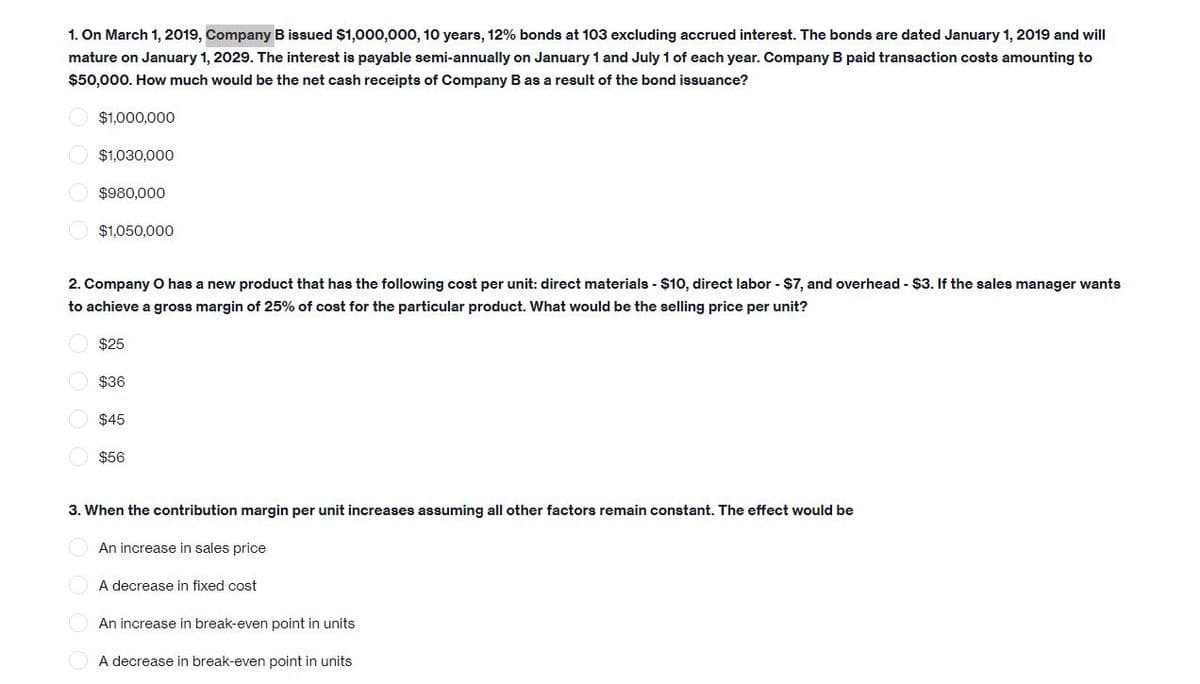

1. On March 1, 2019, Company B issued $1,000,000, 10 years, 12% bonds at 103 excluding accrued interest. The bonds are dated January 1, 2019 and will mature on January 1, 2029. The interest is payable semi-annually on January 1 and July 1 of each year. Company B paid transaction costs amounting to $50,000. How much would be the net cash receipts of Company B as a result of the bond issuance? O $1,000,000 O $1,030,000 $980,000 $1,050,000 2. Company O has a new product that has the following cost per unit: direct materials - $10, direct labor - $7, and overhead - $3. If the sales manager wants to achieve a gross margin of 25% of cost for the particular product. What would be the selling price per unit? $25 O $36 O $45 $56 3. When the contribution margin per unit increases assuming all other factors remain constant. The effect would be An increase in sales price O A decrease in fixed cost An increase in break-even point in units A decrease in break-even point in units

1. On March 1, 2019, Company B issued $1,000,000, 10 years, 12% bonds at 103 excluding accrued interest. The bonds are dated January 1, 2019 and will mature on January 1, 2029. The interest is payable semi-annually on January 1 and July 1 of each year. Company B paid transaction costs amounting to $50,000. How much would be the net cash receipts of Company B as a result of the bond issuance? O $1,000,000 O $1,030,000 $980,000 $1,050,000 2. Company O has a new product that has the following cost per unit: direct materials - $10, direct labor - $7, and overhead - $3. If the sales manager wants to achieve a gross margin of 25% of cost for the particular product. What would be the selling price per unit? $25 O $36 O $45 $56 3. When the contribution margin per unit increases assuming all other factors remain constant. The effect would be An increase in sales price O A decrease in fixed cost An increase in break-even point in units A decrease in break-even point in units

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 5PA: Volunteer Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July...

Related questions

Question

Second One Answer Please

Transcribed Image Text:1. On March 1, 2019, Company B issued $1,000,000, 10 years, 12% bonds at 103 excluding accrued interest. The bonds are dated January 1, 2019 and will

mature on January 1, 2029. The interest is payable semi-annually on January 1 and July 1 of each year. Company B paid transaction costs amounting to

$50,000. How much would be the net cash receipts of Company B as a result of the bond issuance?

$1,000,000

$1,030,000

$980,000

$1,050,000

2. Company O has a new product that has the following cost per unit: direct materials - $10, direct labor - $7, and overhead - $3. If the sales manager wants

to achieve a gross margin of 25% of cost for the particular product. What would be the selling price per unit?

$25

$36

$45

$56

3. When the contribution margin per unit increases assuming all other factors remain constant. The effect would be

An increase in sales price

A decrease in fixed cost

An increase in break-even point in units

A decrease in break-even point in units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning