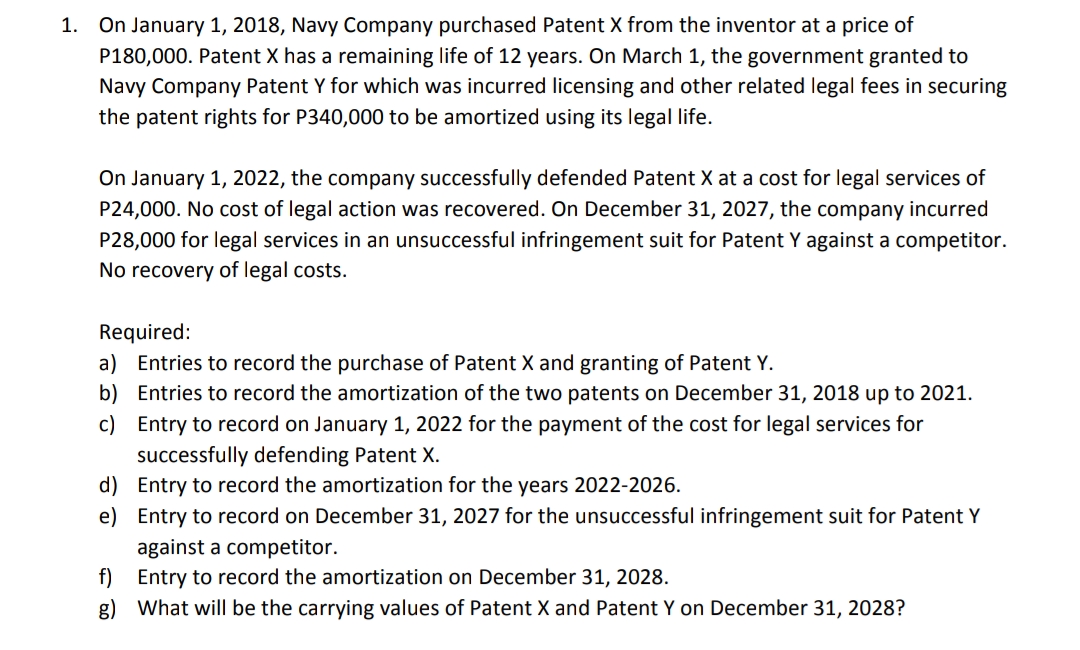

1. On January 1, 2018, Navy Company purchased Patent X from the inventor at a price of P180,000. Patent X has a remaining life of 12 years. On March 1, the government granted to Navy Company Patent Y for which was incurred licensing and other related legal fees in securing the patent rights for P340,000 to be amortized using its legal life. On January 1, 2022, the company successfully defended Patent X at a cost for legal services of P24,000. No cost of legal action was recovered. On December 31, 2027, the company incurred P28,000 for legal services in an unsuccessful infringement suit for Patent Y against a competitor. No recovery of legal costs. Required: a) Entries to record the purchase of Patent X and granting of Patent Y. b) Entries to record the amortization of the two patents on December 31, 2018 up to 2021. c) Entry to record on January 1, 2022 for the payment of the cost for legal services for successfully defending Patent X. d) Entry to record the amortization for the years 2022-2026. e) Entry to record on December 31, 2027 for the unsuccessful infringement suit for Patent Y against a competitor. f) Entry to record the amortization on December 31, 2028. g) What will be the carrying values of Patent X and Patent Y on December 31, 2028?

1. On January 1, 2018, Navy Company purchased Patent X from the inventor at a price of P180,000. Patent X has a remaining life of 12 years. On March 1, the government granted to Navy Company Patent Y for which was incurred licensing and other related legal fees in securing the patent rights for P340,000 to be amortized using its legal life. On January 1, 2022, the company successfully defended Patent X at a cost for legal services of P24,000. No cost of legal action was recovered. On December 31, 2027, the company incurred P28,000 for legal services in an unsuccessful infringement suit for Patent Y against a competitor. No recovery of legal costs. Required: a) Entries to record the purchase of Patent X and granting of Patent Y. b) Entries to record the amortization of the two patents on December 31, 2018 up to 2021. c) Entry to record on January 1, 2022 for the payment of the cost for legal services for successfully defending Patent X. d) Entry to record the amortization for the years 2022-2026. e) Entry to record on December 31, 2027 for the unsuccessful infringement suit for Patent Y against a competitor. f) Entry to record the amortization on December 31, 2028. g) What will be the carrying values of Patent X and Patent Y on December 31, 2028?

Chapter13: Property Transactions: Determination Of Gain Or Loss, Basis Considerations, And Nonta Xable Exchanges

Section: Chapter Questions

Problem 85P

Related questions

Question

What are the proper entries for each question?

Transcribed Image Text:1. On January 1, 2018, Navy Company purchased Patent X from the inventor at a price of

P180,000. Patent X has a remaining life of 12 years. On March 1, the government granted to

Navy Company Patent Y for which was incurred licensing and other related legal fees in securing

the patent rights for P340,000 to be amortized using its legal life.

On January 1, 2022, the company successfully defended Patent X at a cost for legal services of

P24,000. No cost of legal action was recovered. On December 31, 2027, the company incurred

P28,000 for legal services in an unsuccessful infringement suit for Patent Y against a competitor.

No recovery of legal costs.

Required:

a) Entries to record the purchase of Patent X and granting of Patent Y.

b) Entries to record the amortization of the two patents on December 31, 2018 up to 2021.

c) Entry to record on January 1, 2022 for the payment of the cost for legal services for

successfully defending Patent X.

d) Entry to record the amortization for the years 2022-2026.

e) Entry to record on December 31, 2027 for the unsuccessful infringement suit for Patent Y

against a competitor.

f) Entry to record the amortization on December 31, 2028.

g) What will be the carrying values of Patent X and Patent Y on December 31, 2028?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT