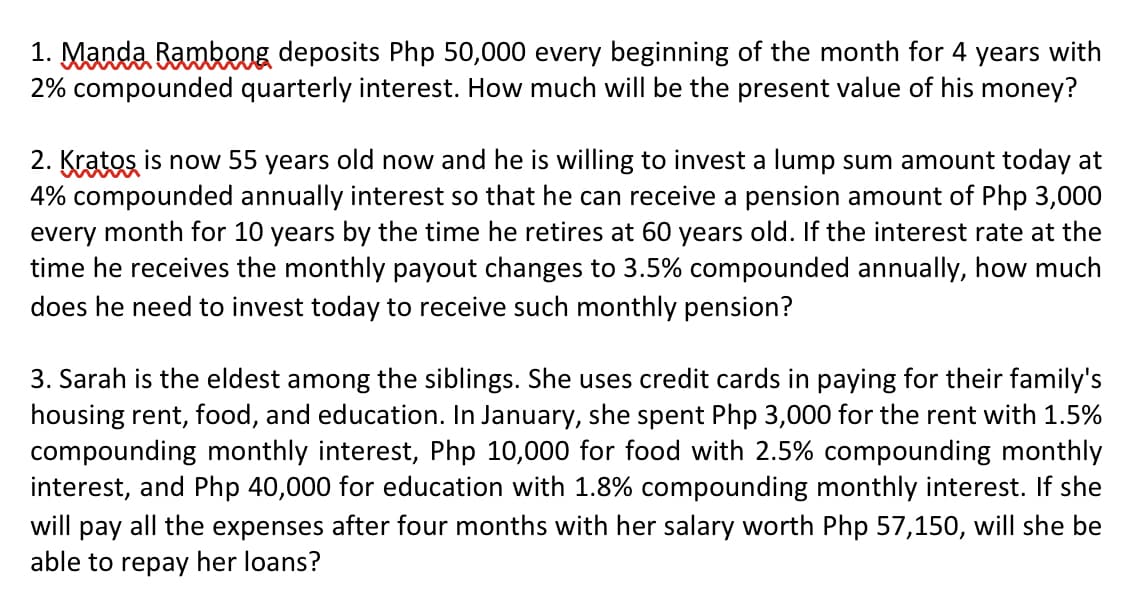

1. Manda Bamkeng deposits Php 50,000 every beginning of the month for 4 years with 2% compounded quarterly interest. How much will be the present value of his money? 2. Kratos is now 55 years old now and he is willing to invest a lump sum amount today at 4% compounded annually interest so that he can receive a pension amount of Php 3,000 every month for 10 years by the time he retires at 60 years old. If the interest rate at the time he receives the monthly payout changes to 3.5% compounded annually, how much does he need to invest today to receive such monthly pension? 3. Sarah is the eldest among the siblings. She uses credit cards in paying for their family's housing rent, food, and education. In January, she spent Php 3,000 for the rent with 1.5% compounding monthly interest, Php 10,000 for food with 2.5% compounding monthly interest, and Php 40,000 for education with 1.8% compounding monthly interest. If she will pay all the expenses after four months with her salary worth Php 57,150, will she be able to repay her loans?

1. Manda Bamkeng deposits Php 50,000 every beginning of the month for 4 years with 2% compounded quarterly interest. How much will be the present value of his money? 2. Kratos is now 55 years old now and he is willing to invest a lump sum amount today at 4% compounded annually interest so that he can receive a pension amount of Php 3,000 every month for 10 years by the time he retires at 60 years old. If the interest rate at the time he receives the monthly payout changes to 3.5% compounded annually, how much does he need to invest today to receive such monthly pension? 3. Sarah is the eldest among the siblings. She uses credit cards in paying for their family's housing rent, food, and education. In January, she spent Php 3,000 for the rent with 1.5% compounding monthly interest, Php 10,000 for food with 2.5% compounding monthly interest, and Php 40,000 for education with 1.8% compounding monthly interest. If she will pay all the expenses after four months with her salary worth Php 57,150, will she be able to repay her loans?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

ChapterM: Time Value Of Money Module

Section: Chapter Questions

Problem 11E

Related questions

Question

Transcribed Image Text:1. Manda Bamkeng deposits Php 50,000 every beginning of the month for 4 years with

2% compounded quarterly interest. How much will be the present value of his money?

2. Kratos is now 55 years old now and he is willing to invest a lump sum amount today at

4% compounded annually interest so that he can receive a pension amount of Php 3,000

every month for 10 years by the time he retires at 60 years old. If the interest rate at the

time he receives the monthly payout changes to 3.5% compounded annually, how much

does he need to invest today to receive such monthly pension?

3. Sarah is the eldest among the siblings. She uses credit cards in paying for their family's

housing rent, food, and education. In January, she spent Php 3,000 for the rent with 1.5%

compounding monthly interest, Php 10,000 for food with 2.5% compounding monthly

interest, and Php 40,000 for education with 1.8% compounding monthly interest. If she

will pay all the expenses after four months with her salary worth Php 57,150, will she be

able to repay her loans?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning