1. For the summer session of 20X1, Armando University (AU), a non-profit organization, assessed its students P1,700,000 (net of refunds), covering tuition and fees for educational and general purposes. However, an amount of P1,500,000 was only expected to be realized. It is because P150,000 were granted to students, and P50,000 tuition remissions were allowed to faculty member's children attending the university. What amount should AU include in its unrestricted funds as revenues from tuition fees?

1. For the summer session of 20X1, Armando University (AU), a non-profit organization, assessed its students P1,700,000 (net of refunds), covering tuition and fees for educational and general purposes. However, an amount of P1,500,000 was only expected to be realized. It is because P150,000 were granted to students, and P50,000 tuition remissions were allowed to faculty member's children attending the university. What amount should AU include in its unrestricted funds as revenues from tuition fees?

Chapter2: Income Tax Concepts

Section: Chapter Questions

Problem 19P

Related questions

Question

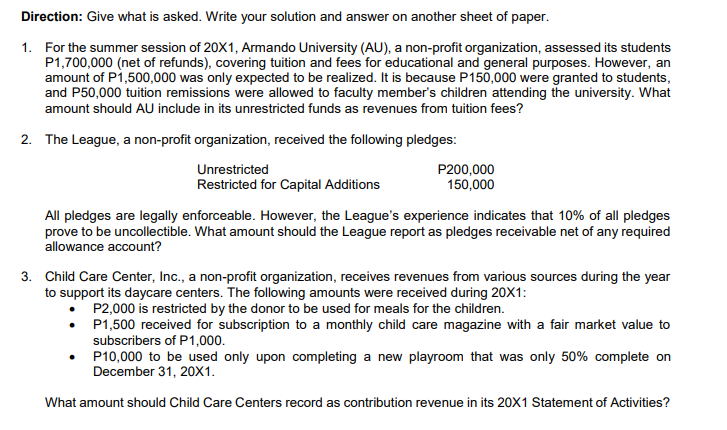

Transcribed Image Text:Direction: Give what is asked. Write your solution and answer on another sheet of paper.

1. For the summer session of 20X1, Armando University (AU), a non-profit organization, assessed its students

P1,700,000 (net of refunds), covering tuition and fees for educational and general purposes. However, an

amount of P1,500,000 was only expected to be realized. It is because P150,000 were granted to students,

and P50,000 tuition remissions were allowed to faculty member's children attending the university. What

amount should AU include in its unrestricted funds as revenues from tuition fees?

2. The League, a non-profit organization, received the following pledges:

Unrestricted

Restricted for Capital Additions

P200,000

150,000

All pledges are legally enforceable. However, the League's experience indicates that 10% of all pledges

prove to be uncollectible. What amount should the League report as pledges receivable net of any required

allowance account?

3. Child Care Center, Inc., a non-profit organization, receives revenues from various sources during the year

to support its daycare centers. The following amounts were received during 20X1:

P2,000 is restricted by the donor to be used for meals for the children.

P1,500 received for subscription to a monthly child care magazine with a fair market value to

subscribers of P1,000.

• P10,000 to be used only upon completing a new playroom that was only 50% complete on

December 31, 20X1.

What amount should Child Care Centers record as contribution revenue in its 20X1 Statement of Activities?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT