1. Cash in bank. 14. Accounts payable. 15. Estimated warranty obligations. 16. Income tax payable. 2. Accounts receivables. 3. Merchandise inventories. 4. Prepaid rent. 5. Equity investment – held for trading. 6. Equity investment – associate. 7. Debt investment – amortized cost. 8. Investment in subsidiary. 9. Forward contract receivable. 17. Unearned rent revenue. 18. Interest rate swap payable. 19. Bonds payable. 20. Deferred tax liabilities. 21. Issued ordinary shares. 22. Redeemable preference shares. 23. Share warrants outstanding. 10. Gold bullion. 11. Biological asset. 12. Property, plant, and equipment 24. Treasury shares. 25. Share appreciation rights payable.

1. Cash in bank. 14. Accounts payable. 15. Estimated warranty obligations. 16. Income tax payable. 2. Accounts receivables. 3. Merchandise inventories. 4. Prepaid rent. 5. Equity investment – held for trading. 6. Equity investment – associate. 7. Debt investment – amortized cost. 8. Investment in subsidiary. 9. Forward contract receivable. 17. Unearned rent revenue. 18. Interest rate swap payable. 19. Bonds payable. 20. Deferred tax liabilities. 21. Issued ordinary shares. 22. Redeemable preference shares. 23. Share warrants outstanding. 10. Gold bullion. 11. Biological asset. 12. Property, plant, and equipment 24. Treasury shares. 25. Share appreciation rights payable.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 28BE: Brief 1-28 Statement of Cash Flows Listed are items that would on a Statement of cash flows. Cash...

Related questions

Question

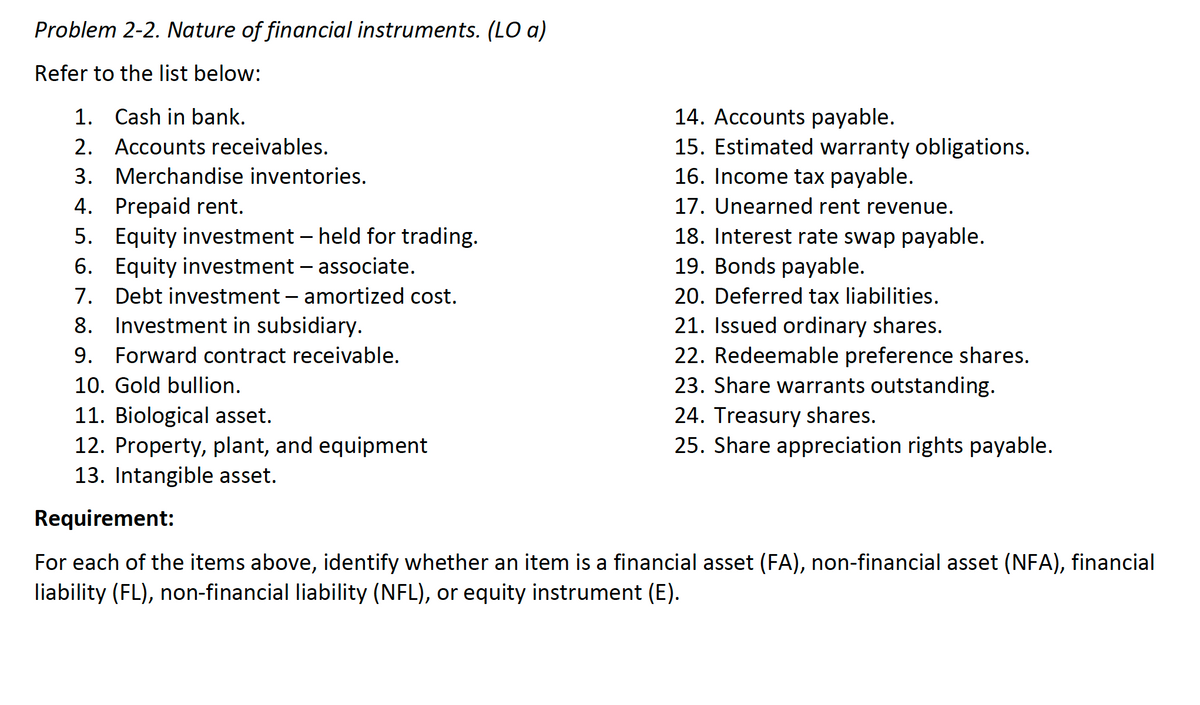

Transcribed Image Text:Problem 2-2. Nature of financial instruments. (LO a)

Refer to the list below:

1. Cash in bank.

2. Accounts receivables.

14. Accounts payable.

15. Estimated warranty obligations.

16. Income tax payable.

17. Unearned rent revenue.

18. Interest rate swap payable.

19. Bonds payable.

3. Merchandise inventories.

4. Prepaid rent.

5. Equity investment – held for trading.

6. Equity investment – associate.

7. Debt investment – amortized cost.

8. Investment in subsidiary.

9. Forward contract receivable.

10. Gold bullion.

20. Deferred tax liabilities.

21. Issued ordinary shares.

22. Redeemable preference shares.

23. Share warrants outstanding.

11. Biological asset.

12. Property, plant, and equipment

13. Intangible asset.

24. Treasury shares.

25. Share appreciation rights payable.

Requirement:

For each of the items above, identify whether an item is a financial asset (FA), non-financial asset (NFA), financial

liability (FL), non-financial liability (NFL), or equity instrument (E).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,