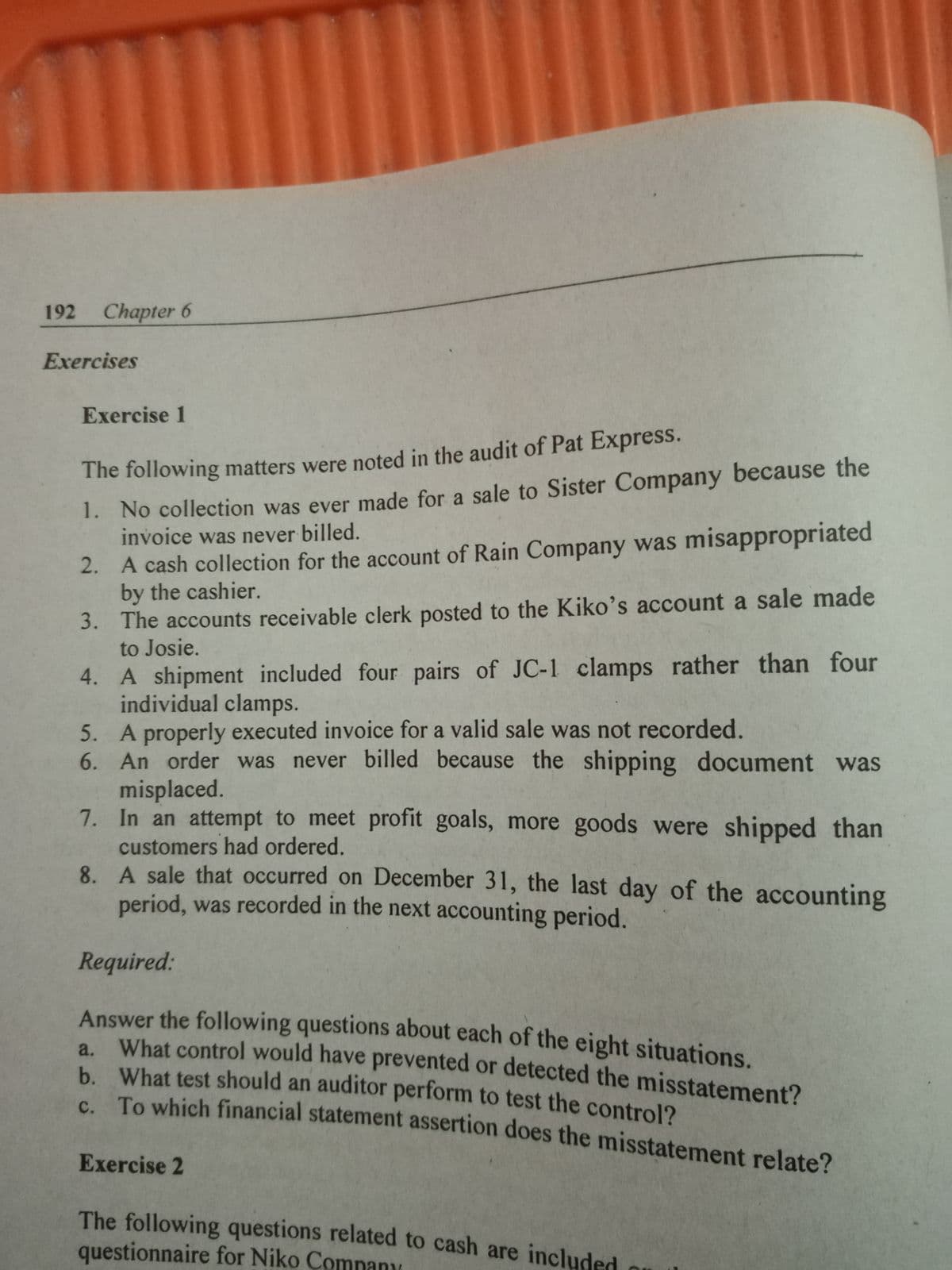

1. No collection was ever made for a sale to Sister Company because the invoice was never billed. The following matters were noted in the audit of Pat Express. A cash collection for the account of Rain Company was misappropriated by the cashier. 3. The accounts receivable clerk posted to the Kiko's account a sale made to Josie. 2. 4. A shipment included four pairs of JC-1 clamps rather than four individual clamps. 5. A properly executed invoice for a valid sale was not recorded. 6. An order was never billed because the shipping document was misplaced. 7. In an attempt to meet profit goals, more goods were shipped than customers had ordered. 8. A sale that occurred on December 31, the last day of the accounting period, was recorded in the next accounting period. Required: Answer the following questions about each of the eight situations. a. What control would have prevented or detected the misstatement? b. What test should an auditor perform to test the control? To which financial statement assertion does the misstatement relate? Exercise 2

1. No collection was ever made for a sale to Sister Company because the invoice was never billed. The following matters were noted in the audit of Pat Express. A cash collection for the account of Rain Company was misappropriated by the cashier. 3. The accounts receivable clerk posted to the Kiko's account a sale made to Josie. 2. 4. A shipment included four pairs of JC-1 clamps rather than four individual clamps. 5. A properly executed invoice for a valid sale was not recorded. 6. An order was never billed because the shipping document was misplaced. 7. In an attempt to meet profit goals, more goods were shipped than customers had ordered. 8. A sale that occurred on December 31, the last day of the accounting period, was recorded in the next accounting period. Required: Answer the following questions about each of the eight situations. a. What control would have prevented or detected the misstatement? b. What test should an auditor perform to test the control? To which financial statement assertion does the misstatement relate? Exercise 2

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Internal Control And Cash

Section: Chapter Questions

Problem 7.14EX

Related questions

Question

Subject:

Required B

Transcribed Image Text:192

Chapter 6

Exercises

Exercise 1

1. No collection was ever made for a sale to Sister Company because the

invoice was never billed.

The following matters were noted in the audit of Pat Express.

2. A cash collection for the account of Rain Company was misappropriated

by the cashier.

3. The accounts receivable clerk posted to the Kiko's account a sale made

to Josie.

4. A shipment included four pairs of JC-1 clamps rather than four

individual clamps.

5. A properly executed invoice for a valid sale was not recorded.

6. An order was never billed because the shipping document was

misplaced.

7. In an attempt to meet profit goals, more goods were shipped than

customers had ordered.

8. A sale that occurred on December 31, the last day of the accounting

period, was recorded in the next accounting period.

Required:

Answer the following questions about each of the eight situations.

a What control would have prevented or detected the misstatement?

h What test should an auditor perform to test the control?

To which financial statement assertion does the misstatement relate?

a.

Exercise 2

The following questions related to cash are included

questionnaire for Niko Comnany

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning