1. Planned Business 1: Upon initial collection of reliable data, a planned chocolate manufacturing business that will last for 20 years will be worth 140 Million pesos to build and with estimated average annual predicted sales of 40.12 million pesos and yearly total operational cost of 15.07 million pesos. Average annual inflation rate: 5 %, T-bill rate: 4.0%. Answer these questions: a) Would you pursue the said business? b) Why?

1. Planned Business 1: Upon initial collection of reliable data, a planned chocolate manufacturing business that will last for 20 years will be worth 140 Million pesos to build and with estimated average annual predicted sales of 40.12 million pesos and yearly total operational cost of 15.07 million pesos. Average annual inflation rate: 5 %, T-bill rate: 4.0%. Answer these questions: a) Would you pursue the said business? b) Why?

Chapter4: Financial Planning And Forecasting

Section: Chapter Questions

Problem 10P

Related questions

Question

Transcribed Image Text:Exercise

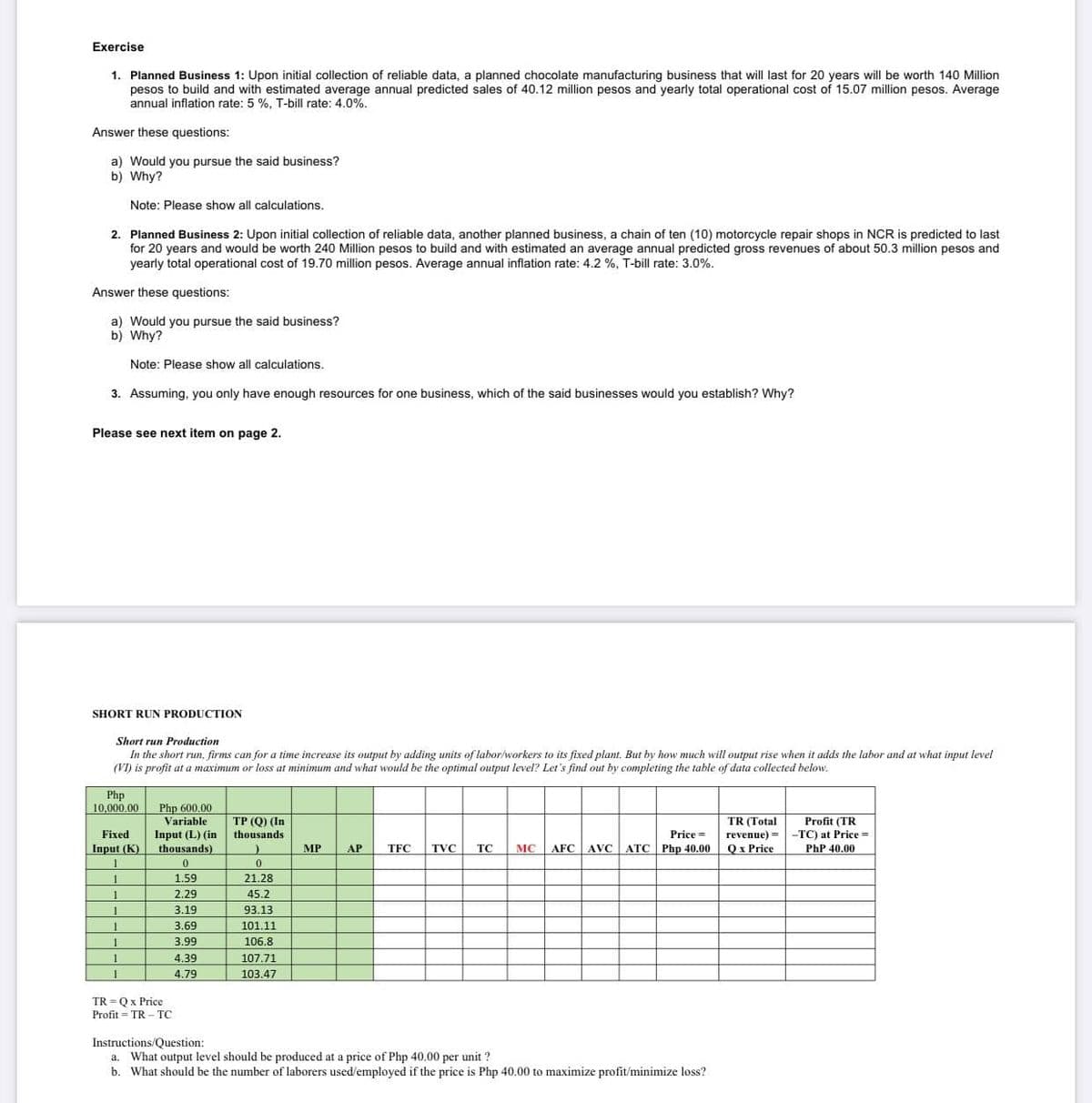

1. Planned Business 1: Upon initial collection of reliable data, a planned chocolate manufacturing business that will last for 20 years will be worth 140 Million

pesos to build and with estimated average annual predicted sales of 40.12 million pesos and yearly total operational cost of 15.07 million pesos. Average

annual inflation rate: 5 %, T-bill rate: 4.0%.

Answer these questions:

a) Would you pursue the said business?

b) Why?

Note: Please show all calculations.

2. Planned Business 2: Upon initial collection of reliable data, another planned business, a chain of ten (10) motorcycle repair shops in NCR is predicted to last

for 20 years and would be worth 240 Million pesos to build and with estimated an average annual predicted gross revenues of about 50.3 million pesos and

yearly total operational cost of 19.70 million pesos. Average annual inflation rate: 4.2 %, T-bill rate: 3.0%.

Answer these questions:

a) Would you pursue the said business?

b) Why?

Note: Please show all calculations.

3. Assuming, you only have enough resources for one business, which of the said businesses would you establish? Why?

Please see next item on page 2.

SHORT RUN PRODUCTION

Short run Production

In the short run, firms can for a time increase its output by adding units of labor/workers to its fixed plant. But by how much will output rise when it adds the labor and at what input level

(VI) is profit at a maximum or loss at minimum and what would be the optimal output level? Let's find out by completing the table of data collected below.

Php

10,000.00

Php 600.00

Variable

TP (Q) (In

thousands

TR (Total

revenue) =

Qx Price

Profit (TR

-TC) at Price=

Fixed

Price =

Input (L) (in

thousands)

Input (K)

MP

AP

TFC

TVC

TC

MC

AFC

AVC

ATC Php 40.00

PhP 40.00

1.59

21.28

2.29

45.2

3.19

93.13

3.69

101.11

1

3.99

106.8

1

4.39

107.71

4.79

103.47

TR =Q x Price

Profit = TR - TC

Instructions/Question:

a. What output level should be produced at a price of Php 40.00 per unit ?

b. What should be the number of laborers used'employed if the price is Php 40.00 to maximize profit/minimize loss?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub