. Paid dividends, 1,500. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of October 31, 20Y6. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for October. 5. Determine the increase or decrease in retained earnings for October.Journal entries and trial balance Valley Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on July 31, 20Y8, follows: The following business transactions were completed by Valley Realty during August 20Y8: Aug. 1. Purchased office supplies on account, 3,150. 2. Paid rent on office for month, 7,200. 3. Received cash from clients on account, 83,900. 5. Paid insurance premiums, 12,000. 9. Returned a portion of the office supplies purchased on August 1, receiving full credit for their cost, 400. 17. Paid advertising expense, 8,000. 23. Paid creditors on account, 13,750. Enter the following transactions on Page 19 of the two-column journal: 29. Paid miscellaneous expenses, 1,700. 30. Paid automobile expense (including rental charges for an automobile), 2,500. 31. Discovered an error in computing a commission during July; received cash from the salesperson for the overpayment, 2,000. 31. Paid salaries and commissions for the month, 53,000. 31. Recorded revenue earned and billed to clients during the month, 183,500. 31. Purchased land for a future building site for 75,000, paying 7,500 in cash and giving a note payable for the remainder. 31. Paid dividends, 1,000. 31. Rented land purchased on August 31 to a local university for use as a parking lot during football season (September, October, and November); received advance payment of 5,000. Instructions 1. Record the August 1 balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for August in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of August 31, 20Y8. 5. Assume that the August 31 transaction for dividends should have been 10,000. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?

- Cornerstone Exercise 2-20 Transaction Analysis Four transactions are listed below. CORNERSTONE 2.2 Sold goods to customers on credit. Collected amounts due from customers. Purchased supplies on account. Used supplies in operations of the business. Required: Prepare three columns labeled assets, liabilities, and stockholders equity. For each of the transactions, indicate whether the transaction increased (+). decreased (-). or had no effect (NE) on Assets, liabilities, or stockholders equity.Brief Exercise 3-36 Preparing and Analyzing Closing Entries At December 31, 2019, the ledger of Aulani Company includes the following accounts, all having normal balances: Sales Revenue, cost of Goods sold, $31,000; Retained $20,000; Interest Expense, $3,200; Dividends, $5,000, Wages Expense $5,000, and Interest Payable, $2,100. Required: Prepare the closing entries for Aulani at December 31, 2019. How does the closing process affect Aulanis retained earnings?The unadjusted trial balance that you prepared for PS Music at the end of Chapter 2 should appear as follows: Unadjusted Trial Balance July 31. 2016 Debit Balances Credit Balances Cash 9,945 Accounts Receivable 2,750 Supplies 1,020 Prepaid Insurance 2,700 Office Equipment 7,500 Accounts Payable 8,350 Unearned Revenue 7,200 Common Stock 9,000 Dividends 1,750 Fees Earned 16,200 Music Expense 3,610 Wages Expense 2.800 Office Rent Expense 2.SS0 Advertising Expense 1,500 Equipment Rent Expense 1,375 Utilities Expense 1,215 Supplies Expense 180 Miscellaneous Expense 1,855 40,750 40,750 The data needed to determine adjustments are as follows: a. During July. PS Music provided guest disc jockeys for KXMD for a total of 115 hours, for information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3, 2016, transaction at the end of Chapter 2. b. Supplies on hand at July 31, 275. c. The balance of the prepaid insurance account relates to the July 1. 2016, transaction at the end of Chapter 2. d. Depreciation of the office equipment is 50. e. The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3, 2016, transaction at the end of Chapter 2. f. Accrued wages as of July 31, 2016, were 140. Instructions 1. Prepare adjusting journal entries. You will need the following additional accounts: 18 Accumulated DepreciationOffice Equipment 22. Wages Payable 57. Insurance Expense 58. Depreciation Expense 2. Post the adjusting entries, inserting balances in the accounts affected. 3. Prepare an adjusted trial balance.