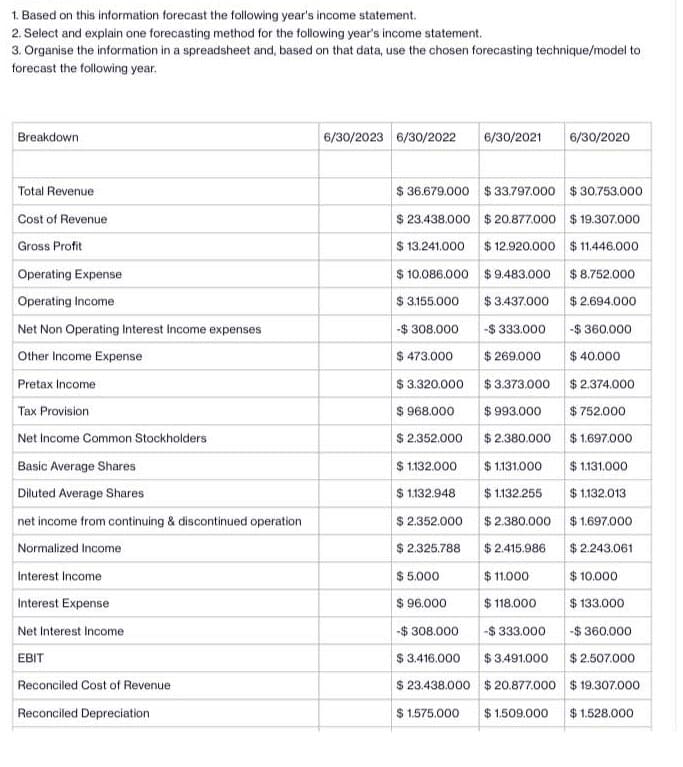

1. Based on this information forecast the following year's income statement. 2. Select and explain one forecasting method for the following year's income statement. 3. Organise the information in a spreadsheet and, based on that data, use the chosen forecasting technique/model to forecast the following year. Breakdown Total Revenue 6/30/2023 6/30/2022 6/30/2021 6/30/2020 $36.679.000 $33.797.000 $30.753.000

1. Based on this information forecast the following year's income statement. 2. Select and explain one forecasting method for the following year's income statement. 3. Organise the information in a spreadsheet and, based on that data, use the chosen forecasting technique/model to forecast the following year. Breakdown Total Revenue 6/30/2023 6/30/2022 6/30/2021 6/30/2020 $36.679.000 $33.797.000 $30.753.000

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 39E: Cuneo Companys income statements for the last 3 years are as follows: Refer to the information for...

Related questions

Question

Please don’t use chat gpt and provide snip from spreadsheet thank you

Transcribed Image Text:1. Based on this information forecast the following year's income statement.

2. Select and explain one forecasting method for the following year's income statement.

3. Organise the information in a spreadsheet and, based on that data, use the chosen forecasting technique/model to

forecast the following year.

Breakdown

Total Revenue

Cost of Revenue

Gross Profit

Operating Expense

Operating Income

Net Non Operating Interest Income expenses

Other Income Expense

Pretax Income

Tax Provision

Net Income Common Stockholders

Basic Average Shares

Diluted Average Shares

net income from continuing & discontinued operation

Normalized Income

Interest Income

Interest Expense

Net Interest Income

EBIT

Reconciled Cost of Revenue

Reconciled Depreciation

6/30/2023 6/30/2022 6/30/2021 6/30/2020

$36.679.000 $33.797.000 $30.753.000

$ 23.438.000 $20.877.000 $19.307.000

$13.241.000 $12.920.000 $11.446.000

$10.086.000 $9.483.000 $8.752.000

$ 3.155.000

$ 3.437.000

$ 2.694.000

-$308.000

-$ 333.000

-$360.000

$ 473.000

$3.320.000

$ 269.000

$3.373.000

$993.000

$2.380.000

$ 968.000

$ 2.352.000

$ 1.132.000

$ 1.132.948

$ 1.131.000

$1.132.255

$2.380.000

$ 40.000

$ 2.374.000

$ 752.000

$ 1.697.000

$ 1.131.000

$ 1.132.013

$1.697.000

$ 2.243.061

$ 10.000

$ 133.000

$ 2.352.000

$ 2.325.788

$2.415.986

$ 5.000

$ 96.000

$11.000

$118.000

-$ 308.000

-$ 333.000

-$360.000

$ 3.416.000

$ 3.491.000

$2.507.000

$23.438.000 $20.877.000 $19.307.000

$ 1.575.000 $1.509.000 $1.528.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning