1. Dividend income received by a resident citizen from domestic corporations 2. Dividend income received by a resident alien from domestic corporations B. Dividend income received by a resident citizon from foroian reian

1. Dividend income received by a resident citizen from domestic corporations 2. Dividend income received by a resident alien from domestic corporations B. Dividend income received by a resident citizon from foroian reian

Chapter16: Multistate Corporate Taxation

Section: Chapter Questions

Problem 6DQ

Related questions

Question

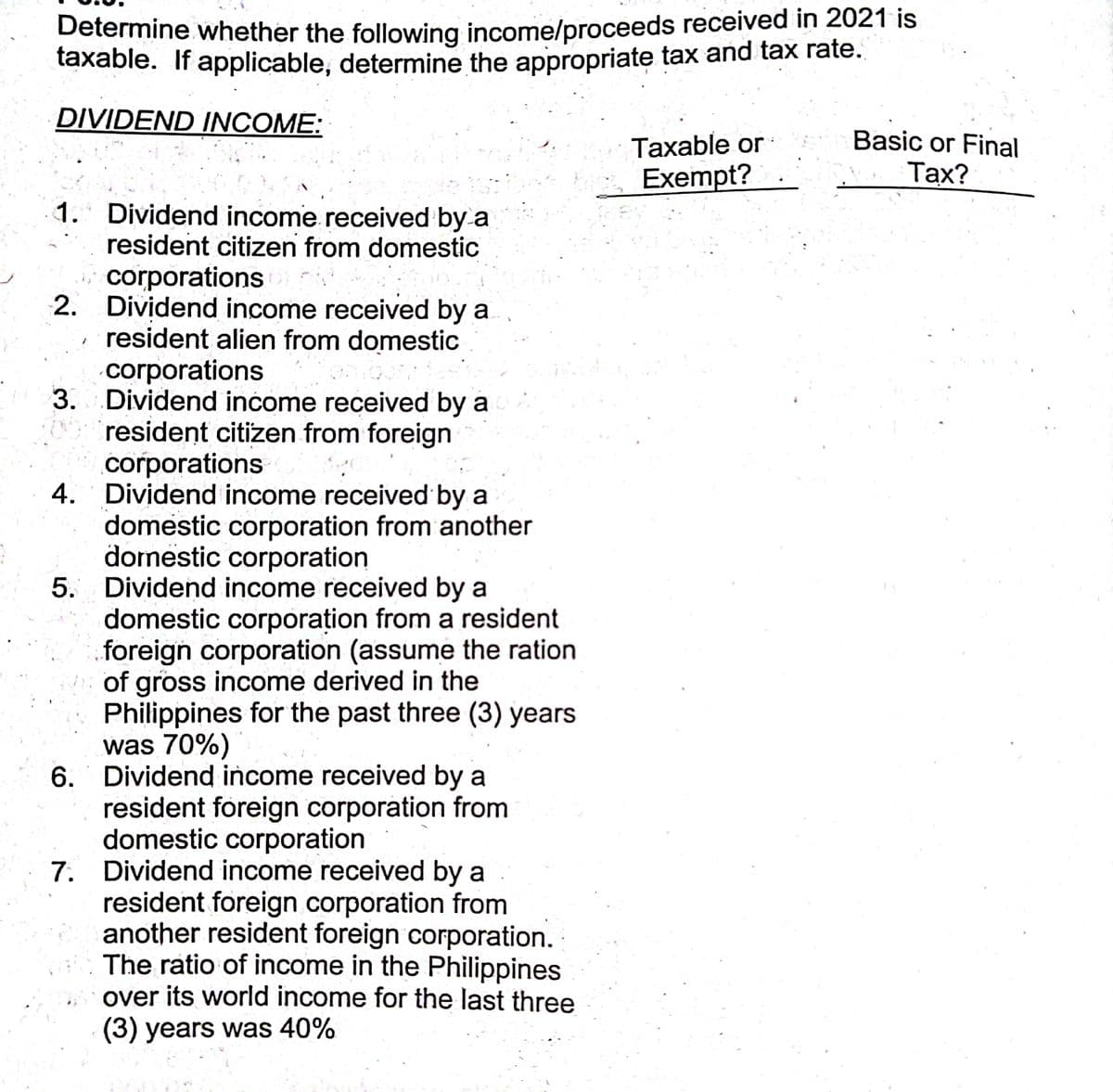

Transcribed Image Text:Determine whether the following income/proceeds received in 2021 is

taxable. If applicable, determine the appropriate tax and tax rate.

DIVIDEND INCOME:

Basic or Final

Тахable or

Exempt?

Тах?

1. Dividend income received by a

resident citizen from domestic

corporations

2. Dividend income received by a

resident alien from domestic

corporations

3. Dividend income received by a

resident citizen from foreign

.corporations

4. Dividend income received by a

domestic corporation from another

domestic corporation

5. Dividend income received by a

domestic corporation from a resident

foreign corporation (assume the ration

of gross income derived in the

Philippines for the past three (3) years

was 70%)

6. Dividend income received by a

resident foreign corporation from

domestic corporation

7. Dividend income received by a

resident foreign corporation from

another resident foreign corporation.

The ratio of income in the Philippines

over its world income for the last three

(3) years was 40%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you