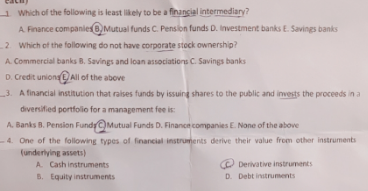

1 Which of the following is least likely to be a financial intermediary? A. Finance companies 8, Mutual funds C. Pension funds D. Investment banks E. Savings banks 2 Which of the following do not have corporate stock ownership? A. Commercial banks B. Savings and loan associations C. Savings banks D. Credit uniong O All of the above 3. A financial institution that raises funds by issuing shares to the public and invests the proceeds in a diversified portfolo for a management fee is: A. Banks B. Pension FundyC)Mutual Funds D. Financn companies E. None of the above - 4. One of the following types of financial instruments derive their value from other instruments (underlying assets) A. Cash instruments B. Equity instruments O Derivative instruments D. Debt instruments

1 Which of the following is least likely to be a financial intermediary? A. Finance companies 8, Mutual funds C. Pension funds D. Investment banks E. Savings banks 2 Which of the following do not have corporate stock ownership? A. Commercial banks B. Savings and loan associations C. Savings banks D. Credit uniong O All of the above 3. A financial institution that raises funds by issuing shares to the public and invests the proceeds in a diversified portfolo for a management fee is: A. Banks B. Pension FundyC)Mutual Funds D. Financn companies E. None of the above - 4. One of the following types of financial instruments derive their value from other instruments (underlying assets) A. Cash instruments B. Equity instruments O Derivative instruments D. Debt instruments

Chapter14: Corporation Accounting

Section: Chapter Questions

Problem 5MC: Which of the following is not one of the five primary responsibilities of the Securities and...

Related questions

Question

Transcribed Image Text:1 Which of the following is least likely to be a financial intermediary?

A. Finance companies 8, Mutual funds C. Pension funds D. Investment banks E. Savings banks

2 Which of the following do not have corporate stock ownership?

A. Commercial banks B. Savings and loan associations C. Savings banks

D. Credit uniong O All of the above

3. A financial institution that raises funds by issuing shares to the public and invests the proceeds in a

diversified portfolo for a management fee is:

A. Banks B. Pension FundyC)Mutual Funds D. Financn companies E. None of the above

- 4. One of the following types of financial instruments derive their value from other instruments

(underlying assets)

A. Cash instruments

B. Equity instruments

O Derivative instruments

D. Debt instruments

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College