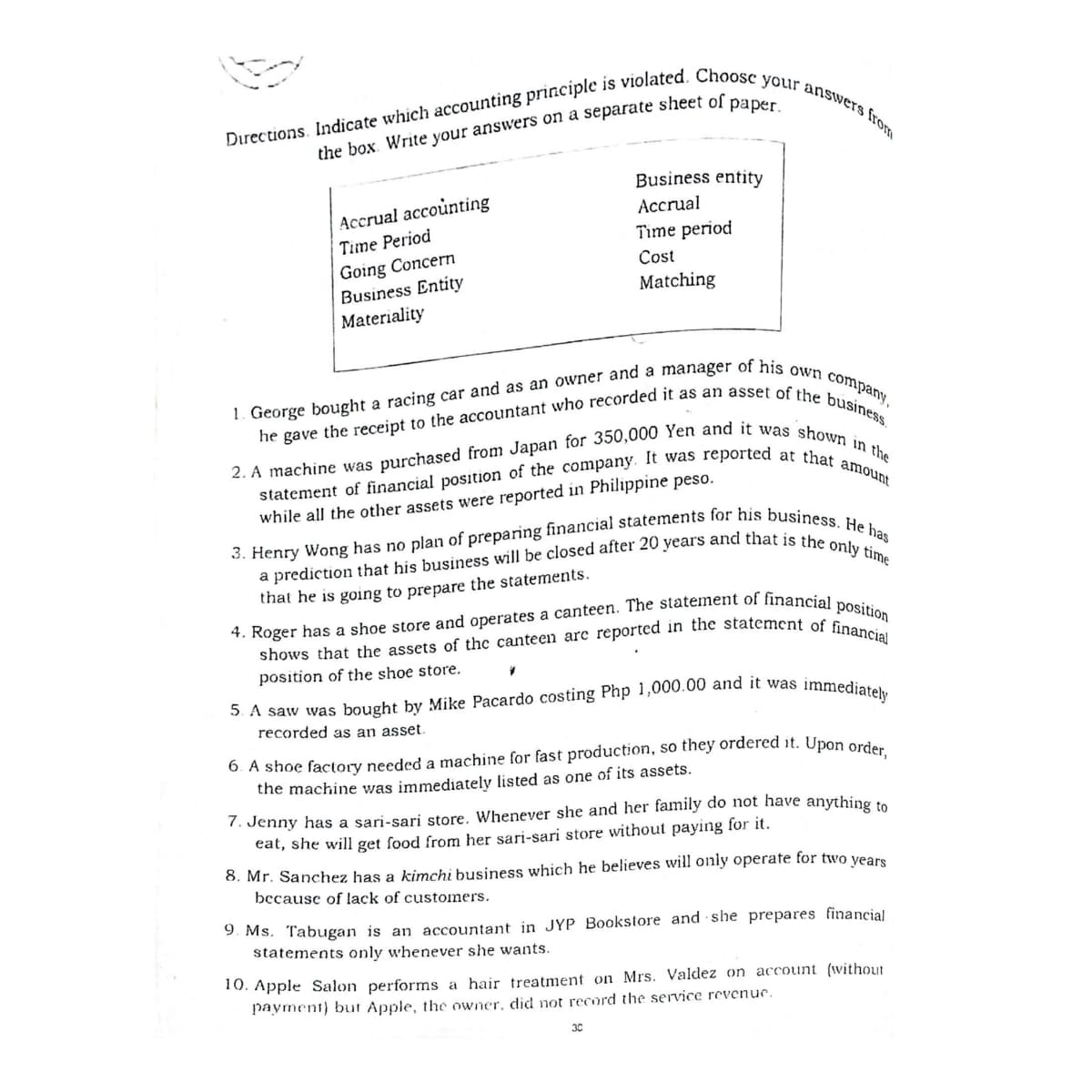

1. George bought a racing car and as an owner and a manager of his own company, Dırections. Indicate which accounting principle is violated. Choosc your answers from Business entity Accrual accounting Accrual Time Period Time period Going Concern Business Entity Materiality Cost Matching a statement of financial position of the company. It was reported at the while all the other assets were reported in Philippine peso. amount that he is going to prepare the statements. position of the shoe store. recorded as an asset 6. A shoe factory needed a machine for fast production, so they ordered it. Upon orden the machine was immediately listed as one of its assets. 7. Jenny has a sari-sari store. Whenever she and her family do not have anything to eat, she will get food from her sari-sari store without paying for it. 8. Mr. Sanchez has a kimchi business which he believes will only operate for two years because of lack of customers. 9. Ms. Tabugan is an accountant in JYP Bookstore and she prepares financial statements only whenever she wants. 10. Apple Salon performs a hair treatment on Mrs. Valdez on account (without payment) but Apple, the owner, did not record the service revenue. 30

1. George bought a racing car and as an owner and a manager of his own company, Dırections. Indicate which accounting principle is violated. Choosc your answers from Business entity Accrual accounting Accrual Time Period Time period Going Concern Business Entity Materiality Cost Matching a statement of financial position of the company. It was reported at the while all the other assets were reported in Philippine peso. amount that he is going to prepare the statements. position of the shoe store. recorded as an asset 6. A shoe factory needed a machine for fast production, so they ordered it. Upon orden the machine was immediately listed as one of its assets. 7. Jenny has a sari-sari store. Whenever she and her family do not have anything to eat, she will get food from her sari-sari store without paying for it. 8. Mr. Sanchez has a kimchi business which he believes will only operate for two years because of lack of customers. 9. Ms. Tabugan is an accountant in JYP Bookstore and she prepares financial statements only whenever she wants. 10. Apple Salon performs a hair treatment on Mrs. Valdez on account (without payment) but Apple, the owner, did not record the service revenue. 30

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter1: The Role Of Accounting In Business

Section: Chapter Questions

Problem 1.26E: Accounting concepts Match each of the following statements with the appropriate accounting concept....

Related questions

Question

Indicate which accounting principle ie violated

Transcribed Image Text:statement of financial position of the company. It was reported at that amount

2. A machine was purchased from Japan for 350,000 Yen and it was shown in the

1. George bought a racing car and as an owner and a manager of his own company,

Directions. Indicate which accounting principle is violated. Choosc your answers from

Business entity

Accrual accounting

Accrual

Time Period

Time period

Going Concern

Business Entity

Materiality

Cost

Matching

while all the other assets were reported in Philippine peso.

that he is going to prepare the statements.

position of the shoe store.

recorded as an asset.

6. A shoe factory needed a machine for fast production, so they ordered it. Upon orde

the machine was immediately listed as one of its assets.

7. Jenny has a sari-sari store. Whenever she and her family do not have anything to

eat, she will get food from her sari-sari store without paying for it.

8. Mr. Sanchez has a kimchi business which he believes will only operate for two years

because of lack of customers.

9. Ms. Tabugan is an accountant in JYP Bookstore and she prepares financial

statements only whenever she wants.

10. Apple Salon performs a hair treatment on Mrs. Valdez on account (without

payment) but Apple, the owner, did not record the service revenue.

30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning