1. Ethics in Financial reporting is a responsibility of the organization and the managers, given the ethical principles of trust and transparency, describe how can you as a manager be able to uphold these two in your practice.

1. Ethics in Financial reporting is a responsibility of the organization and the managers, given the ethical principles of trust and transparency, describe how can you as a manager be able to uphold these two in your practice.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter2: Financial Statements And The Annual Report

Section: Chapter Questions

Problem 2.11E

Related questions

Concept explainers

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Topic Video

Question

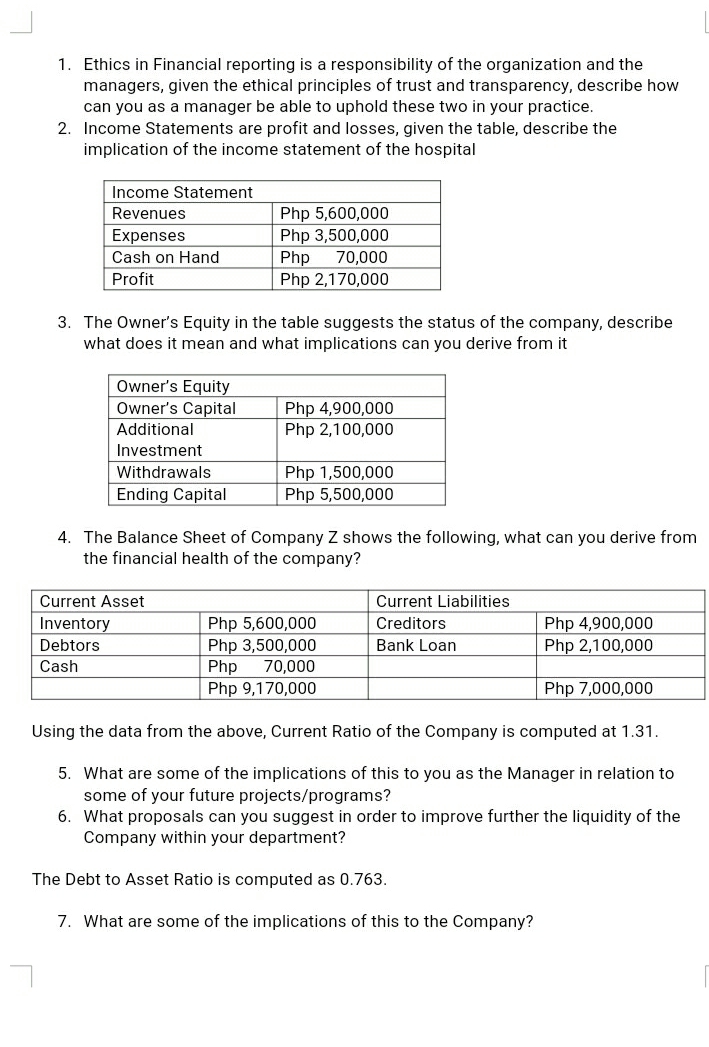

Transcribed Image Text:1. Ethics in Financial reporting is a responsibility of the organization and the

managers, given the ethical principles of trust and transparency, describe how

can you as a manager be able to uphold these two in your practice.

2. Income Statements are profit and losses, given the table, describe the

implication of the income statement of the hospital

Income Statement

Php 5,600,000

Php 3,500,000

Php

Php 2,170,000

Revenues

Expenses

Cash on Hand

70,000

Profit

3. The Owner's Equity in the table suggests the status of the company, describe

what does it mean and what implications can you derive from it

Owner's Equity

Owner's Capital

Php 4,900,000

Php 2,100,000

Additional

Investment

Withdrawals

Php 1,500,000

Php 5,500,000

Ending Capital

4. The Balance Sheet of Company Z shows the following, what can you derive from

the financial health of the company?

Current Asset

Current Liabilities

Php 5,600,000

Php 3,500,000

Php

Inventory

Creditors

Php 4,900,000

Debtors

Bank Loan

Php 2,100,000

70,000

Php 9,170,000

Cash

Php 7,000,000

Using the data from the above, Current Ratio of the Company is computed at 1.31.

5. What are some of the implications of this to you as the Manager in relation to

some of your future projects/programs?

6. What proposals can you suggest in order to improve further the liquidity of the

Company within your department?

The Debt to Asset Ratio is computed as 0.763.

7. What are some of the implications of this to the Company?

Transcribed Image Text:9:39 Xil .l KB/S

0.37

18

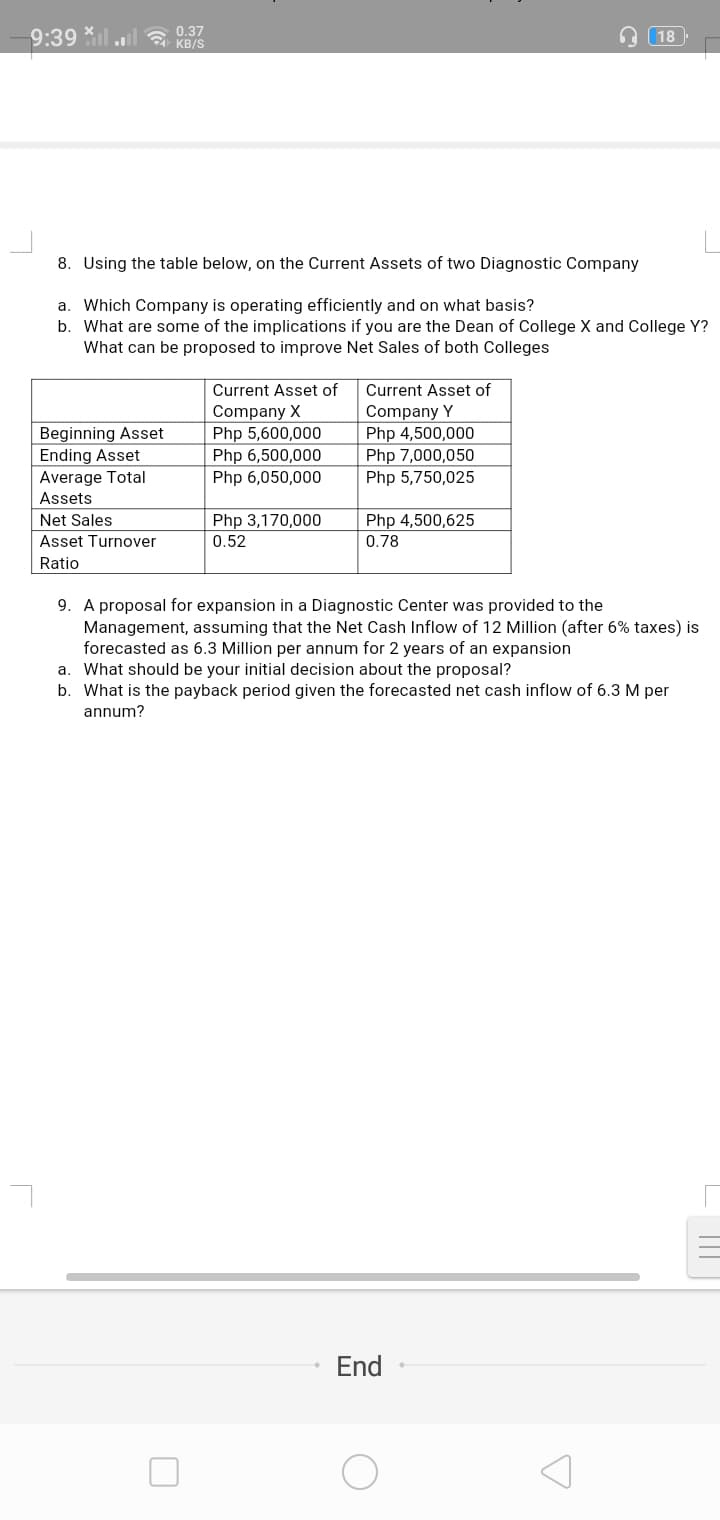

8. Using the table below, on the Current Assets of two Diagnostic Company

a. Which Company is operating efficiently and on what basis?

b. What are some of the implications if you are the Dean of College X and College Y?

What can be proposed to improve Net Sales of both Colleges

Current Asset of

Current Asset of

Company X

Php 5,600,000

Beginning Asset

Ending Asset

Average Total

Company Y

Php 4,500,000

Php 7,000,050

Php 5,750,025

Php 6,500,000

Php 6,050,000

Assets

Php 4,500,625

0.78

Net Sales

Php 3,170,000

Asset Turnover

0.52

Ratio

9. A proposal for expansion in a Diagnostic Center was provided to the

Management, assuming that the Net Cash Inflow of 12 Million (after 6% taxes) is

forecasted as 6.3 Million per annum for 2 years of an expansion

a. What should be your initial decision about the proposal?

b. What is the payback period given the forecasted net cash inflow of 6.3 M per

annum?

End

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College