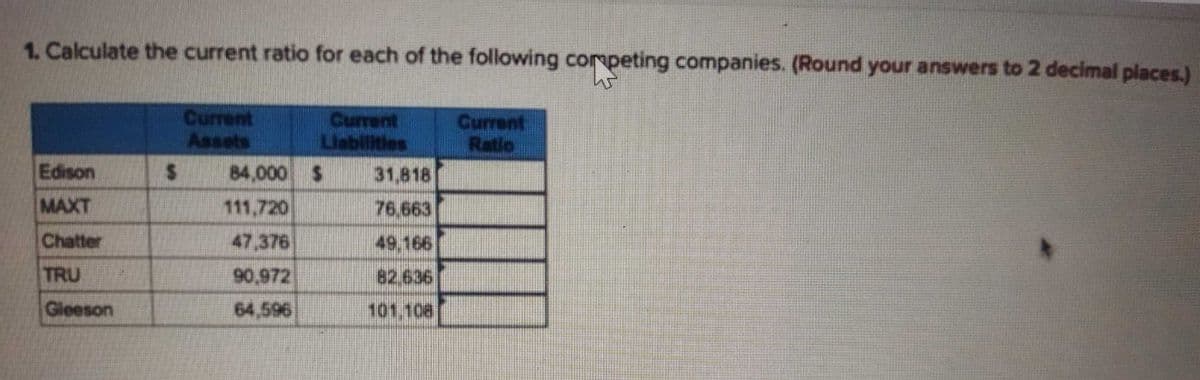

1. Calculate the current ratio for each of the following competing companies. (Round your answers to 2 decimal places.) W Edison MAXT Chatter TRU Gleeson $ Current Assets Current Liabilities 84,000 $ 31,818 111,720 76,663 47,376 49,166 90,972 82,636 64,596 101,108 Current Ratio

Q: You didnt answer the question 4, 5 , 6

A: Under or Overapplied Overhead: When real manufacturing overhead expenses exceed allocated…

Q: Rodriguez Company pays $342,225 for real estate with land, land improvements, and a building. Land…

A: The various assets can be acquired by the business at a lump sum price. The assets acquired at lump…

Q: Willie is a boat dealer. He pays 28250 for a boat and uses a 30% markup on cost. At what price…

A: The resale price includes the cost value and the markup required by the seller. The markup value can…

Q: 4-36. A geothermal heat pump can save up to 80% of the annual heating and cooling bills of a certain…

A: An asset's "useful life" is an accounting assessment of how long it will likely continue to be used…

Q: Kartik Inc. is a merchandising company. Last month the company's cost of goods sold was $76,000. The…

A: Cost of Goods Sold :— It is the total cost of units sold during the period. Cost of Goods Sold is…

Q: The adjusted trial balance for Sarasota Bowling Alley at December 31, 2022, contains the following…

A: Balance Sheet :— It is one of the financial statement that shows list of final balances of assets,…

Q: Collin Company manufactures small appliances and uses an activity-based costing system. Information…

A: The profit margin of a business, good, or service determines how profitable it is. In contrast to a…

Q: please explain 120/360

A: Solution: Interest amount is computed using formula = Principal * Interest rate * time Where time is…

Q: The following information is available for the Jacobs Company on March 31 of the current year: Bank…

A: Bank reconciliation: It is a statement drawn up by the business to verify the cash book balance with…

Q: On 1 July 2020, Kent Ltd acquired all the share capital (Ex-dividend) of Sub Ltd for $500,000. The…

A: For accounting purposes, when a company acquires another company then the consideration is paid (in…

Q: The reason for some costs to be mixed in nature is: 1. presence of sunken cost in the cost…

A: Mixed costs includes the nature of fixed costs as well nature of variable cost. Some part of the…

Q: Maria and Sylvia always wanted to start their own restaurant business and be an entrepreneur. as…

A: Two or more persons can share in the ownership and, in certain situations, the administration of a…

Q: show me the Post-Closing trial balance for daily driver inc.

A: A trial balance's main function is to confirm that the entries in a firm's accounting system are…

Q: Blue Spruce Architects incorporated as licensed architects on April 1, 2022. During the first month…

A: T-Account :— It is the journal ledger account in which journal entries are posted. Journal Entry…

Q: Notes payable (due next year) Pension obligation Rent payable Premium on bonds payable Long-term…

A: Revised balance sheet A revised balance sheet is a document that provides a snapshot of a…

Q: Net income Interest expense Fiscal Year 3 $146,200 3,000 Fiscal Year 3 Fiscal Year 2 $3,398,445…

A: In order to determine the return on stockholders' equity, the net income available to stockholders…

Q: Question No. 13: Calgary Company manufactures three products-X, Y, and Z. The selling price,…

A: Either a gross either per basis can be used to express the contribution margin. It represents the…

Q: REVENUES Base management fees Franchise fees Incentive management fees Gross fee revenues Contract…

A: Vertical analysis is a method of financial statement analysis in which each item on a financial…

Q: The company’s financial year end is December 31 each year. They have provided the following…

A: Honor Code- “Since you have posted a question with multiple sub-parts, we will provide the solution…

Q: Adams Medical Equipment Company makes a blood pressure measuring kit. Jason McCoy is the production…

A: FLEXIBLE BUDGET Flexible Budget is a Budget that is Prepared For Different Levels of Activities…

Q: 1. What are the possible actions when a business becomes insolvent? One of them is fresh start…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Coastal Cycles makes three models of electric bicycles: E20, E35, and E60. The models differ by the…

A: COST OF GOODS MANUFACTURED Cost of Goods Manufactured are those Cost which is Directly or…

Q: Required: 2. The name for the symbol that you selected to replace block 1 in the process is which of…

A: Events are activities that occur throughout a BPNM process and are symbolized by squares. Start…

Q: Below are approximate amounts related to cash flow information reported by five companies in…

A: Cash flows - cash flows for an organization represent the movement of cash or net cash (i.e, cash…

Q: Requirement 3. Prepare the journal entry transferring Job M1 to finished goods. (Record debits…

A: For job M1 As calculated in req : 2 • Direct materials $78,000 •Direct manufacturing labor…

Q: A company had stock outstanding as follows during each of its first 3 years of operations: 1,000…

A: Dividend per share: Dividend per share is calculated for Preferred stock as well as Common Stock.…

Q: Castor Incorporated is preparing its master budget. Budgeted sales and cash payments for merchandise…

A: The cash budget is prepared by the business entities so as to make an estimate regarding the…

Q: In describing the cost formula equation, Y = a + bX, which of the following is correct? a. “Y” is…

A: Variable cost means the cost which vary with the level of output and fixed cost means the cost…

Q: [The following information applies to the questions displayed below.] Wells Technical Institute…

A: Adjusted Trial Balance: The general ledger account names and balances are presented in the adjusted…

Q: The adjusted trial balance for AA Construction on December 21 of the current year follows. AA…

A: The financial statements of the business including income statement, balance sheet and retained…

Q: Seasons Construction is constructing an office building under contract for Cannon Company and uses…

A: Given information is Percentage of completion as of Dec 31,2025 = 75% Total contract revenue =…

Q: Prepare a balance sheet at May 31, 2022. (List Assets in order of liquidity.) I DONNA CONSULTING…

A: When an accountant closes the accounting books periodically, the owner’s equity is recorded in the…

Q: A manufacturing company prepays its insurance coverage for a three-year period. The premium for the…

A: Period costs: Period costs are not directly related to the production process of a product. Sales,…

Q: $280,000; and Tulip, $200,000. ournal entries to record the retirement of Tulip under the following…

A: Answer : 1.Assuming Tulip has been paid $200,000 for her equity using partnership cash Date…

Q: Egrane, Incorporated's monthly bank statement showed the ending balance of cash of $20,400. The bank…

A: Businesses typically utilise a bank reconciliation statement to look for errors that could affect…

Q: At the beginning of her current tax year, Angela purchased a zero-coupon corporate bond at original…

A: BOND Bond is a Financial Securities which is Generally Issued by the Corporation's, Government…

Q: ompute the 2022 AMT exemption for the following taxpayers. If an amount is zero, enter "0". Click…

A: Alternative Minimum Tax (AMT) Exemption In order to guarantee that wealthy taxpayers pay a minimal…

Q: Give an account of the three guidelines for conduct that the company relies on to maintain its…

A: As a language model, I don't have access to specific company guidelines. However, I can provide some…

Q: Syarikat Maju Niaga Sdn Bhd is a medium-sized manufacturing company that operates in Shah Alam. The…

A: The cost of goods manufactured is calculated as follows - Total Manufacturing Cost = Direct Material…

Q: David Ltd manufactures and sells a single product. The standard selling price per unit is $120. The…

A: MARGINAL COSTING INCOME STATEMENT Marginal Costing Income Statement is One of the Important Cost…

Q: Prepare the journal entries for Sunland in 2017. Sunland Windows manufactures and sells custom…

A: INTRODUCTION: A journal entry is a record of a commercial transaction in an organization's…

Q: Do items reported as a credit memorandum on the bank statement represents (a) additions made by the…

A: A credit memorandum is a document issued by seller of goods or services to it's buyers, this impacts…

Q: Arundel Company disclosed the following information for its recent calendar year. Income Statement…

A: A company's ability to generate cash through its core business operations is shown by the operating…

Q: The Cansler Corporation provides an executive stock option plan. Under the plan, the company granted…

A: In the accounting books of the business organizations the journal entry served as a record of its…

Q: Morrow Enterprises Inc. manufactures bathroom fixtures. Morrow Enterprises' stockholders' equity…

A: Disclaimer : As per question we have require to solve Requirement 4. Stockholders' Equity…

Q: Robinson Products Company has two service departments (S1 and S2) and two production departments (P1…

A: There are so many departments in a company, from which some are primary departments where the main…

Q: Required: 1. Prepare journal entries to record the transactions for the year. 2. Prepare T-accounts…

A: Part 2: Workings:

Q: don't understand how they got $18,000

A: Solution: Total interest amount = $540 Interest rate = 9% Period = 120 days

Q: Sandhill Corporation acquired two inventory items at a lump-sum cost of $62500. The acquisition…

A: The gross profit represents the difference between the sales revenue and the cost of goods sold. The…

Q: The following are selected unadjusted account balances as at December 31, the year end of Joseph's…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- SDJ Inc., has net working capital of $1165, current liabilities of $6,775 and inventory of $1185 a What is the current ratio? b What is the quick ratio? (do not round intermediate calculations and round your answer to 2 decimal placesRefer to the original data. Compute the company's margin of safety in both dollar and percentage terms. (Round your percentage answer to 2 decimal places (i.e. 0.1234 should be entered as 12.34).)What is Horizontal Analysis? How does it differ from Vertical Analysis? Do you believe one type of analysis is more useful than the other? (2) Perform horizontal analysis on the figures below using dollar amounts and percentages. Round percent answers to one decimal place. (3) Think of the different users of financial statements and discuss who would be interested in this information (and why). 20Y8 20Y7 Fees Earned $680,000 $850,000 Operating Expenses 541,875 637,500 Net Income $138,125 $212,500

- Using these data from the comparative balance sheet of Cullumber Company, perform horizontal analysis. (If amount and percentage are a decrease show the numbers as negative, e.g. -55,000, -20% or (55,000), (20%). Round percentages to 0 decimal places, e.g. 12%.) Increase or (Decrease) Dec. 31, 2022 Dec. 31, 2021 Amount Percentage Accounts receivable $ 608,400 $ 520,000 $Enter increase or decrease amount in dollars. Enter increase or decrease in percentages rounded to 0 decimal places. % Inventory $ 931,700 $ 770,000 $Enter increase or decrease amount in dollars. Enter increase or decrease in percentages rounded to 0 decimal points. % Total assets $3,381,000 $2,940,000 $Enter increase or decrease amount in dollars. Enter increase or decrease in percentages rounded to 0 decimal points. %1. SDJ, Inc., has net working capital of $2,710, current liabilities of $3,950, and inventory of $3,420. What is the current ratio? (Round your answer to 2 decimal places. (e.g., 32.16)) What is the quick ratio? (Round your answer to 2 decimal places. (e.g., 32.16))Your answer is partially correct. Try again. Using these data from the comparative balance sheet of Cullumber Company, perform horizontal analysis. (If amount and percentage are a decrease show the numbers as negative, e.g. -55,000, -20% or (55,000), (20%). Round percentages to 0 decimal places, e.g. 12%.) Increase or (Decrease) Dec. 31, 2022 Dec. 31, 2021 Amount Percentage Accounts receivable $ 608,400 $ 520,000 $Enter increase or decrease amount in dollars. Enter increase or decrease in percentages rounded to 0 decimal places. % Inventory $ 931,700 $ 770,000 $Enter increase or decrease amount in dollars. Enter increase or decrease in percentages rounded to 0 decimal points. % Total assets $3,381,000 $2,940,000 $Enter increase or decrease amount in dollars. Enter increase or decrease in percentages rounded to 0 decimal points. %

- Using these data from the comparative balance sheet of Ivanhoe Company, perform horizontal analysis. (If amount and percentage are a decrease show the numbers as negative, e.g. -55,000, -20% or (55,000), (20%). Round percentages to 0 decimal places, e.g. 12%.) Increase or (Decrease) Dec. 31, 2022 Dec. 31, 2021 Amount Percentage Accounts receivable $ 487,200 $ 420,000 $Enter increase or decrease amount in dollars. Enter increase or decrease in percentages rounded to 0 decimal places. % Inventory $ 804,000 $ 670,000 $Enter increase or decrease amount in dollars. Enter increase or decrease in percentages rounded to 0 decimal points. % Total assets $3,237,600 $2,840,000 $Enter increase or decrease amount in dollars. Enter increase or decrease in percentages rounded to 0 decimal points. %SDJ, Inc., has net working capital of $2,060, current liabilities of $5,550, and inventory of $1,250. Requirement 1: What is the current ratio? (Round your answer to 2 decimal places (e.g., 3.16).) Current ratio times Requirement 2: What is the quick ratio? (Round your answer to 2 decimal places (e.g., 3.16).) Quick ratio timesIf your total assets equal $11,886 and your total liabilities equal $10,296; your solvency ratio is: (Keep 2 decimal places)

- Suppose McDonald’s 2022 financial statements contain the following selected data (in millions). Current assets $3,381.0 Interest expense $466.0 Total assets 30,189.0 Income taxes 1,929.0 Current liabilities 2,963.0 Net income 4,544.0 Total liabilities 16,156.0 (a1)Compute the following values. a. Working capital. (Round to 1 decimal place, e.g. 5,275.5) $enter a dollar amount in millions millions b. Current ratio. (Round to 2 decimal places, e.g. 6.25:1.) enter current ratio rounded to 2 decimal places :1 c. Debt to assets ratio. (Round to 0 decimal places, e.g. 62%.) enter percentages rounded to 0 decimal places % d. Times interest earned. (Round to 2 decimal places, e.g. 6.25.) enter times interest earned rounded to 2 decimal places timesThe following information is available from the annualreport of Frixell, Inc.: Currentliabilities . . . . $300,000Operatingincome . . . . . 240,000Net income . . . . 80,000 Currentassets . . . . $ 480,000Average totalassets . . . . 2,000,000Average totalequity . . . . 800,000Which of the following statements are correct? (More thanone statement may be correct.)a. The return on equity exceeds the return on assets.b. The current ratio is 0.625 to 1.SDJ, Incorporated, has net working capital of $3,490, current liabilities of $4,950, and inventory of $4,990. a. What is the current ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the quick ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)