1. Fahad gets into a long European call option to purchase one share of stock X for $95 that costs $5 and is held until maturity. Under what circumstances will Fahad make a profit? Under what circumstances will the option be exercised? Draw a diagram illustrating how the profit from a long position in the option depends on the stock price at maturity of the option.

1. Fahad gets into a long European call option to purchase one share of stock X for $95 that costs $5 and is held until maturity. Under what circumstances will Fahad make a profit? Under what circumstances will the option be exercised? Draw a diagram illustrating how the profit from a long position in the option depends on the stock price at maturity of the option.

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

I need the answer as soon as possible

Transcribed Image Text:0:T.

Assignment 2... +966 55 670 8009

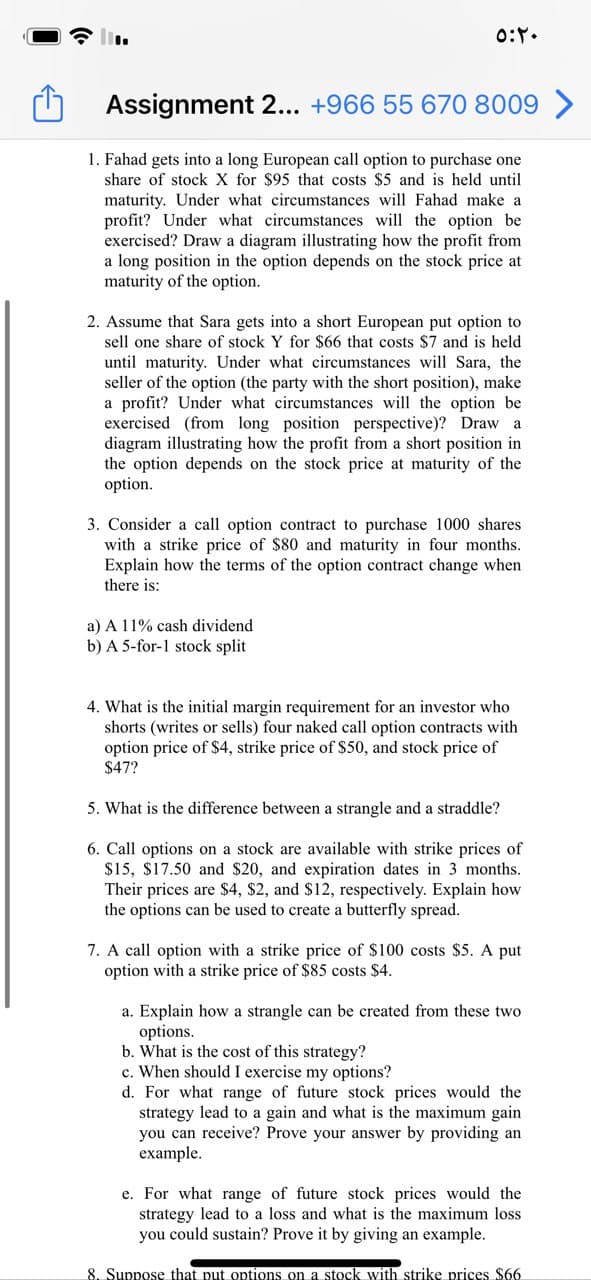

1. Fahad gets into a long European call option to purchase one

share of stock X for $95 that costs $5 and is held until

maturity. Under what circumstances will Fahad make a

profit? Under what circumstances will the option be

exercised? Draw a diagram illustrating how the profit from

a long position in the option depends on the stock price at

maturity of the option.

2. Assume that Sara gets into a short European put option to

sell one share of stock Y for $66 that costs $7 and is held

until maturity. Under what circumstances will Sara, the

seller of the option (the party with the short position), make

a profit? Under what circumstances will the option be

exercised (from long position perspective)? Draw a

diagram illustrating how the profit from a short position in

the option depends on the stock price at maturity of the

option.

3. Consider a call option contract to purchase 1000 shares

with a strike price of $80 and maturity in four months.

Explain how the terms of the option contract change when

there is:

a) A 11% cash dividend

b) A 5-for-1 stock split

4. What is the initial margin requirement for an investor who

shorts (writes or sells) four naked call option contracts with

option price of $4, strike price of S50, and stock price of

$47?

5. What is the difference between a strangle and a straddle?

6. Call options on a stock are available with strike prices of

$15, $17.50 and $20, and expiration dates in 3 months.

Their prices are $4, $2, and $12, respectively. Explain how

the options can be used to create a butterfly spread.

7. A call option with a strike price of $100 costs $5. A put

option with a strike price of $85 costs $4.

a. Explain how a strangle can be created from these two

options.

b. What is the cost of this strategy?

c. When should I exercise my options?

d. For what range of future stock prices would the

strategy lead to a gain and what is the maximum gain

you can receive? Prove your answer by providing an

example.

e. For what range of future stock prices would the

strategy lead to a loss and what is the maximum loss

you could sustain? Prove it by giving an example.

8. Suppose that put options on a stock with strike prices $66

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education