1. Name the transactions or events which can be considered "IDENTIFYING" based on the definition of Accounting? 2. Name the transactions or events which can be considered "RECORDING" based on the definition of Accounting? 3. Name the "COMMUNICATING" based on the definition of Accounting? transactions or events which can be considered

1. Name the transactions or events which can be considered "IDENTIFYING" based on the definition of Accounting? 2. Name the transactions or events which can be considered "RECORDING" based on the definition of Accounting? 3. Name the "COMMUNICATING" based on the definition of Accounting? transactions or events which can be considered

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 64P

Related questions

Question

100%

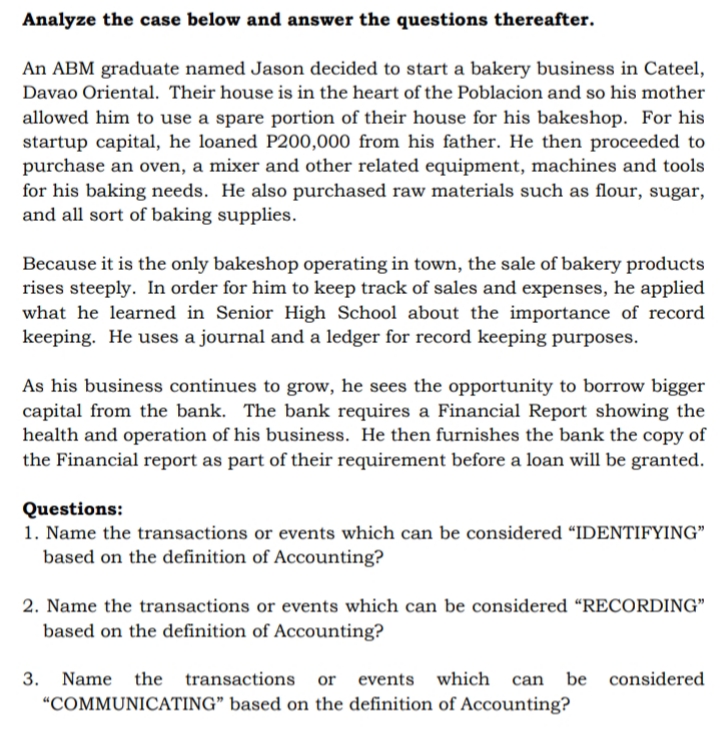

Transcribed Image Text:Analyze the case below and answer the questions thereafter.

An ABM graduate named Jason decided to start a bakery business in Cateel,

Davao Oriental. Their house is in the heart of the Poblacion and so his mother

allowed him to use a spare portion of their house for his bakeshop. For his

startup capital, he loaned P200,000 from his father. He then proceeded to

purchase an oven, a mixer and other related equipment, machines and tools

for his baking needs. He also purchased raw materials such as flour, sugar,

and all sort of baking supplies.

Because it is the only bakeshop operating in town, the sale of bakery products

rises steeply. In order for him to keep track of sales and expenses, he applied

what he learned in Senior High School about the importance of record

keeping. He uses a journal and a ledger for record keeping purposes.

As his business continues to grow, he sees the opportunity to borrow bigger

capital from the bank. The bank requires a Financial Report showing the

health and operation of his business. He then furnishes the bank the copy of

the Financial report as part of their requirement before a loan will be granted.

Questions:

1. Name the transactions or events which can be considered "IDENTIFYING"

based on the definition of Accounting?

2. Name the transactions or events which can be considered “RECORDING"

based on the definition of Accounting?

3. Name

the transactions

or

events which can

be considered

"COMMUNICATING" based on the definition of Accounting?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT