1. Suppose that 10 years ago you bought a home for $160,000, paying 10% as a down payment, and financing the rest at 7% interest for 30 years. How much money did you pay as your down payment? 2. How much money was your existing mortgage (loan) for? 3. What is your current monthly payment on your existing mortgage? Note: Carry at least 4 decimal places during calculations, but round your final answer to the nearest cent.

1. Suppose that 10 years ago you bought a home for $160,000, paying 10% as a down payment, and financing the rest at 7% interest for 30 years. How much money did you pay as your down payment? 2. How much money was your existing mortgage (loan) for? 3. What is your current monthly payment on your existing mortgage? Note: Carry at least 4 decimal places during calculations, but round your final answer to the nearest cent.

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter5: Making Automobile And Housing Decisions

Section: Chapter Questions

Problem 7FPE

Related questions

Question

100%

Please solve 1-13

thanks

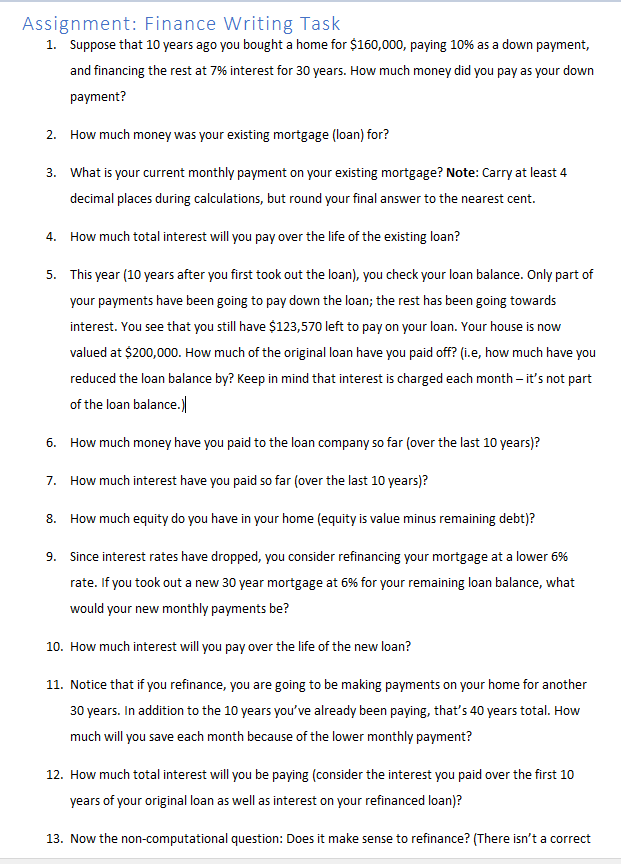

Transcribed Image Text:Assignment: Finance Writing Task

1. Suppose that 10 years ago you bought a home for $160,000, paying 10% as a down payment,

and financing the rest at 7% interest for 30 years. How much money did you pay as your down

payment?

2. How much money was your existing mortgage (loan) for?

3. What is your current monthly payment on your existing mortgage? Note: Carry at least 4

decimal places during calculations, but round your final answer to the nearest cent.

4.

How much total interest will you pay over the life of the existing loan?

5. This year (10 years after you first took out the loan), you check your loan balance. Only part of

your payments have been going to pay down the loan; the rest has been going towards

interest. You see that you still have $123,570 left to pay on your loan. Your house is now

valued at $200,000. How much of the original loan have you paid off? (i.e, how much have you

reduced the loan balance by? Keep in mind that interest is charged each month – it's not part

of the loan balance.)

6. How much money have you paid to the loan company so far (over the last 10 years)?

7. How much interest have you paid so far (over the last 10 years)?

8. How much equity do you have in your home (equity is value minus remaining debt)?

9. Since interest rates have dropped, you consider refinancing your mortgage at a lower 6%

rate. If you took out a new 30 year mortgage at 6% for your remaining loan balance, what

would your new monthly payments be?

10. How much interest will you pay over the life of the new loan?

11. Notice that if you refinance, you are going to be making payments on your home for another

30 years. In addition to the 10 years you've already been paying, that's 40 years total. How

much will you save each month because of the lower monthly payment?

12. How much total interest will you be paying (consider the interest you paid over the first 10

years of your original loan as well as interest on your refinanced loan)?

13. Now the non-computational question: Does it make sense to refinance? (There isn't a correct

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning