1. Prepare journal entries to record the income tax and 2. Present the income tax expense in the incone statement The income statement and tax return showed the following: 2021 2022 Income before tax per income statement Income before tax per tax return Income tax rate 6,000,000 7,000,000 9,000,000 8,000,000 25% 25% Required: 1. Prepare journal entries to record the income tax ane deferred tax for 2021 and 2022. for 2021 and 2022.

1. Prepare journal entries to record the income tax and 2. Present the income tax expense in the incone statement The income statement and tax return showed the following: 2021 2022 Income before tax per income statement Income before tax per tax return Income tax rate 6,000,000 7,000,000 9,000,000 8,000,000 25% 25% Required: 1. Prepare journal entries to record the income tax ane deferred tax for 2021 and 2022. for 2021 and 2022.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 9DQ: LO.2 Osprey Corporation, an accrual basis taxpayer, had taxable income for 2019 and paid 40,000 on...

Related questions

Question

Transcribed Image Text:1. Prepare journal entries to record the income tax and

2. Present the income tax expense in the income statement

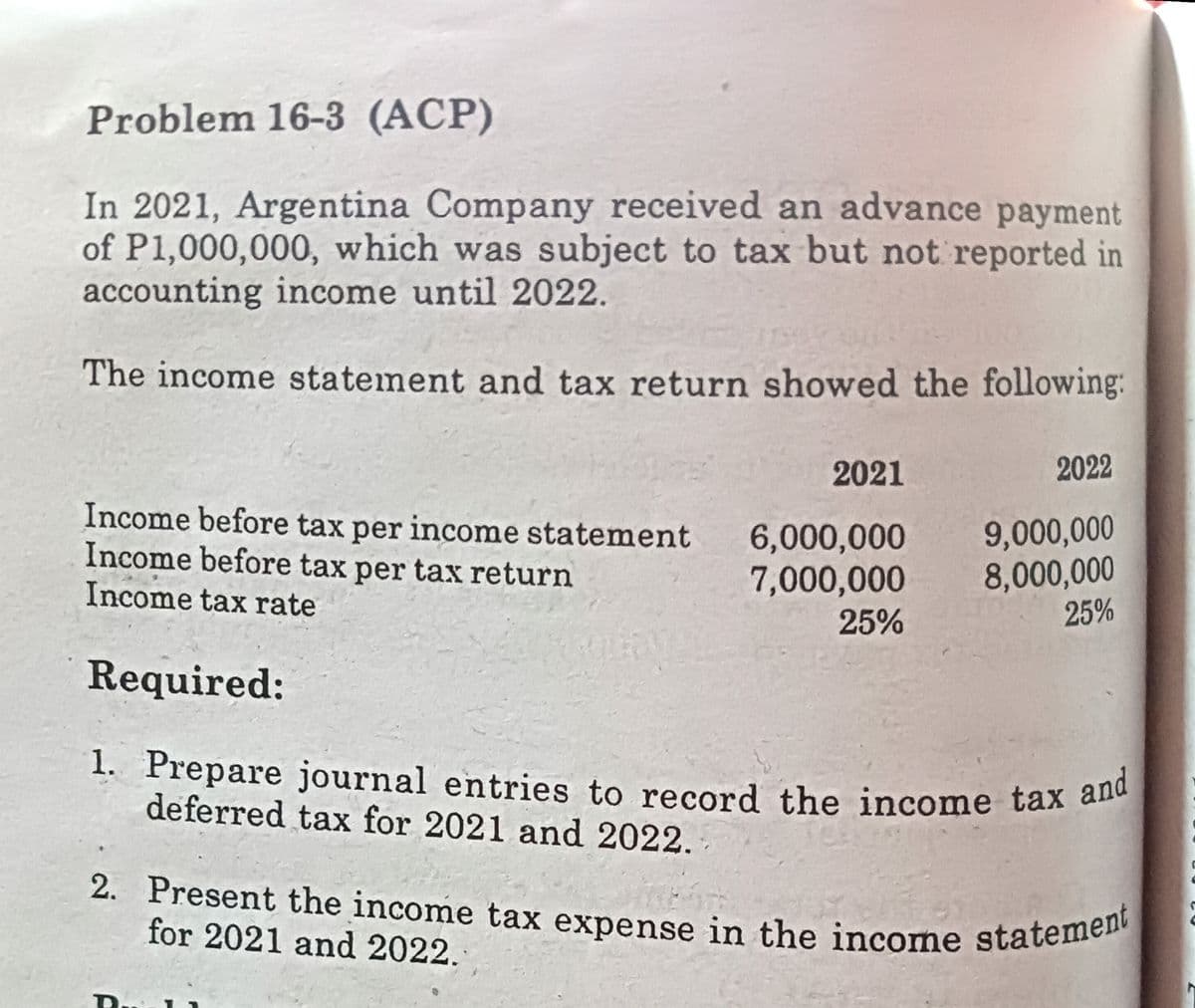

Problem 16-3 (ACP)

In 2021, Argentina Company received an advance payment

of P1,000,000, which was subject to tax but not reported in

accounting income until 2022.

The income statement and tax return showed the following:

2021

2022

Income before tax per income statement

Income before tax per tax return

Income tax rate

6,000,000

7,000,000

9,000,000

8,000,000

25%

25%

Required:

1. Prepare journal entries to record the income tax a

deferred tax for 2021 and 2022.

for 2021 and 2022.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning