1. Define internal control. 2. The system of internal control must be tested by external auditors. What law or rule requires this testing? 3. Identify each item in the list above 3s either a strength or a weakness in internal control, and give your reason for ach answer.

1. Define internal control. 2. The system of internal control must be tested by external auditors. What law or rule requires this testing? 3. Identify each item in the list above 3s either a strength or a weakness in internal control, and give your reason for ach answer.

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 5MC: There are several elements to internal controls. Which of the following would not address the issue...

Related questions

Question

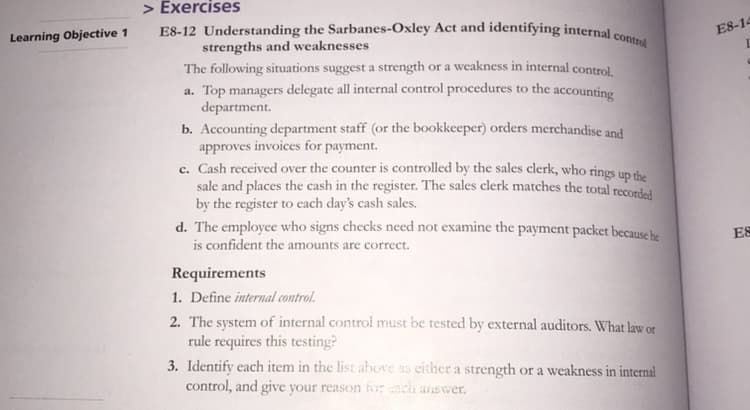

Transcribed Image Text:> Exercises

E8-12 Understanding the Sarbanes-Oxley Act and identifying internal c

strengths and weaknesses

The following situations suggest a strength or a weakness in internal control.

a. Top managers delegate all internal control procedures to the accounting

department.

E8-14

Learning Objective 1

b. Accounting department staff (or the bookkeeper) orders merchandise and

approves invoices for payment.

c. Cash received over the counter is controlled by the sales clerk, who rings up th

sale and places the cash in the register. The sales clerk matches the total recorded

by the register to each day's cash sales.

d. The employee who signs checks need not examine the payment packet because be

is confident the amounts are correct.

ES

Requirements

1. Define internal control.

2. The system of internal control must be tested by external auditors. What law or

rule requires this testing?

3. Identify each item in the list above as either a strength or a weakness in internal

control, and give your reason for ach answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning