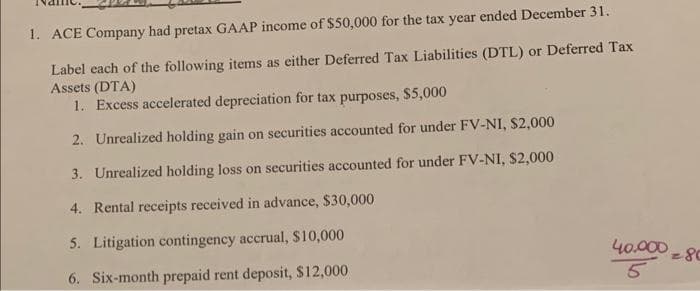

1. ACE Company had pretax GAAP income of $50,000 for the tax year ended December 31. Label each of the following items as either Deferred Tax Liabilities (DTL) or Deferred Tax Assets (DTA) 1. Excess accelerated depreciation for tax purposes, $5,000 2. Unrealized holding gain on securities accounted for under FV-NI, $2,000 3. Unrealized holding loss on securities accounted for under FV-NI, $2,000 4. Rental receipts received in advance, $30,000 5. Litigation contingency accrual, $10,000 6. Six-month prepaid rent deposit, $12,000 40. 5

1. ACE Company had pretax GAAP income of $50,000 for the tax year ended December 31. Label each of the following items as either Deferred Tax Liabilities (DTL) or Deferred Tax Assets (DTA) 1. Excess accelerated depreciation for tax purposes, $5,000 2. Unrealized holding gain on securities accounted for under FV-NI, $2,000 3. Unrealized holding loss on securities accounted for under FV-NI, $2,000 4. Rental receipts received in advance, $30,000 5. Litigation contingency accrual, $10,000 6. Six-month prepaid rent deposit, $12,000 40. 5

Chapter14: Taxes On The Financial Statements

Section: Chapter Questions

Problem 31P

Related questions

Question

Transcribed Image Text:1. ACE Company had pretax GAAP income of $50,000 for the tax year ended December 31.

Label each of the following items as either Deferred Tax Liabilities (DTL) or Deferred Tax

Assets (DTA)

1. Excess accelerated depreciation for tax purposes, $5,000

2. Unrealized holding gain on securities accounted for under FV-NI, $2,000

3. Unrealized holding loss on securities accounted for under FV-NI, $2,000

4. Rental receipts received in advance, $30,000

5. Litigation contingency accrual, $10,000

6. Six-month prepaid rent deposit, $12,000

40.000

5

2.80

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you