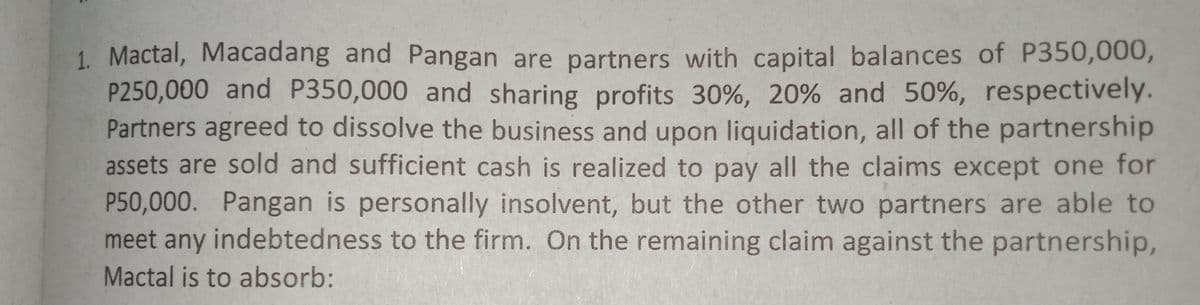

1. Mactal, Macadang and Pangan are partners with capital balances of P350,000, P250,000 and P350,000 and sharing profits 30%, 20% and 50%, respectively. Partners agreed to dissolve the business and upon liquidation, all of the partnership assets are sold and sufficient cash is realized to pay all the claims except one for P50,000. Pangan is personally insolvent, but the other two partners are able to meet any indebtedness to the firm. On the remaining claim against the partnership, Mactal is to absorb:

1. Mactal, Macadang and Pangan are partners with capital balances of P350,000, P250,000 and P350,000 and sharing profits 30%, 20% and 50%, respectively. Partners agreed to dissolve the business and upon liquidation, all of the partnership assets are sold and sufficient cash is realized to pay all the claims except one for P50,000. Pangan is personally insolvent, but the other two partners are able to meet any indebtedness to the firm. On the remaining claim against the partnership, Mactal is to absorb:

Chapter10: Partnerships: Formation, Operation, And Basis

Section: Chapter Questions

Problem 59P

Related questions

Question

Please help and provide solutions. Thanks

Transcribed Image Text:1. Mactal, Macadang and Pangan are partners with capital balances of P350,000,

P250,000 and P350,000 and sharing profits 30%, 20% and 50%, respectively.

Partners agreed to dissolve the business and upon liquidation, all of the partnership

assets are sold and sufficient cash is realized to pay all the claims except one for

P50,000. Pangan is personally insolvent, but the other two partners are able to

meet any indebtedness to the firm. On the remaining clainm against the partnership,

Mactal is to absorb:

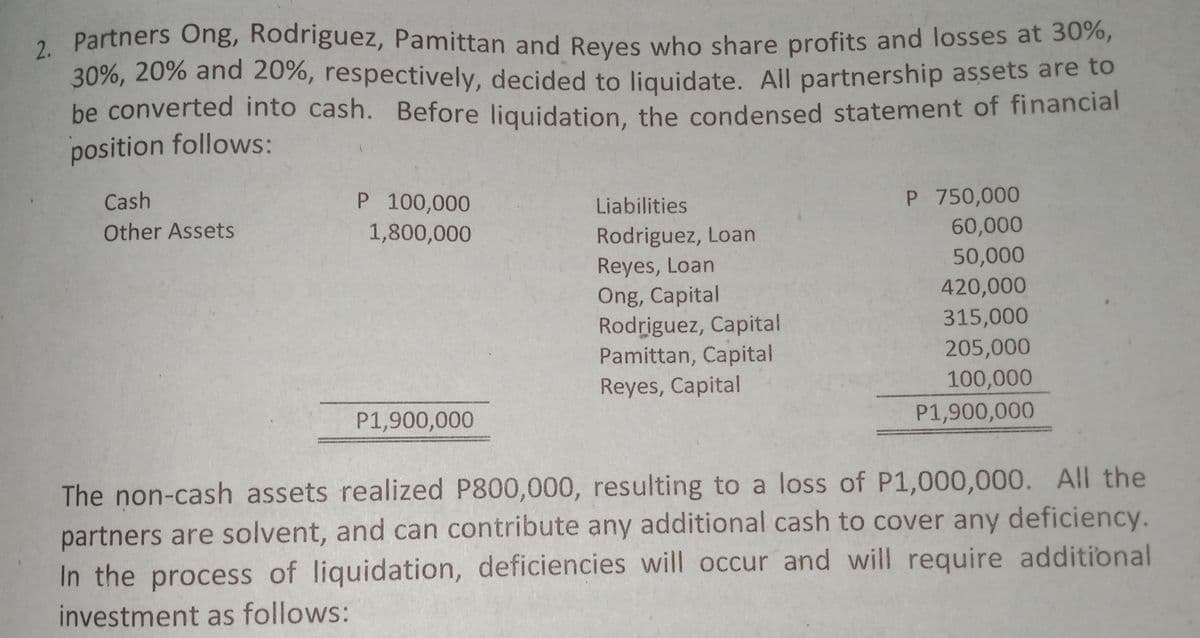

Transcribed Image Text:2. Partners Ong, Rodriguez, Pamittan and Reyes who share profits and losses at 30%,

30%, 20% and 20%, respectively, decided to liquidate. All partnership assets are to

be converted into cash. Before liquidation, the condensed statement of financial

position follows:

P 100,000

1,800,000

P 750,000

60,000

50,000

Cash

Liabilities

Other Assets

Rodriguez, Loan

Reyes, Loan

Ong, Capital

Rodriguez, Capital

Pamittan, Capital

420,000

315,000

205,000

Reyes, Capital

100,000

P1,900,000

P1,900,000

The non-cash assets realized P800,000, resulting to a loss of P1,000,000. All the

partners are solvent, and can contribute any additional cash to cover any deficiency.

In the process of liquidation, deficiencies will occur and will require additional

investment as follows:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT