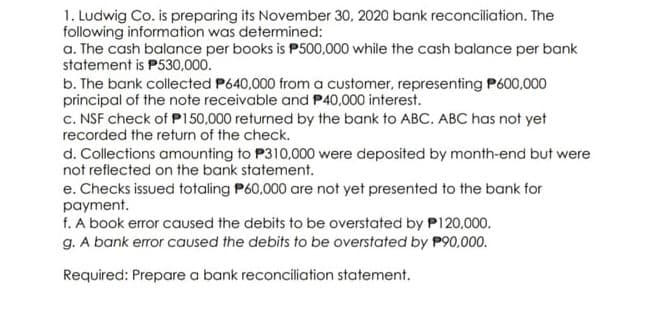

1. Ludwig Co. is preparing its November 30, 2020 bank reconciliation. The following information was determined: a. The cash balance per books is P500,000 while the cash balance per bank statement is P530,000. b. The bank collected P640,000 from a customer, representing P600,000 principal of the note receivable and P40,000 interest. C. NSF check of P150.000 returned by the bank to ABC. ABC has not yet recorded the return of the check. d. Collections amounting to P310,000 were deposited by month-end but were not reflected on the bank statement. e. Checks issued totaling P60,000 are not yet presented to the bank for payment. f. A book error caused the debits to be overstated by P120,000. g. A bank error caused the debits to be overstated by P90,000. Required: Prepare a bank reconciliation statement.

1. Ludwig Co. is preparing its November 30, 2020 bank reconciliation. The following information was determined: a. The cash balance per books is P500,000 while the cash balance per bank statement is P530,000. b. The bank collected P640,000 from a customer, representing P600,000 principal of the note receivable and P40,000 interest. C. NSF check of P150.000 returned by the bank to ABC. ABC has not yet recorded the return of the check. d. Collections amounting to P310,000 were deposited by month-end but were not reflected on the bank statement. e. Checks issued totaling P60,000 are not yet presented to the bank for payment. f. A book error caused the debits to be overstated by P120,000. g. A bank error caused the debits to be overstated by P90,000. Required: Prepare a bank reconciliation statement.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 5E

Related questions

Question

Prepare a

Transcribed Image Text:1. Ludwig Co. is preparing its November 30, 2020 bank reconciliation. The

following information was determined:

a. The cash balance per books is P500,000 while the cash balance per bank

statement is P530,000.

b. The bank collected P640,000 from a customer, representing P600,000

principal of the note receivable and P40,000 interest.

c. NSF check of P150,000 returned by the bank to ABC. ABC has not yet

recorded the return of the check.

d. Collections amounting to P310,000 were deposited by month-end but were

not reflected on the bank statement.

e. Checks issued totaling P60,000 are not yet presented to the bank for

payment.

f. A book error caused the debits to be overstated by P120,000.

g. A bank error caused the debits to be overstated by P90,000.

Required: Prepare a bank reconciliation statement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning