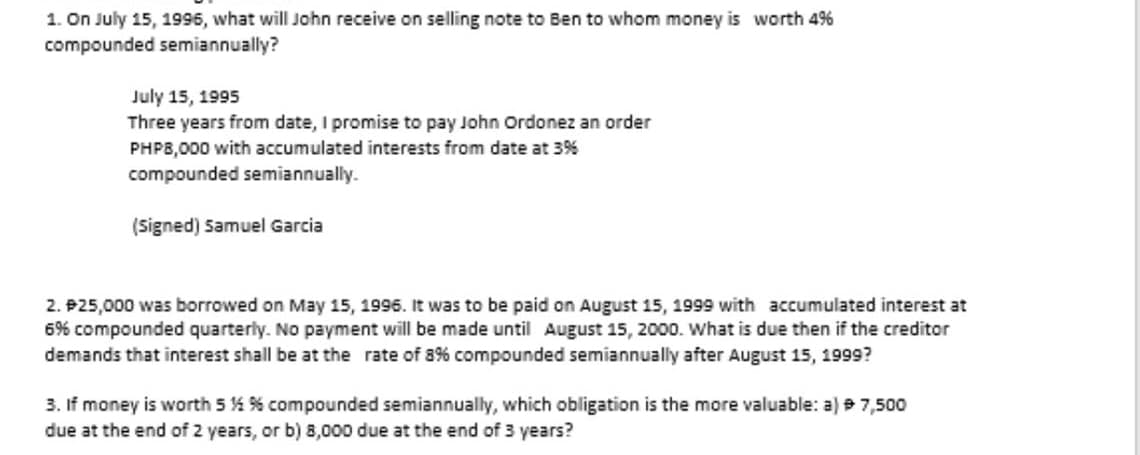

1. On July 15, 1996, what will John receive on selling note to Ben to whom money is worth 4% compounded semiannually? July 15, 1995 Three years from date, I promise to pay John Ordonez an order PHP8,000 with accumulated interests from date at 3% compounded semiannually. (Signed) Samuel Garcia

1. On July 15, 1996, what will John receive on selling note to Ben to whom money is worth 4% compounded semiannually? July 15, 1995 Three years from date, I promise to pay John Ordonez an order PHP8,000 with accumulated interests from date at 3% compounded semiannually. (Signed) Samuel Garcia

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 1PA: On January 1, 2018, King Inc. borrowed $150,000 and signed a 5-year, note payable with a 10%...

Related questions

Question

Transcribed Image Text:1. On July 15, 1996, what will John receive on selling note to Ben to whom money is worth 4%

compounded semiannually?

July 15, 1995

Three years from date, I promise to pay John Ordonez an order

PHPB,000 with accumulated interests from date at 3%

compounded semiannually.

(Signed) Samuel Garcia

2. P25,000 was borrowed on May 15, 1996. It was to be paid on August 15, 1999 with accumulated interest at

6% compounded quarterly. No payment will be made until August 15, 2000. What is due then if the creditor

demands that interest shall be at the rate of 8% compounded semiannually after August 15, 1999?

3. If money is worth 5 % % compounded semiannually, which obligation is the more valuable: a) e 7,500

due at the end of 2 years, or b) 8,000 due at the end of 3 years?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT