1. During June, non-cash assets were sold at 120% of carrying value resulting to a gain on realization. How much is the share of Levi on the gain on realization of non-cash assets? choices P29,880 P24,900 P 49,800 P 19,920 2. How much should Simeon and Levi receive upon final distribution of cash? (Simeon; Levi) P 131,880; P 118,920 P 155,880; P 118,920 P 118,920; P 131,880 P 118,920; P 155,880

1. During June, non-cash assets were sold at 120% of carrying value resulting to a gain on realization. How much is the share of Levi on the gain on realization of non-cash assets? choices P29,880 P24,900 P 49,800 P 19,920 2. How much should Simeon and Levi receive upon final distribution of cash? (Simeon; Levi) P 131,880; P 118,920 P 155,880; P 118,920 P 118,920; P 131,880 P 118,920; P 155,880

Chapter11: Partnerships: Distributions, Transfer Of Interests, And Terminations

Section: Chapter Questions

Problem 4BCRQ

Related questions

Topic Video

Question

1. During June, non-cash assets were sold at 120% of carrying value resulting to a gain on realization. How much is the share of Levi on the gain on realization of non-cash assets?

choices

P29,880

P24,900

P 49,800

P 19,920

2. How much should Simeon and Levi receive upon final distribution of cash? (Simeon; Levi)

P 131,880; P 118,920

P 155,880; P 118,920

P 118,920; P 131,880

P 118,920; P 155,880

3.

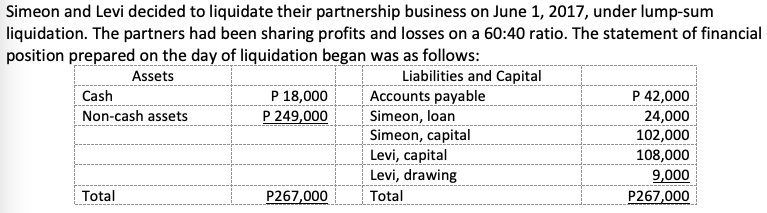

Transcribed Image Text:Simeon and Levi decided to liquidate their partnership business on June 1, 2017, under lump-sum

liquidation. The partners had been sharing profits and losses on a 60:40 ratio. The statement of financial

position prepared on the day of liquidation began was as follows:

Liabilities and Capital

Accounts payable

Simeon, loan

Assets

P 42,000

P 18,000

P 249,000

Cash

Non-cash assets

24,000

Simeon, capital

Levi, capital

Levi, drawing

Total

102,000

108,000

9,000

P267,000

Total

P267,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,